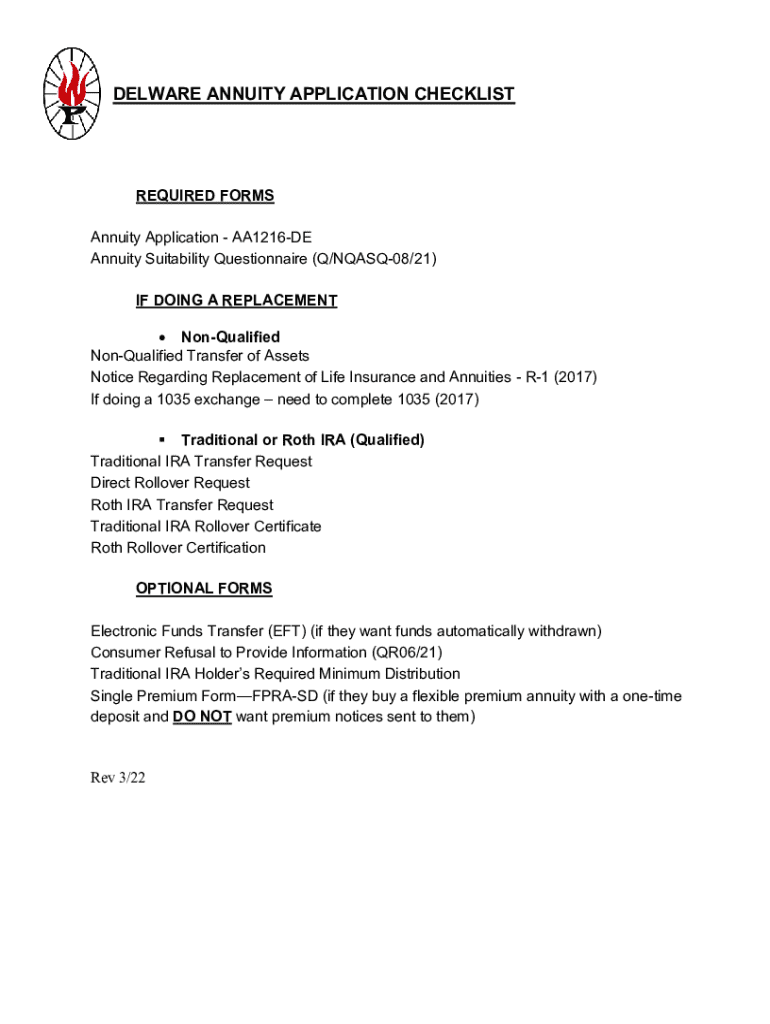

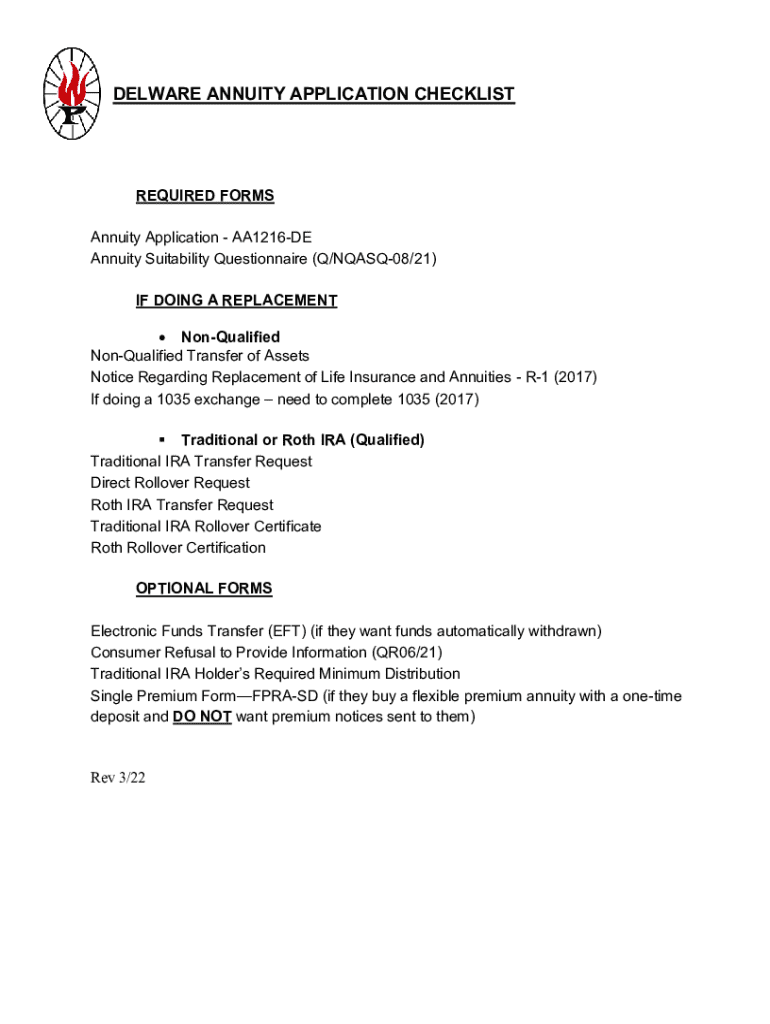

Get the free DELWARE ANNUITY APPLICATION CHECKLIST

Get, Create, Make and Sign delware annuity application checklist

Editing delware annuity application checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out delware annuity application checklist

How to fill out delware annuity application checklist

Who needs delware annuity application checklist?

Delaware annuity application checklist form: A comprehensive guide

Overview of the Delaware annuity application process

An annuity serves as a financial product designed to provide a steady income, particularly for individuals preparing for retirement or seeking to secure their financial future. In Delaware, the application process for obtaining an annuity involves specific guidelines and requirements essential for both individuals and businesses. This process is critical as it guarantees that applicants understand their financial responsibilities and the benefits associated with such investment options.

Understanding the mechanics of annuities provides clarity for applicants. These financial instruments are typically used for long-term investments, allowing individuals to accumulate funds over time and withdraw in a structured manner. The application process must therefore be thorough, ensuring that every relevant detail is captured accurately for smooth processing.

Key requirements for annuity applications in Delaware

When applying for an annuity in Delaware, applicants must fulfill certain eligibility criteria. Firstly, the age requirement stipulates that individuals must be at least 18 years old to enter into a contract for an annuity. This legal age requirement protects the interests of younger individuals, ensuring that they are sufficiently equipped to manage such investments.

