Get the free Federal Flood Risk Management Standard - HUD

Show details

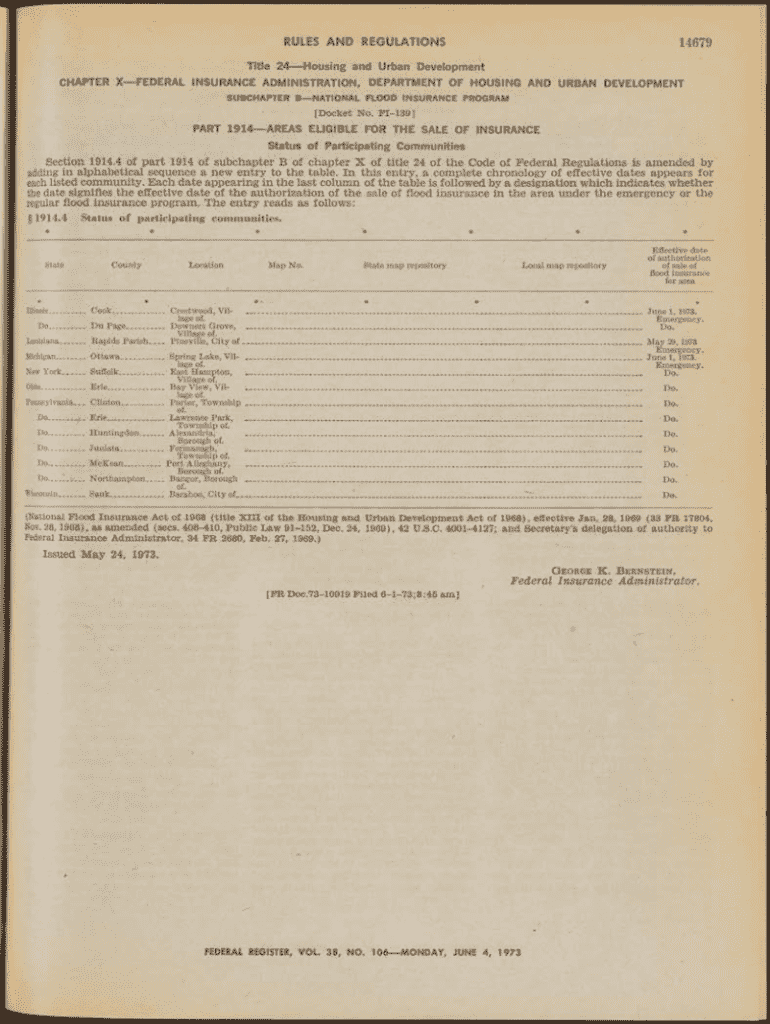

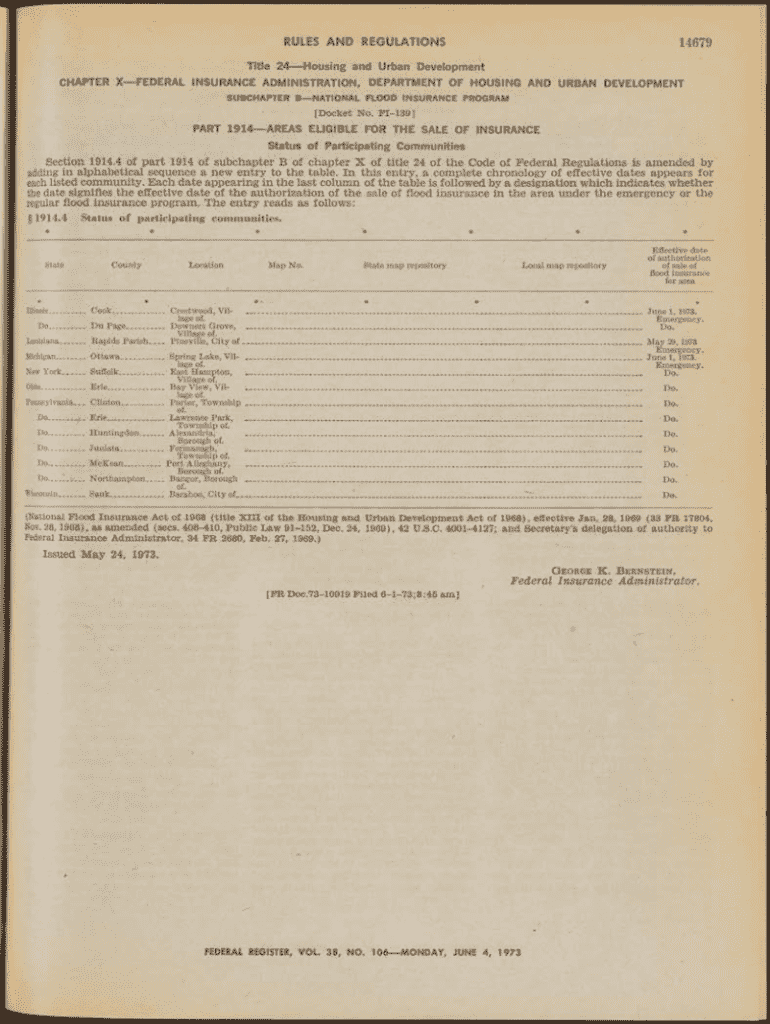

RULES AND REGULATIONS14679Title 24 Housing and Urban Development CHAPTER X FEDERAL INSURANCE ADMINISTRATION, DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT SUBCHAPTER B NATIONAL FLOOD INSURANCE PROGRAM[Docket

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal flood risk management

Edit your federal flood risk management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal flood risk management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal flood risk management online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit federal flood risk management. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal flood risk management

How to fill out federal flood risk management

01

Gather all necessary information and documents related to the property.

02

Access the federal flood risk management form online or obtain a physical copy.

03

Fill out the form accurately and completely, providing all requested information.

04

Double-check the information provided for accuracy and completeness.

05

Submit the completed form to the appropriate federal agency or department.

Who needs federal flood risk management?

01

Property owners located in flood-prone areas who want to assess and mitigate their risk of flooding.

02

Government agencies responsible for disaster preparedness and response.

03

Insurance companies offering flood insurance policies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify federal flood risk management without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your federal flood risk management into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the federal flood risk management in Gmail?

Create your eSignature using pdfFiller and then eSign your federal flood risk management immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out federal flood risk management using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign federal flood risk management and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is federal flood risk management?

Federal flood risk management refers to the policies and practices implemented by the federal government to assess, manage, and mitigate the risks associated with flooding. This includes the planning and regulation of floodplain development, financial assistance for flood recovery, and the establishment of flood insurance programs.

Who is required to file federal flood risk management?

Federal flood risk management filings are typically required for property owners and developers whose activities may impact floodplains or who are obtaining federal loans or grants for construction in flood-prone areas.

How to fill out federal flood risk management?

To fill out federal flood risk management forms, individuals must provide detailed information about their property, including its location within flood zones, any past flood damage, mitigation measures taken, and plans for future development. It often requires completing specific federal forms and may involve consultations with local floodplain managers.

What is the purpose of federal flood risk management?

The purpose of federal flood risk management is to reduce the impact of flooding on communities, protect lives and property, enhance awareness of flood risks, and promote sustainable development practices in flood-prone areas.

What information must be reported on federal flood risk management?

Information that must be reported includes the property address, the nature of the flood risk, previous flood claims, proposed construction or renovation details, and compliance with local floodplain regulations.

Fill out your federal flood risk management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Flood Risk Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.