Get the free F AQ s - Maryland Department of Labor

Show details

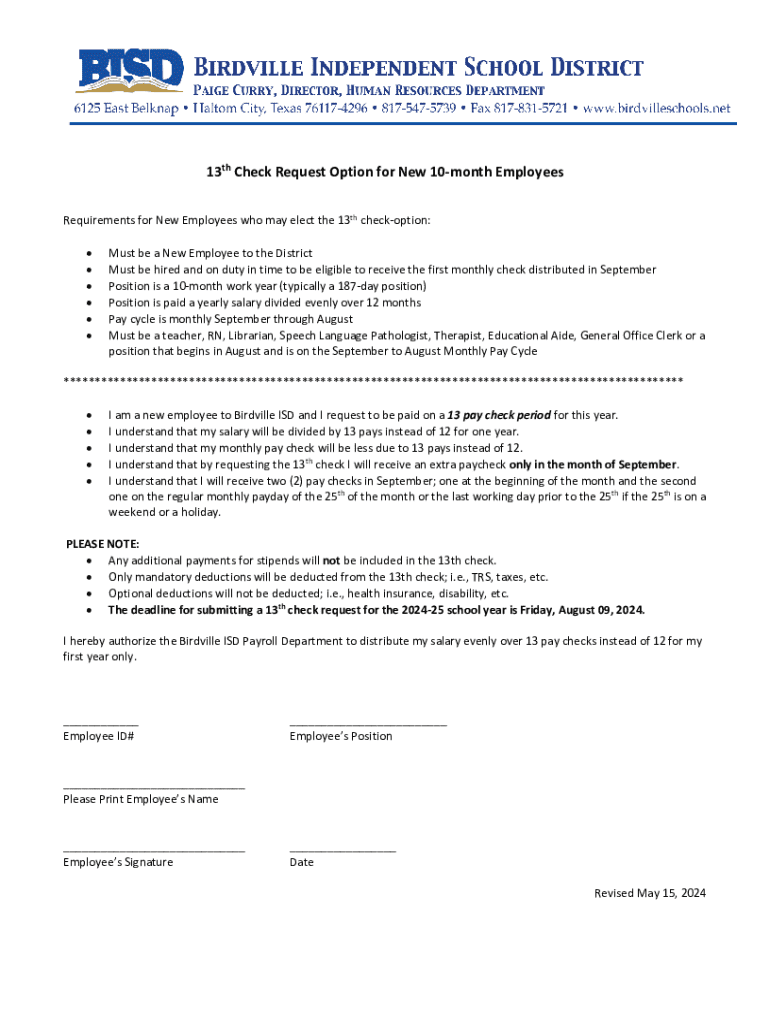

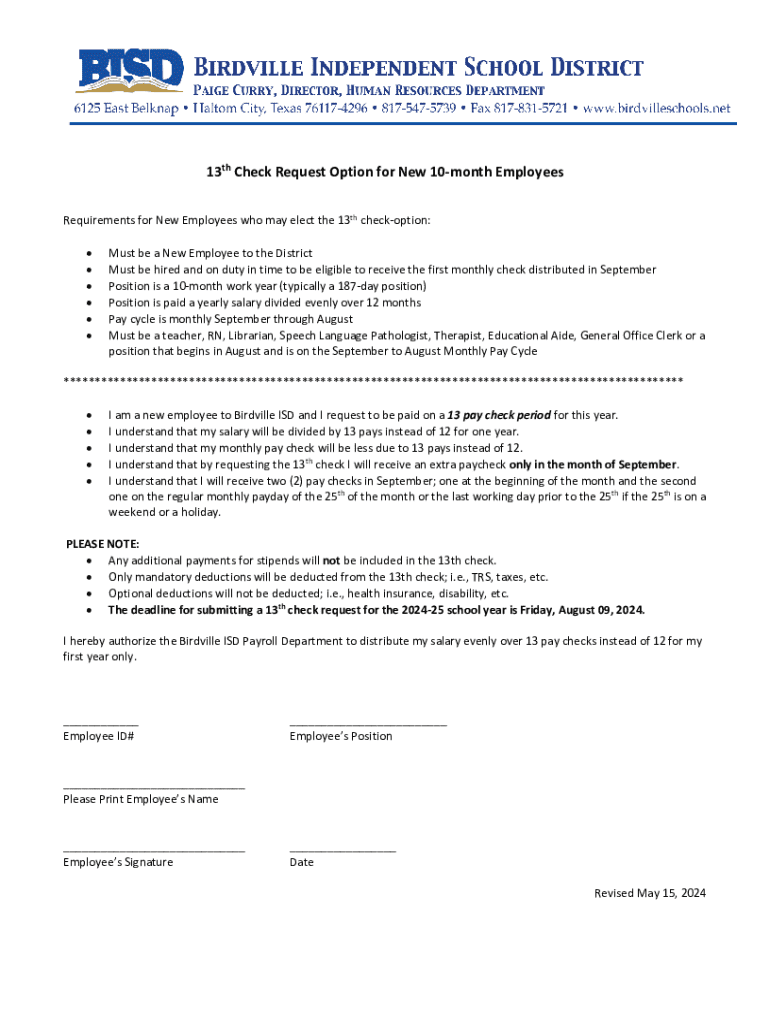

13th Check Request Option for New 10month Employees Requirements for New Employees who may elect the 13th check option: Must be a New Employee to the District Must be hired and on duty in time to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign f aq s

Edit your f aq s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your f aq s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing f aq s online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit f aq s. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out f aq s

How to fill out f aq s

01

Identify common questions or concerns that customers may have

02

Organize the FAQ topics into categories for easy navigation

03

Write clear and concise answers to each question

04

Use simple language that is easy for customers to understand

05

Update the FAQ regularly to include new questions and update existing answers.

Who needs f aq s?

01

Businesses that want to provide quick and easy answers to common customer inquiries

02

Websites that want to improve user experience by addressing common issues upfront

03

Organizations that want to reduce the load on customer support by providing self-service options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in f aq s without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your f aq s, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I fill out f aq s on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your f aq s, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit f aq s on an Android device?

You can edit, sign, and distribute f aq s on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is f aq s?

FATCA (Foreign Account Tax Compliance Act) requires U.S. financial institutions to report on the foreign assets held by U.S. account holders.

Who is required to file f aq s?

U.S. taxpayers with specified foreign financial assets exceeding certain thresholds must file Form 8938, which is part of the FATCA reporting.

How to fill out f aq s?

Form 8938 must be filled out accurately by listing the foreign financial assets, providing their values, and disclosing any foreign accounts as specified in the instructions.

What is the purpose of f aq s?

The purpose of FATCA is to prevent tax evasion by U.S. taxpayers using foreign accounts.

What information must be reported on f aq s?

Taxpayers must report the name of the financial institution, the account number, the maximum value of the asset during the year, and whether the asset is held jointly.

Fill out your f aq s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

F Aq S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.