Additionally, applicants must demonstrate their residency status in Delaware. This is crucial as some products may be tailored specifically for local residents. Demonstrating residency is typically accomplished through the submission of identification documents.

Necessary identification documents include your Social Security number and either a state ID or a driver’s license. This documentation is essential for verifying the applicant's identity and ensuring compliance with regulatory requirements.

Detailed Delaware annuity application checklist

Creating a strong application begins with a systematic checklist. Firstly, gather your personal information including your full name, contact information, date of birth, and Social Security number. Accurate personal details are crucial for the application to be processed without complications.

Next, provide detailed financial information. This includes your current financial situation, assets, income sources, and details about any previous annuities or claims if applicable. The insurer reviews these details to assess your suitability for their annuity products.

Selecting the right annuity type is pivotal. An applicant must understand the differences between fixed and variable annuities. Fixed annuities provide guaranteed payouts, while variable annuities allow for investment in various financial instruments that may offer higher returns but come with increased risks. The review of terms and conditions associated with the chosen annuity is also essential to ensure that applicants fully understand what they are entering into.

Essential tips for filling out the application include double-checking all information for accuracy, avoiding common pitfalls such as incomplete fields, and adhering to deadlines. Best practices extend to consulting with a financial advisor if unsure about certain aspects of the application.

