Get the free Foreign Currency Option Margin

Show details

OMB APPROVAL OMB Number: 3235-0045 Expires: June 30, 2010, Estimated average burden hours per response............38 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 Form 19b-4 Page 1 of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign currency option margin

Edit your foreign currency option margin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign currency option margin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreign currency option margin online

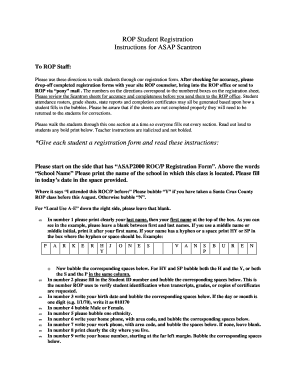

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit foreign currency option margin. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign currency option margin

How to fill out foreign currency option margin:

01

Determine the type of foreign currency option you want to trade. There are two types: a call option, which gives you the right to buy a foreign currency at a specified price within a certain time frame, and a put option, which gives you the right to sell a foreign currency at a specified price within a certain time frame.

02

Choose the foreign currency pair you want to trade. For example, if you want to trade the EUR/USD pair, you would be exchanging euros for US dollars.

03

Determine the strike price, which is the price at which the option can be exercised. This should be based on your analysis of the foreign currency market and your trading strategy.

04

Decide on the expiration date for the option. This is the date when the option contract expires and you can no longer exercise your right to buy or sell the foreign currency.

05

Calculate the required margin for the foreign currency option. Margin is the amount of money you need to deposit in your trading account to cover potential losses. This is calculated based on the notional value of the option and the margin requirement set by your broker.

06

Fill out the necessary paperwork or online forms provided by your broker to open a margin account for trading foreign currency options.

07

Deposit the required margin into your trading account. This will vary depending on the size of the option contract and the leverage offered by your broker.

08

Monitor the foreign currency market and your option position. Keep track of any changes in the exchange rate and market conditions that may affect the value of your option.

09

Decide whether to exercise your option or let it expire. If the market moves in your favor and the option is profitable, you may choose to exercise it and take the profit. If the market moves against your option, you may choose to let it expire and limit your losses to the initial margin deposit.

Who needs foreign currency option margin?

01

Currency traders: Foreign currency option margin is needed by professional and retail currency traders who want to take advantage of currency exchange rate movements and protect themselves against potential losses.

02

Importers and exporters: Businesses involved in international trade often use foreign currency options to hedge their currency exposure. By using options, they can lock in exchange rates and protect themselves against adverse currency movements.

03

Multinational corporations: Companies with operations in multiple countries often need to manage their foreign currency risk. Foreign currency option margin allows them to hedge their currency exposure and reduce the impact of exchange rate fluctuations on their financial results.

04

Speculators: Some traders and investors use foreign currency options as a speculative tool. They aim to profit from the volatility in currency markets by speculating on the direction of exchange rates.

05

Individuals with overseas assets: Individuals who own assets denominated in foreign currencies, such as real estate or investments, may use foreign currency options to protect the value of their assets against currency fluctuations.

In summary, filling out a foreign currency option margin involves determining the type of option, choosing a currency pair, setting the strike price and expiration date, calculating the required margin, opening a margin account, depositing the margin, monitoring the market, and deciding whether to exercise the option. The need for foreign currency option margin extends to currency traders, importers/exporters, multinational corporations, speculators, and individuals with overseas assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is foreign currency option margin?

Foreign currency option margin is the amount of funds required to be deposited by parties trading in foreign currency options to cover potential losses.

Who is required to file foreign currency option margin?

Individuals or entities trading in foreign currency options are required to file foreign currency option margin.

How to fill out foreign currency option margin?

To fill out foreign currency option margin, traders must provide detailed information about their trading activities, including the amount of funds deposited and the exchange rates used.

What is the purpose of foreign currency option margin?

The purpose of foreign currency option margin is to ensure that traders have sufficient funds to cover potential losses and mitigate risk in foreign currency trading.

What information must be reported on foreign currency option margin?

Information such as the amount of funds deposited, the currency pairs traded, and the expiration dates of the options must be reported on foreign currency option margin.

How do I modify my foreign currency option margin in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your foreign currency option margin and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit foreign currency option margin in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing foreign currency option margin and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit foreign currency option margin on an Android device?

The pdfFiller app for Android allows you to edit PDF files like foreign currency option margin. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your foreign currency option margin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Currency Option Margin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.