Get the free dire score

Show details

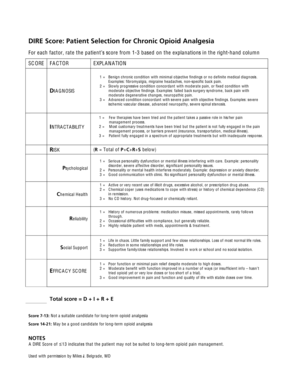

DIRE Score Patient Selection for Chronic Opioid Analgesia For each factor rate the patient s score from 1-3 based on the explanations in the right-hand column SCORE FACTOR EXPLANATION DIAGNOSIS 1 Benign chronic condition with minimal objective findings or no definite medical diagnosis. 3 Good improvement in pain and function and quality of life with stable doses over time. Total score D I R E Score 7-13 Not a suitable candidate for long-term opioid analgesia Score 14-21 May be a good...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dire score form

Edit your dire score form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dire score form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dire score form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dire score form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dire score form

How to fill out dire score:

01

Start by obtaining a copy of the dire score form. This can typically be done online or by requesting it from the relevant authority.

02

Read the instructions carefully before filling out the form. Make sure you understand the information required and any specific guidelines provided.

03

Begin by providing your personal details, such as your full name, date of birth, and contact information. This is usually the first section of the form.

04

Move on to the specific sections of the dire score form. These sections may vary depending on the purpose of the score (e.g., financial assessment, risk evaluation).

05

Fill out each section accurately and honestly. Provide all the necessary information requested, ensuring you do not leave any required fields blank.

06

If you come across a section that you are unsure about or if you have any questions, seek clarification from the authority that issued the form. It is essential to provide accurate information to ensure an accurate assessment.

07

Review your filled-out dire score form for any errors or omissions. Double-check all the information provided to ensure its accuracy before submitting it.

08

Once you have completed the form, sign and date it as required. Some forms may require additional signatures from witnesses or other relevant parties.

09

Keep a copy of the filled-out form for your records before submitting it to the appropriate authority. This will serve as proof of the information you provided.

Who needs dire score:

01

Individuals or companies applying for loans or credit often need a dire score. Lenders typically use this score to assess the creditworthiness and financial stability of the applicant.

02

Insurance companies may also require dire scores to determine the level of risk associated with providing coverage to individuals or businesses.

03

Landlords or property managers may request dire scores from prospective tenants to evaluate their rental history and financial responsibility.

04

Employers may use dire scores as part of their background check process when hiring new employees, particularly for positions involving financial responsibilities.

05

Government agencies or regulatory bodies may utilize dire scores for various purposes, such as assessing the eligibility of individuals or companies for certain benefits or licenses.

06

Individuals or businesses seeking investment opportunities may be required to provide dire scores to potential investors to demonstrate their financial stability and credibility.

07

Financial institutions and credit card companies may request dire scores to determine the credit limits and interest rates applicable to their customers.

08

Educational institutions, particularly those offering student loans or scholarships, may consider dire scores when evaluating applicants' financial needs and eligibility.

09

Any individual or organization interested in obtaining an overview of their financial situation and creditworthiness can request and benefit from a dire score.

Fill

form

: Try Risk Free

People Also Ask about

What is the dire score for pain?

The DIRE is a clinician-rated instrument designed for use by primary care physicians to predict the efficacy of analgesia and adherence with long-term opioid therapy. The DIRE score can range from 7 to 21, with a score of 13 or below suggesting that a patient is not a suitable candidate for long-term opioid therapy.

What is the full form of the dire score?

This project sought to implement an ORAT, Page 13 IMPLEMENTATION OF AN OPIOID RISK ASSESSMENT TOOL 12 specifically the Diagnosis, Intractability, Risk, and Efficacy (DIRE) Score, in clinical practice.

What are the 5 A's of monitoring chronic opioid response?

For this reason, we recommend Five A's of assessment: Analgesia, Activity, Adverse reactions, Aberrant behavior and Affect. Every person for whom opioids are prescribed has the potential to abuse their medication (Webster & Dove, 2007).

How do you use the word dire?

Examples of 'dire' in a sentence Yet now the building is in dire need of restoration. THE country is in dire need of new homes. America's roads, airports and rail network are in dire need of upgrades. When you were in dire straits she was superb.

What is the meaning of Dire pain?

causing or involving great fear or suffering; dreadful; terrible: a dire calamity.

What is an opioid risk score?

This tool should be administered to patients upon an initial visit prior to beginning opioid therapy for pain management. A score of 3 or lower indicates low risk for future opioid abuse, a score of 4 to 7 indicates moderate risk for opioid abuse, and a score of 8 or higher indicates a high risk for opioid abuse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit dire score form online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your dire score form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit dire score form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign dire score form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete dire score form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your dire score form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is dire score?

The Dire Score is a measurement that assesses the risk and creditworthiness of an entity, often used in financial contexts to evaluate potential lending or investment decisions.

Who is required to file dire score?

Entities such as businesses, financial institutions, and individuals seeking loans or credit may be required to file a Dire Score as part of the application or assessment process.

How to fill out dire score?

To fill out a Dire Score, one typically needs to provide financial statements, personal or business credit information, and relevant transaction history, adhering to the guidelines set by the reporting authority.

What is the purpose of dire score?

The purpose of the Dire Score is to evaluate financial health and risk, aiding lenders in making informed decisions about extending credit or loans.

What information must be reported on dire score?

Information that must be reported includes credit history, outstanding debts, payment records, and other financial indicators that contribute to overall creditworthiness.

Fill out your dire score form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dire Score Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.