Get the free Sba 504 Loan Deferment Request

Show details

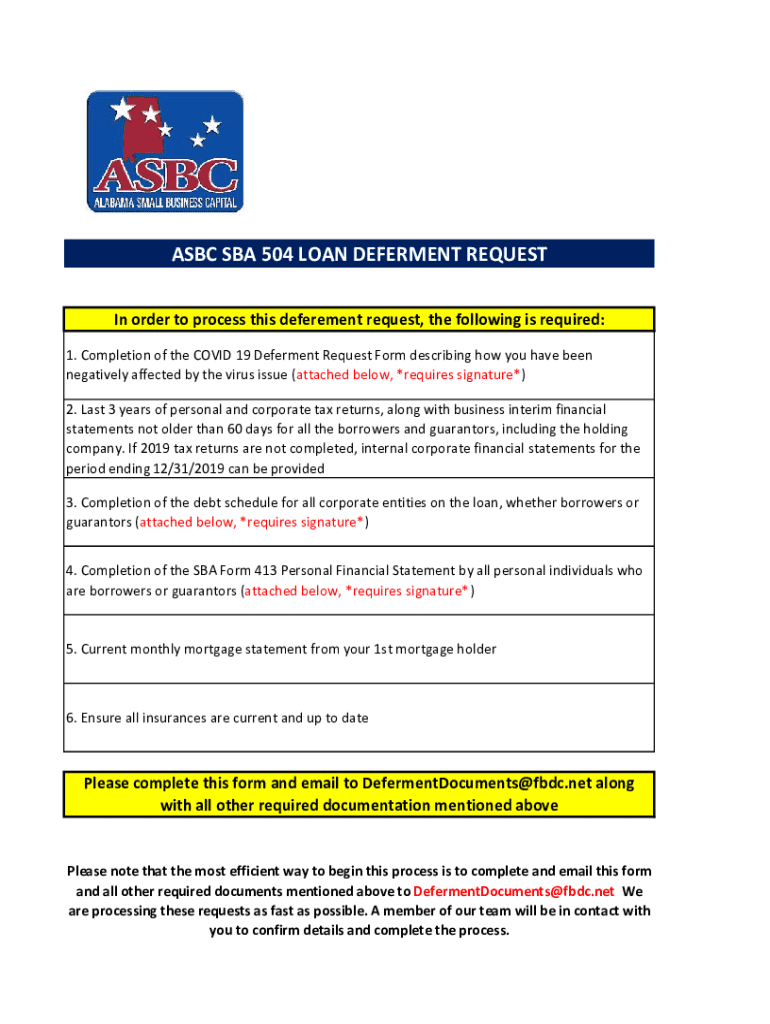

Submit your SBA 504 loan deferment request with required documents to receive assistance amid COVID-19 impacts. Essential for business recovery.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba 504 loan deferment

Edit your sba 504 loan deferment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba 504 loan deferment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba 504 loan deferment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sba 504 loan deferment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba 504 loan deferment

How to fill out sba 504 loan deferment

01

Gather necessary documentation, including your SBA 504 loan information, financial statements, and a recent profit and loss statement.

02

Identify the reason for your deferment request, such as financial hardship or unexpected circumstances.

03

Contact your lender or SBA representative to discuss your intention to apply for a deferment.

04

Complete the deferment application form provided by your lender, ensuring all information is accurate and complete.

05

Attach supporting documents that justify your request for deferment.

06

Submit the deferment application and any required documents to your lender.

07

Follow up with your lender to confirm receipt of your application and inquire about the processing timeline.

Who needs sba 504 loan deferment?

01

Businesses facing temporary financial challenges due to economic downturns, natural disasters, or other unexpected events.

02

Small business owners who are unable to make their scheduled SBA 504 loan payments due to cash flow issues.

03

Companies seeking to manage their financial obligations during periods of decreased revenue or increased expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the sba 504 loan deferment in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your sba 504 loan deferment right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete sba 504 loan deferment on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your sba 504 loan deferment, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit sba 504 loan deferment on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share sba 504 loan deferment on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is sba 504 loan deferment?

SBA 504 loan deferment is a temporary suspension of loan payments for borrowers who are facing financial difficulties, allowing them to alleviate cash flow pressures.

Who is required to file sba 504 loan deferment?

Borrowers who are experiencing financial hardship and wish to temporarily suspend their loan payments must file for SBA 504 loan deferment.

How to fill out sba 504 loan deferment?

To fill out the SBA 504 loan deferment, borrowers typically need to complete a deferment application form provided by their lender, detailing their current financial situation and the reason for the deferment request.

What is the purpose of sba 504 loan deferment?

The purpose of the SBA 504 loan deferment is to provide financial relief to borrowers by allowing them to temporarily postpone loan payments during times of economic distress or uncertainty.

What information must be reported on sba 504 loan deferment?

Borrowers must report their current financial status, reasons for requesting the deferment, and any supporting documentation that demonstrates their financial hardship.

Fill out your sba 504 loan deferment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba 504 Loan Deferment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.