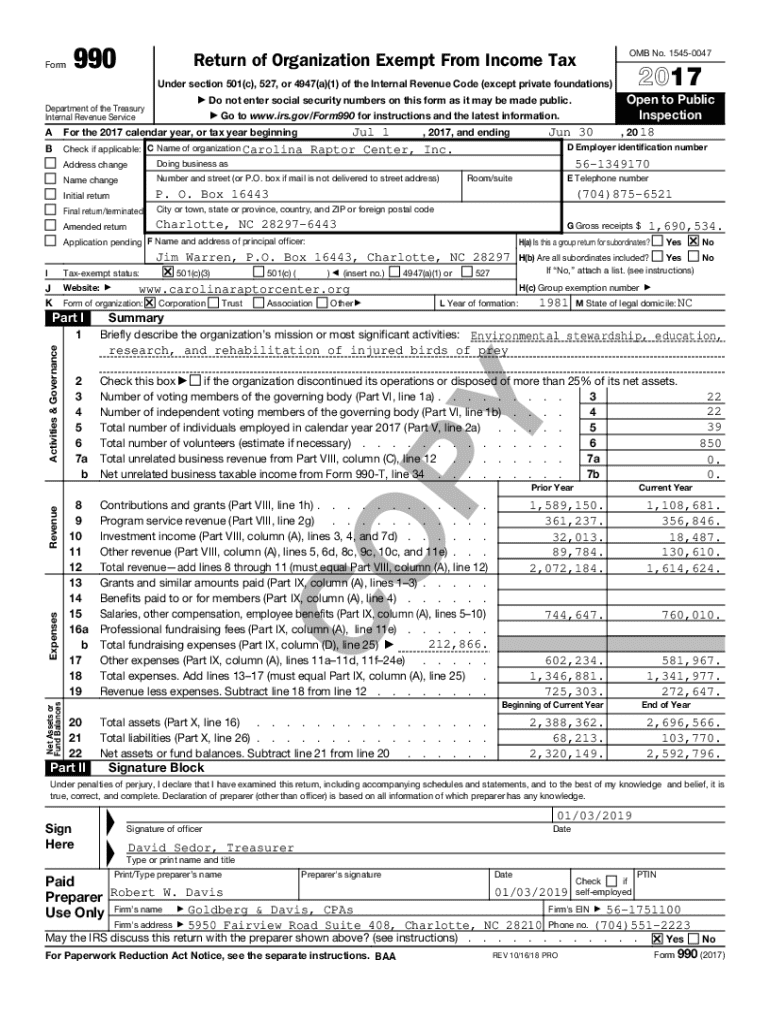

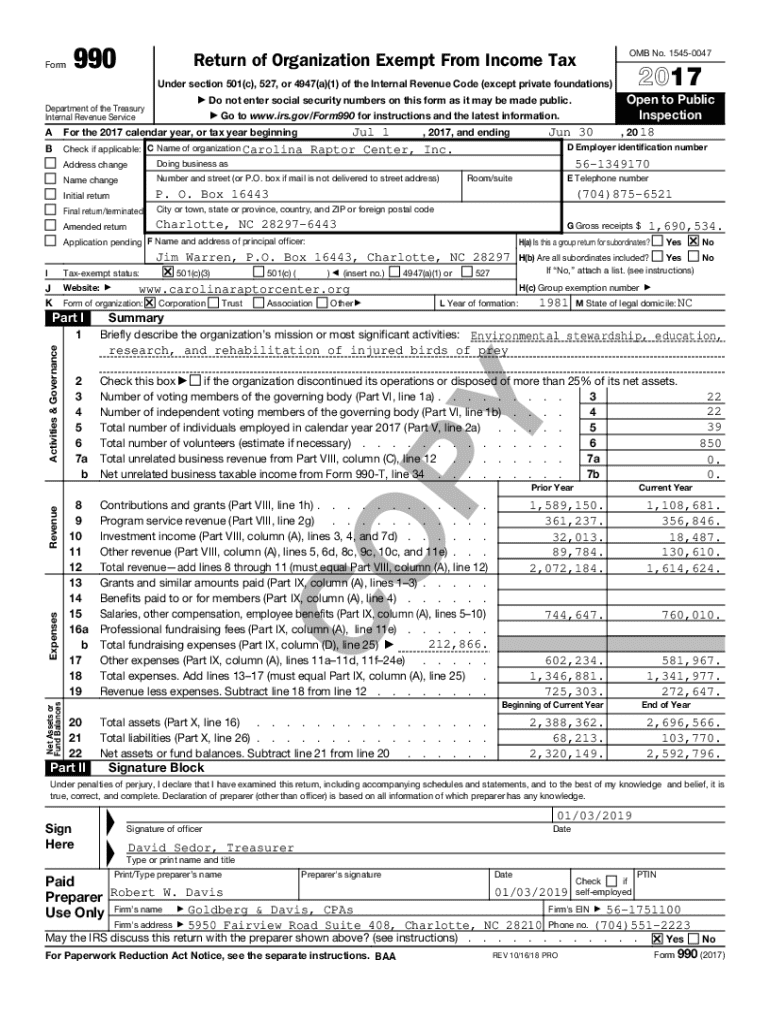

Get the free Check if applicable: C Name of organization Carolina

Get, Create, Make and Sign check if applicable c

How to edit check if applicable c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check if applicable c

How to fill out check if applicable c

Who needs check if applicable c?

