Get the free Level 3-Comprehensive Credit Rating Report Company - cms creditman co

Show details

Level 3Comprehensive Credit Rating Report Supplied on Client Reference Reporter Verification 6 February 2014 www.creditman.co.uk In order to ensure the ac curacy of this report, certain information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign level 3-comprehensive credit rating

Edit your level 3-comprehensive credit rating form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your level 3-comprehensive credit rating form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit level 3-comprehensive credit rating online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit level 3-comprehensive credit rating. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out level 3-comprehensive credit rating

How to fill out level 3-comprehensive credit rating:

01

Start by gathering all necessary financial documents, including bank statements, tax returns, and any other relevant financial information.

02

Review the credit rating form and ensure you understand each section and the required information.

03

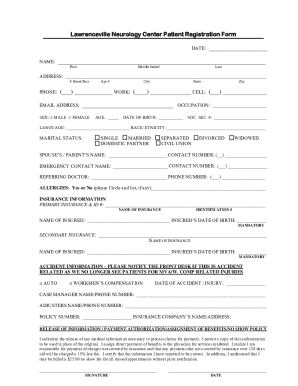

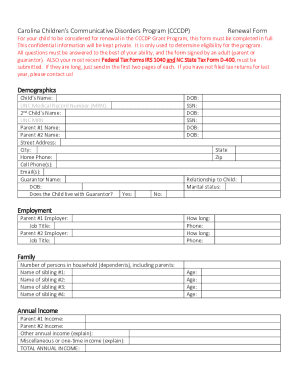

Begin by filling out personal details such as your name, address, and contact information.

04

Provide information about your employment, including your current job title, employer's name, and contact details.

05

If you own a business, fill out the relevant section with accurate information about the business, including its name, address, and type of industry.

06

Move on to the financial information section, where you will need to provide details about your income, assets, and liabilities.

07

Include accurate information about your debts, such as loans, credit card balances, and mortgages.

08

Be sure to fill out any additional sections that apply to your financial situation, such as investments, assets, and any other relevant details.

09

Once you have completed all the required sections, review the form carefully to ensure accuracy and completeness.

10

Double-check your contact information, as this is crucial for the credit agency to reach you if needed.

11

Attach any supporting documents required by the credit agency, such as proof of income, bank statements, or identification documents.

12

Finally, submit your completed level 3-comprehensive credit rating form to the appropriate credit agency and retain a copy for your records.

Who needs level 3-comprehensive credit rating:

01

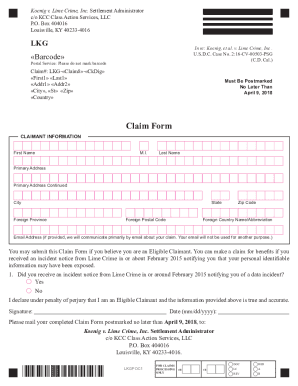

Individuals or businesses applying for large loans from financial institutions often require a level 3-comprehensive credit rating. This rating provides a more detailed and comprehensive assessment of the borrower's creditworthiness.

02

Investors or creditors may request a level 3-comprehensive credit rating as part of their due diligence process before investing or providing credit to an individual or business.

03

Companies looking to establish or enhance their credit profile may seek a level 3-comprehensive credit rating to demonstrate their creditworthiness to potential investors, partners, or clients.

04

Government institutions or agencies may require a level 3-comprehensive credit rating as part of regulatory compliance or for evaluating eligibility for specific programs or contracts.

05

Individuals or businesses involved in mergers, acquisitions, or partnerships may need a level 3-comprehensive credit rating to assess the financial stability and credibility of the other party.

06

Professionals in certain industries, such as finance, real estate, or investment management, may obtain a level 3-comprehensive credit rating to enhance their professional reputation and demonstrate financial responsibility.

07

Some landlords or property managers may request a level 3-comprehensive credit rating when screening prospective tenants to assess their ability to fulfill rental obligations.

08

Individuals seeking to improve their creditworthiness or establish a credit history may opt for a level 3-comprehensive credit rating to understand areas of improvement and enhance their overall credit profile.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get level 3-comprehensive credit rating?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the level 3-comprehensive credit rating. Open it immediately and start altering it with sophisticated capabilities.

How do I edit level 3-comprehensive credit rating online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your level 3-comprehensive credit rating to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete level 3-comprehensive credit rating on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your level 3-comprehensive credit rating from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is level 3-comprehensive credit rating?

Level 3-comprehensive credit rating is a detailed evaluation of a company's creditworthiness done by credit rating agencies.

Who is required to file level 3-comprehensive credit rating?

Companies or organizations seeking to borrow money through bonds or other debt instruments may be required to file level 3-comprehensive credit rating.

How to fill out level 3-comprehensive credit rating?

Level 3-comprehensive credit rating can be filled out by providing detailed financial information such as income statements, balance sheets, and cash flow statements.

What is the purpose of level 3-comprehensive credit rating?

The purpose of level 3-comprehensive credit rating is to provide investors and creditors with an assessment of the company's ability to repay its debts.

What information must be reported on level 3-comprehensive credit rating?

Information such as financial statements, market conditions, industry trends, and management qualifications must be reported on level 3-comprehensive credit rating.

Fill out your level 3-comprehensive credit rating online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Level 3-Comprehensive Credit Rating is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.