Get the free Tax Deductible Sponsorship Opportunities - My Home, Your Home Inc. - myhomeyourhome

Show details

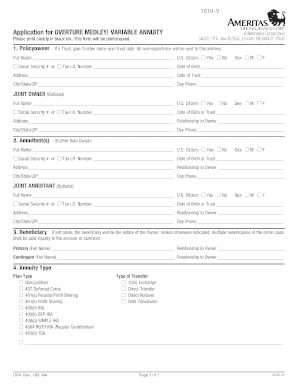

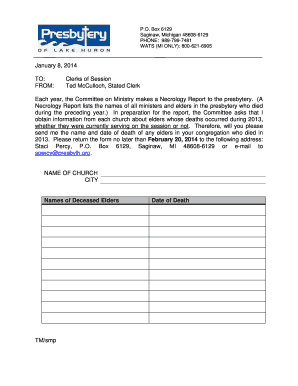

The Home, Your Home Inc. 4th Annual Fundraising Luncheon Heart in a Purse Tuesday, April 23rd, 2013 11:30am Italian Community Center Tax Deductible Sponsorship Opportunities LEVEL ? The Louis Vuitton

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deductible sponsorship opportunities

Edit your tax deductible sponsorship opportunities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deductible sponsorship opportunities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax deductible sponsorship opportunities online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax deductible sponsorship opportunities. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deductible sponsorship opportunities

How to fill out tax deductible sponsorship opportunities:

01

Start by researching organizations or events that offer tax deductible sponsorship opportunities. Look for non-profit organizations, community programs, or charitable events that align with your interests or values.

02

Review the sponsorship guidelines and requirements provided by the organization or event. This may include specific sponsorship levels, benefits, and deadlines for submissions.

03

Determine the amount you are willing to contribute as a sponsorship. Consider your budget and any potential tax benefits you may receive from the sponsorship.

04

Complete the sponsorship application or proposal form provided by the organization or event. Provide all requested information, including your contact details, business or organization information, and desired sponsorship level.

05

If necessary, include any supporting materials such as logos, brochures, or marketing materials that showcase your business or organization.

06

Consider including a personalized message or cover letter expressing your interest in supporting the organization or event and explaining how the sponsorship aligns with your objectives.

07

Submit your completed sponsorship application or proposal within the specified deadline. Ensure that all required documents and information are included.

08

Follow up with the organization or event to confirm receipt of your sponsorship application and to inquire about any further steps or requirements.

09

Keep track of your sponsorship contribution for tax purposes. Consult with a tax professional or accountant to ensure you understand the tax benefits associated with your sponsorship and how to properly claim them.

Who needs tax deductible sponsorship opportunities?

01

Non-profit organizations that rely on funding from sponsors to support their initiatives and operations.

02

Businesses or individuals looking to support causes, events, or organizations aligned with their values and interests while also receiving potential tax benefits.

03

Events or community programs seeking financial support to cover expenses and enhance their offerings.

04

Individuals or organizations looking to increase their brand visibility and reputation through sponsorships while capitalizing on potential tax deductions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax deductible sponsorship opportunities online?

pdfFiller has made filling out and eSigning tax deductible sponsorship opportunities easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the tax deductible sponsorship opportunities in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your tax deductible sponsorship opportunities in seconds.

How do I fill out tax deductible sponsorship opportunities using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign tax deductible sponsorship opportunities. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is tax deductible sponsorship opportunities?

Tax deductible sponsorship opportunities refer to financial support provided by businesses or individuals to a charitable organization, which can be used as a tax deduction on their tax returns.

Who is required to file tax deductible sponsorship opportunities?

Businesses or individuals who provide sponsorship to charitable organizations and want to deduct it from their taxes are required to file tax deductible sponsorship opportunities.

How to fill out tax deductible sponsorship opportunities?

Tax deductible sponsorship opportunities can be filled out by providing details of the sponsorship amount, recipient organization, and ensuring the donation meets the criteria set by the tax laws for deductibility.

What is the purpose of tax deductible sponsorship opportunities?

The purpose of tax deductible sponsorship opportunities is to incentivize businesses and individuals to support charitable causes by offering a tax deduction for their contributions.

What information must be reported on tax deductible sponsorship opportunities?

Information that must be reported on tax deductible sponsorship opportunities includes the amount of the sponsorship, details of the recipient organization, and any other relevant documentation required by the tax authorities.

Fill out your tax deductible sponsorship opportunities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deductible Sponsorship Opportunities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.