UT TC-20MC 2023 free printable template

Show details

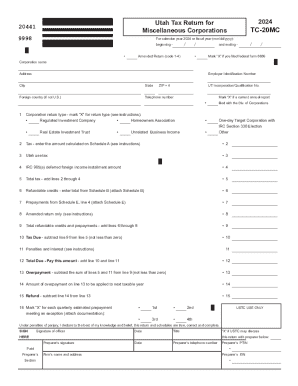

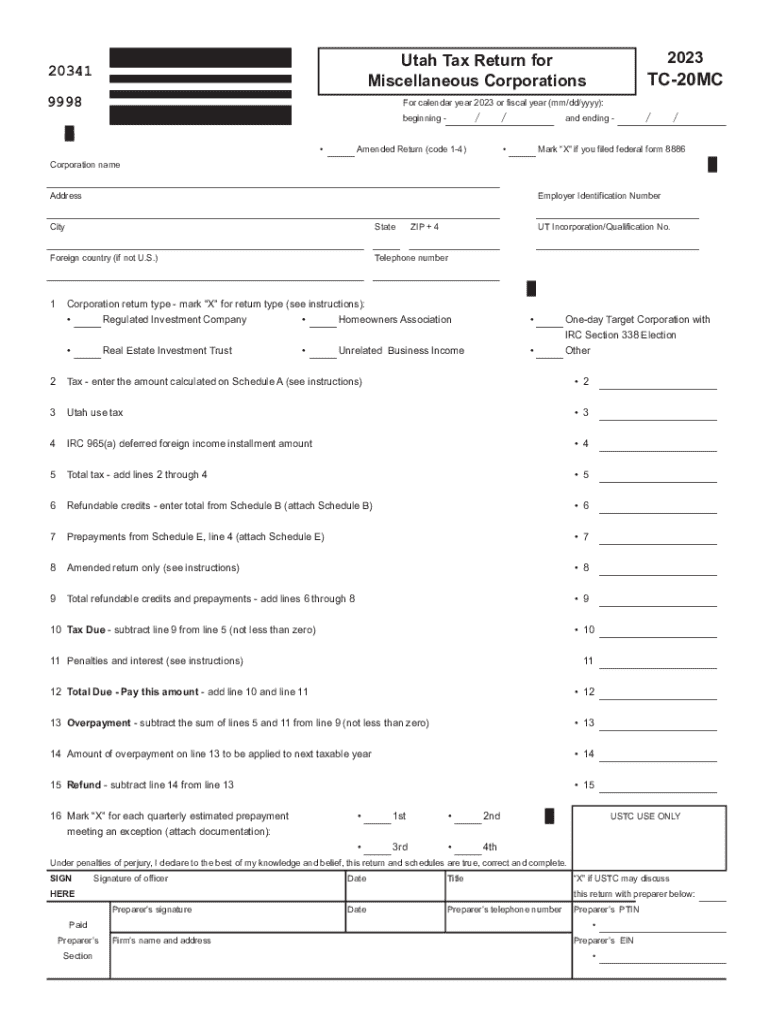

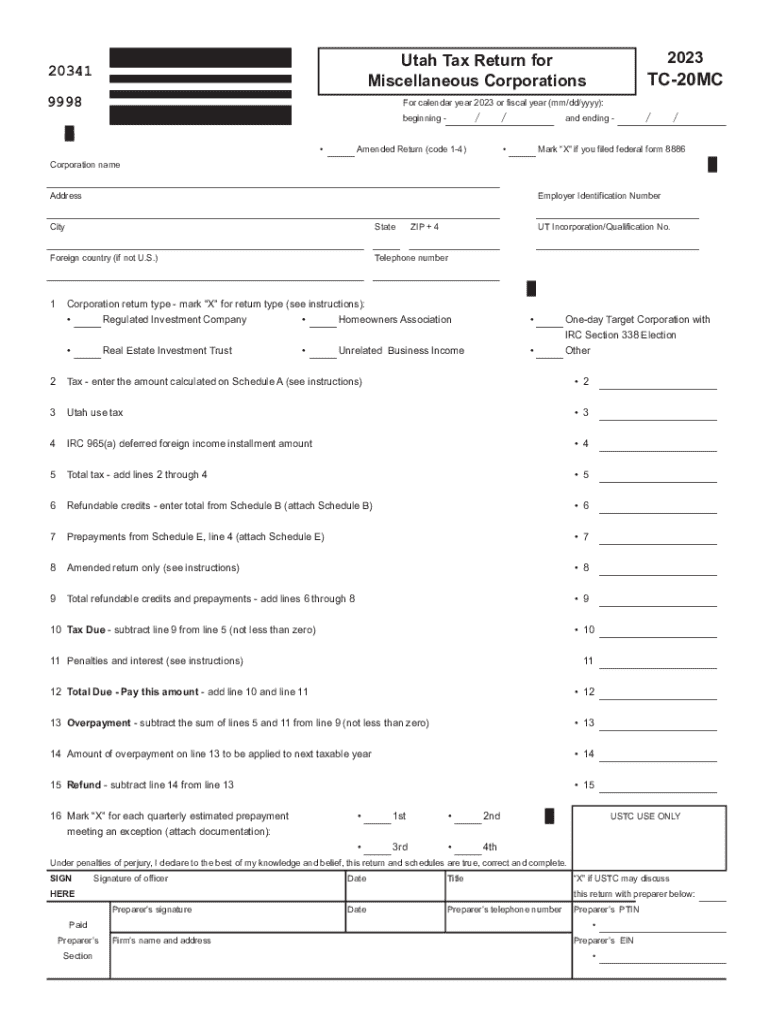

Clear form2023Utah Tax Return for

Miscellaneous Corporations20341

9998TC20MCFor calendar year 2023 or fiscal year (mm/dd/yyyy):/beginning /and ending //USTC

CO

ORIGINAL FORMAmended Return (code 14)Mark

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign utah tc 20mc form

Edit your ut tc 20mc 2023 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ut tc 20mc 2023 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ut tc 20mc 2023 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ut tc 20mc 2023. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-20MC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ut tc 20mc 2023

How to fill out UT TC-20MC

01

Begin by downloading the UT TC-20MC form from the official website or obtaining a copy from your local office.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Specify the purpose for using the TC-20MC in the designated section.

04

Provide additional information or documentation required as per the instructions on the form.

05

Review all the filled sections for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form either electronically or in-person to the appropriate authority.

Who needs UT TC-20MC?

01

Individuals applying for a tax exemption or reduction.

02

Businesses needing to claim tax rebates or refunds.

03

Entities involved in activities that require compliance with taxation policies.

04

Any individuals or organizations seeking to report tax-related information to the UT Department.

Fill

form

: Try Risk Free

People Also Ask about

Does Utah require a state tax form?

ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return.

How do I get a tax clearance certificate in Utah?

To receive your customized application for tax clearance, please call the Tax Commission at 801-297-2200 or 1-800-662-4335. Application forms from other sources may be denied. NOTE: When calling, please have your Federal Employer Identification Number (FEIN) and your Utah Entity Number.

Why am i getting a letter from Utah State Tax Commission?

