Get the free HR & Payroll Services in West Palm Beach, FL

Show details

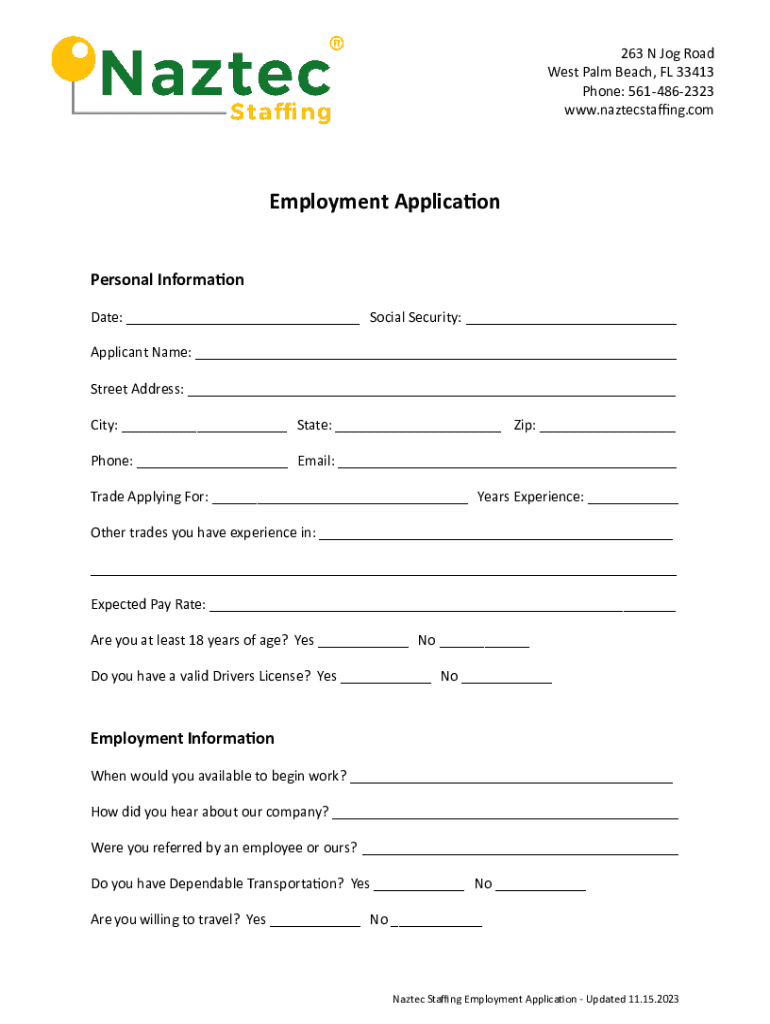

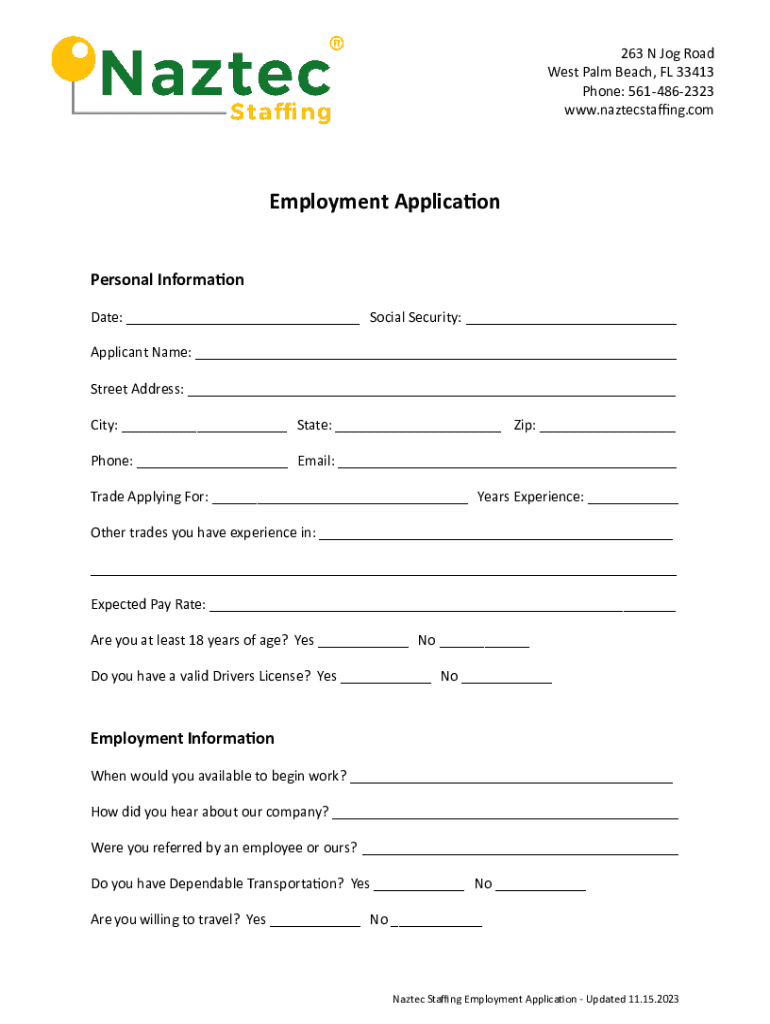

263 N Jog Road West Palm Beach, FL 33413 Phone: 5614862323 www.naztecstaffing.comEmployment Application Personal Information Date: ___ Social Security: ___ Applicant Name: ___ Street Address: ___

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hr amp payroll services

Edit your hr amp payroll services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hr amp payroll services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hr amp payroll services online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hr amp payroll services. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hr amp payroll services

How to fill out hr amp payroll services

01

Gather all necessary information such as employee details, hours worked, wages, deductions, and benefits.

02

Choose a reliable HR and payroll service provider that meets your business needs.

03

Input all the gathered information accurately into the HR and payroll system.

04

Review and verify all the data entered to ensure accuracy.

05

Submit the information to the service provider for processing and generating payroll reports.

06

Review the payroll reports and make any necessary adjustments before finalizing payments.

07

Distribute paychecks or initiate direct deposits to employees in a timely manner.

08

Keep thorough records of all payroll transactions for future reference and compliance purposes.

Who needs hr amp payroll services?

01

Small businesses that do not have a dedicated HR department.

02

Large corporations looking to streamline their payroll processes.

03

Startups looking to outsource non-core functions and focus on growth.

04

Companies experiencing growth and needing assistance with managing payroll complexities.

05

Business owners that want to ensure compliance with labor laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out hr amp payroll services on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your hr amp payroll services. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit hr amp payroll services on an Android device?

You can make any changes to PDF files, such as hr amp payroll services, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete hr amp payroll services on an Android device?

Use the pdfFiller mobile app and complete your hr amp payroll services and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is hr amp payroll services?

HR and payroll services refer to the management and processing of employee-related functions, including hiring, managing employee records, and processing payroll and tax obligations.

Who is required to file hr amp payroll services?

Employers with employees on their payroll are required to file HR and payroll services to comply with labor laws and tax regulations.

How to fill out hr amp payroll services?

To fill out HR and payroll services, employers need to gather necessary employee information, complete appropriate forms, and ensure accurate calculations of wages, deductions, and taxes before submitting them to relevant authorities.

What is the purpose of hr amp payroll services?

The purpose of HR and payroll services is to ensure accurate payment of employees, compliance with employment laws, and effective management of human resources within a company.

What information must be reported on hr amp payroll services?

Information that must be reported includes employee wages, tax withholding amounts, hours worked, benefits and deductions, and any additional payroll data required by federal or state regulations.

Fill out your hr amp payroll services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hr Amp Payroll Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.