Editing and managing your application

Utilizing a platform like pdfFiller can significantly enhance the editing and management of your Delaware annuity application. With pdfFiller, users can easily modify documents to ensure all details are correct. The platform offers user-friendly editing tools that allow for real-time corrections, which can prevent delays associated with erroneous submissions.

Additionally, the tool facilitates collaboration with team members or financial advisors. Inviting others to view or make suggestions can streamline the application process, ensuring that no critical information is overlooked. Once your application is thoroughly reviewed and finalized, the e-sign feature enables users to sign their documents electronically, further simplifying the submission process.

Submission procedure for Delaware annuity applications

Submitting your Delaware annuity application is a straightforward process once all components are completed. Applicants have the option to submit their forms either online or through traditional paper methods. The online submission offers quicker processing times, as digital forms can be immediately sent to the appropriate state offices.

Tracking the status of your application is vital. After submission, you can use specific tools or methods provided by the state offices to monitor your application's progress. Staying informed can provide peace of mind and allow you to address any potential issues swiftly.

Troubleshooting common application issues

Despite careful preparation, applicants sometimes face delays. Common reasons for application issues include missing documents, discrepancies in personal information, or failure to meet eligibility criteria. Addressing these issues promptly is essential to ensure that your application is processed smoothly and efficiently.

If you encounter challenges, contacting support for assistance is recommended. State offices provide various methods of communication, including email and phone contact options, designed to assist you with any particular concerns you may have regarding your application.

Frequently asked questions (FAQs)

Many potential applicants have similar questions surrounding the Delaware annuity application process. For instance, if your application is denied, understanding the reasons cited can provide insight and clarity regarding your eligibility for future applications.

Amending an application post-submission is permitted, although it requires following specific state protocols. Additionally, some applicants may wonder if there is a fee for applying; checking with the relevant state office can provide accurate information.

Interactive tools offered by pdfFiller

pdfFiller hosts a plethora of interactive tools that enhance the creation and management of documents, including annuity application forms. The platform allows for customers to create custom documents tailored to their needs with ease using included templates and features. These tools streamline the process, making it accessible and efficient for users.

Examples of user-friendly templates specifically designed for annuities can alleviate the stress of document preparation. By utilizing these templates, users can save time, ensure compliance with requirements, and maintain a high degree of accuracy.

Why choose pdfFiller for your annuity application needs?

One of the primary advantages of using pdfFiller is its cloud-based document management system. Users can access their documents securely from anywhere, which is a significant benefit for individuals managing applications remotely. The platform's security features ensure that sensitive information remains protected throughout the entire process.

Success stories abound as many users share their experiences navigating their document submissions with pdfFiller. They testify to the increased efficiency and convenience afforded by using a central platform for managing crucial documents, ensuring that processes such as those involved in applying for an annuity are not only manageable but also successful.

Enhancing your awareness of Delaware annuity options

Understanding the various annuity options available is crucial for making informed financial decisions. Delaware offers diverse resources aimed at educating residents about their financial choices. Engaging with local workshops or financial advising sessions can bolster your knowledge and prepare you for successful applications.

Additionally, staying updated with upcoming announcements about changes in annuity legislation can impact the products available and the overall application process. Being proactive will ensure you remain in tune with legislative changes that could affect your investments.

Final thoughts on using pdfFiller

Building confidence in managing your Delaware annuity application can be made significantly easier with pdfFiller's comprehensive solutions at your disposal. With tools designed for editing, signing, and collaborating, pdfFiller equips users to navigate their applications effectively, ensuring an organized and straightforward approach.

Utilizing pdfFiller's features empowers individuals and teams alike, making the annuity application process less daunting and more accessible, ultimately leading to informed financial decisions and successful annuity acquisitions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send delware annuity application checklist for eSignature?

How do I make edits in delware annuity application checklist without leaving Chrome?

Can I edit delware annuity application checklist on an Android device?

What is delware annuity application checklist?

Who is required to file delware annuity application checklist?

How to fill out delware annuity application checklist?

What is the purpose of delware annuity application checklist?

What information must be reported on delware annuity application checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.