If your return is chosen, we will send you an Identity Protection Verification letter that asks you to complete a verification process. Depending on the situation, this letter may ask you to take a short online quiz or to provide documents to verify your identity.

Does Utah have a state tax withholding form?

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return.

Does Utah have a state tax form?

These 2021 forms and more are available: Utah Form TC-40 – Personal Income Tax Return for Residents. Utah Form TC-40A – Income Tax Supplemental Schedule. Utah Form TC-40B – Nonresident or Part-Year Resident Income Schedule.

Where do I mail my Utah TC 20?

A copy of the IRS letter of authorization, “Notice of Acceptance as an S Corporation,” must be at- tached to the S Corporation Franchise or Income Tax Return, TC-20S, when filing for the first time. and Tax Commission Master File Maintenance 210 N 1950 W Salt Lake City, UT 84134.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ut tc 20mc 2023 to be eSigned by others?

When you're ready to share your ut tc 20mc 2023, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit ut tc 20mc 2023 in Chrome?

Install the pdfFiller Google Chrome Extension to edit ut tc 20mc 2023 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the ut tc 20mc 2023 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your ut tc 20mc 2023 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is UT TC-20MC?

UT TC-20MC is a form used in Utah for reporting corporate income tax information.

Who is required to file UT TC-20MC?

Any corporation or entity doing business in Utah and subject to the state's corporate income tax is required to file UT TC-20MC.

How to fill out UT TC-20MC?

To fill out UT TC-20MC, you need to provide information on taxable income, deductions, and credits, along with necessary identification details of the corporation.

What is the purpose of UT TC-20MC?

The purpose of UT TC-20MC is to report the financial activities of corporations to the Utah State Tax Commission for tax assessment and compliance.

What information must be reported on UT TC-20MC?

UT TC-20MC requires reporting of details such as total income, deductions, taxable income, and required corporate information.

Fill out your ut tc 20mc 2023 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ut Tc 20mc 2023 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.