Get the free Life Insurance for NRI - Insurance Plans for Non-Resident ...

Show details

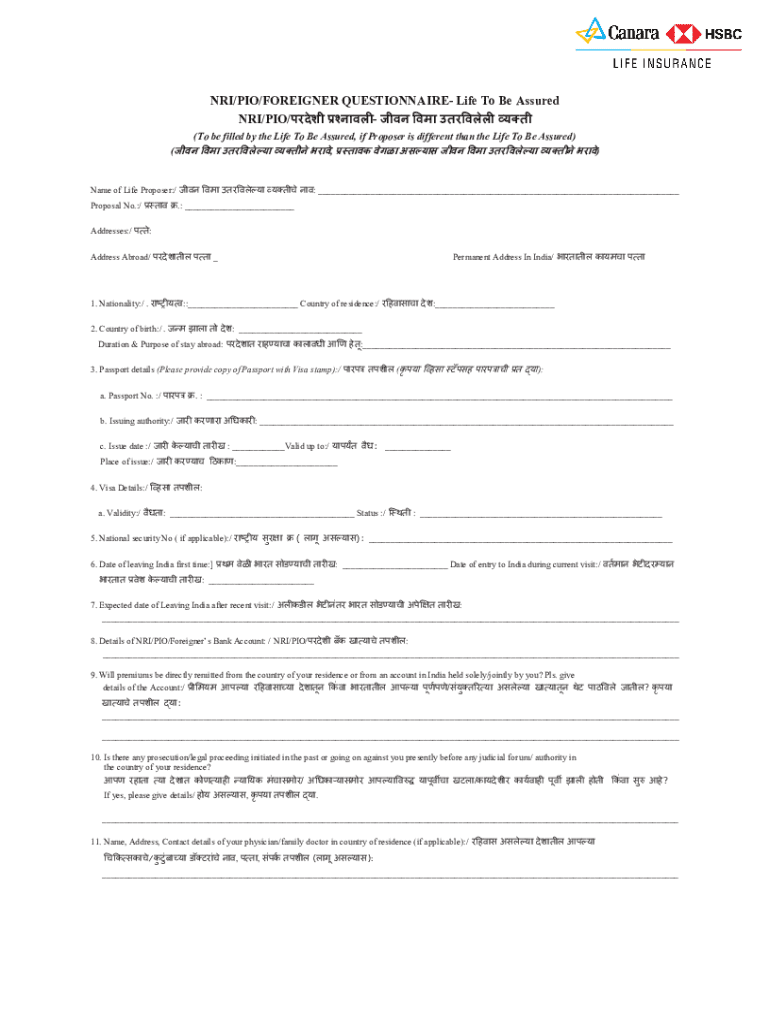

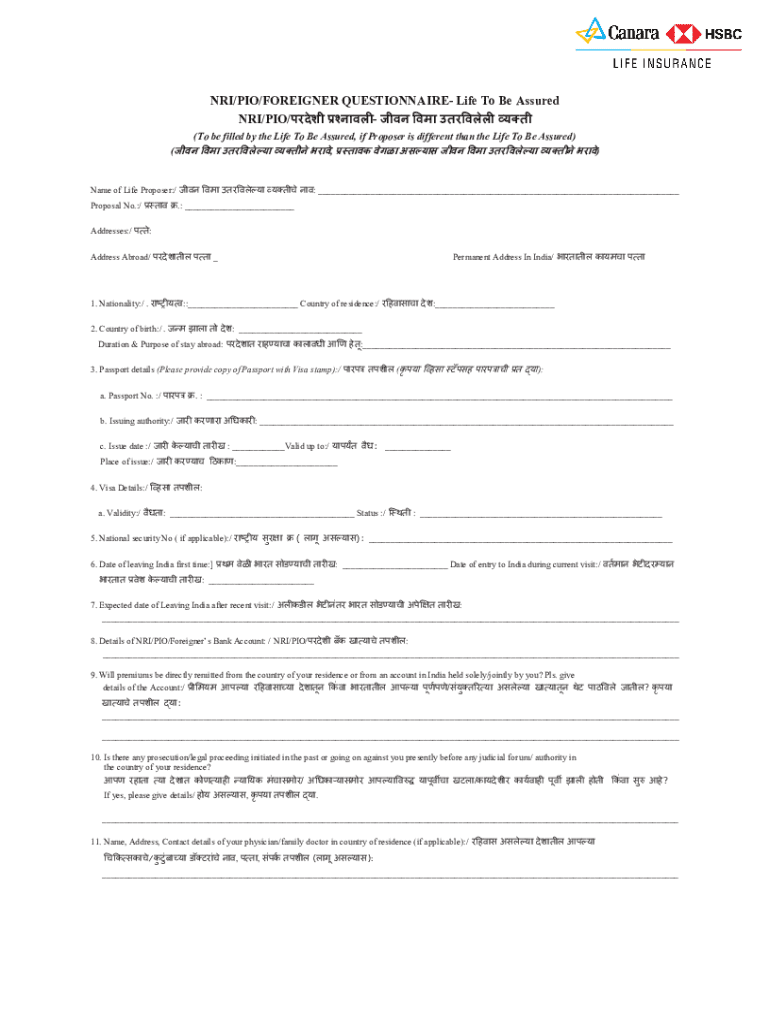

NRI/PIO/FOREIGNER QUESTIONNAIRE Life To Be Assured NRI/PIO/ (To be filled by the Life To Be Assured, if Proposer is different than the Life To Be Assured) ( ,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance for nri

Edit your life insurance for nri form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance for nri form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance for nri online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit life insurance for nri. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance for nri

How to fill out life insurance for nri

01

Determine the type of life insurance policy you need (term or whole life).

02

Gather necessary documents, such as passport, proof of residency, and financial information.

03

Find a reputable insurance provider that offers policies for NRIs.

04

Complete the application form, providing accurate personal and financial details.

05

Disclose any health-related information and medical history as required.

06

Submit any required identification and supporting documents.

07

Review the policy terms and conditions before finalizing.

08

Make the initial premium payment to activate the policy.

Who needs life insurance for nri?

01

NRIs with dependents who need financial security.

02

Individuals looking to cover debts and loans to avoid burdening family members.

03

Those who want to save on estate taxes for their beneficiaries.

04

Individuals planning for retirement and seeking long-term financial planning.

05

People wanting to leave a legacy for their loved ones.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify life insurance for nri without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your life insurance for nri into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I edit life insurance for nri on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing life insurance for nri.

How do I edit life insurance for nri on an Android device?

The pdfFiller app for Android allows you to edit PDF files like life insurance for nri. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is life insurance for nri?

Life insurance for Non-Resident Indians (NRIs) is a financial product that provides a payout to the beneficiary in the event of the policyholder's death. It ensures financial security for the family of the policyholder living abroad.

Who is required to file life insurance for nri?

NRIs who hold life insurance policies and need to report their earnings or tax liabilities in their home country are required to file life insurance for NRIs.

How to fill out life insurance for nri?

To fill out life insurance for NRIs, one must provide personal identification details, policy information, beneficiary details, and any income-related information as required by the insurance provider or tax authority.

What is the purpose of life insurance for nri?

The purpose of life insurance for NRIs is to provide financial support to their family members in their home country in the event of the policyholder's death, ensuring their dependents have financial security.

What information must be reported on life insurance for nri?

Information that must be reported includes the policyholder's details, policy number, premiums paid, benefits payable, and any surrender value, along with tax implications in both host and home countries.

Fill out your life insurance for nri online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance For Nri is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.