Check if applicable form: A comprehensive guide to Form 1095-

Overview of Form 1095-

Form 1095-C serves as an essential document for providing information about health insurance coverage offered by employers to their employees. This form is part of the reporting requirements mandated under the Affordable Care Act (ACA), ensuring that employers meet their obligations to offer health coverage to eligible employees. Understanding its purpose helps both employers and employees navigate their healthcare responsibilities more effectively.

For employers classified as Applicable Large Employers (ALEs), Form 1095-C is crucial in demonstrating compliance with ACA health coverage requirements. Meanwhile, employees use it to confirm their health insurance status, particularly during tax season, impacting their eligibility for premium subsidies and tax penalties.

Understanding ACA requirements

The Affordable Care Act (ACA) has established specific requirements for employers related to providing health insurance coverage. Not every business has the same obligations; thus, defining who must file Form 1095-C is critical. Essentially, the ACA mandates that employers with 50 or more full-time equivalent employees are considered Applicable Large Employers (ALEs) and must comply with these reporting requirements. This includes various types of entities, such as corporations, partnerships, and non-profit organizations.

For smaller employers, those with fewer than 50 employees, understanding their exemptions and specific duties under ACA requirements is equally important. While they are not required to file Form 1095-C, many still need to provide documentation on employee health coverage.

Checking applicability of Form 1095-

To determine if Form 1095-C is applicable to your situation, you must evaluate certain criteria, including employee status and employer size. Full-time employees are defined as those working 30 hours or more per week. If your organization employs 50 or more full-time employees, then you must file Form 1095-C, regardless of whether you offer health benefits.

It's also essential to correct common misconceptions regarding the applicability of this form. Employers might believe that they can avoid compliance simply by offering minimal health plans or part-time jobs. However, the ACA views full-time employee count differently, which can lead to errors in compliance.

Detailed steps for completing Form 1095-

Completing Form 1095-C can be straightforward if you follow these detailed steps: Start by gathering necessary employee information, including names, SSNs, and employment details. This data is fundamental as it flows into the form's various sections.

While completing the form, it is crucial to avoid common errors. Double-check employee details, particularly Social Security Numbers, as these mistakes can complicate tax filing and reporting.

Filing and submission guidelines

Form 1095-C must be submitted by a specific deadline to avoid penalties. Typically, the due date is aligned with the tax filing season. Employers are required to distribute this form to employees by January 31 and file it with the IRS by February 28 if submitted by paper or by March 31 if electronically.

Employers must also consider the location for sending filed forms, ensuring they are dispatched to the correct IRS address based on their locale.

Compliance and penalties

Non-compliance with ACA requirements, including the failure to file Form 1095-C, can lead to significant penalties. Employers may face fines of $250 for each unfiled form, with potential maximum penalties reaching $3 million for neglectful behavior.

Recordkeeping is another critical factor for employers. Companies should retain copies of Form 1095-C for at least three years after filing. This retention can be vital if the IRS questions compliance or if an employee seeks to validate coverage during the tax season.

Correcting Form 1095-

Mistakes can happen, and knowing how to issue a corrected Form 1095-C is essential for compliance. If you discover an error after filing, it’s important to amend the form promptly to avoid penalties. Employers must issue a corrected form when they have new information or if an error is identified.

Be mindful that corrections should be communicated effectively to employees, ensuring they are aware of the necessary updates regarding their health coverage.

Additional resources for employers

Employers can benefit from a plethora of resources designed to aid ACA compliance. Tools available through platforms like pdfFiller provide comprehensive guides and document management solutions to streamline the process of handling Form 1095-C.

Additionally, the IRS offers extensive guidance related to Form 1095-C, which can be accessed online. Staying informed through such resources is crucial, especially considering the constant developments within ACA regulations.

Form 1095- codes explained

Understanding codes incorporated in Form 1095-C is vital for interpreting the health coverage provided. These codes inform the IRS and employees about the type of coverage offered and whether it meets ACA requirements.

Employers and employees should create a reference document that outlines these codes, ensuring clarity when evaluating health benefits and compliance.

FAQs regarding Form 1095-

Employers often have questions about their responsibilities related to Form 1095-C. Common inquiries include whether multiple employers can file for an employee or what actions employees should take if they do not receive their Form 1095-C in time for tax filing.

For additional assistance, employers and employees can refer to IRS publications or contact professional tax advisors to ensure correct compliance with ACA guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my check if applicable c directly from Gmail?

How do I make edits in check if applicable c without leaving Chrome?

How do I fill out check if applicable c on an Android device?

What is check if applicable c?

Who is required to file check if applicable c?

How to fill out check if applicable c?

What is the purpose of check if applicable c?

What information must be reported on check if applicable c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.