Get the free abn 11 005 357 522

Show details

M Menu Next Back AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ABN 11 005 357 522 CONSOLIDATED FINANCIAL STATEMENTS AND DIVIDEND ANNOUNCEMENT Year Ended 30 September 2000 CONTENTS PAGE HIGHLIGHTS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign abn 11 005 357

Edit your abn 11 005 357 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your abn 11 005 357 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit abn 11 005 357 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit abn 11 005 357. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out abn 11 005 357

How to fill out ABN 11 005 357:

01

Start by obtaining the ABN application form, which can be downloaded from the Australian Business Register (ABR) website or requested by calling the ABR contact center.

02

Provide the required information on the form, such as the legal name of the individual or business entity applying for the ABN, trading name (if applicable), and contact details.

03

Indicate the entity type, which could be a sole trader, company, partnership, trust, or superannuation fund.

04

Specify the main business activity or occupation that the ABN will be used for.

05

If applying as a company or partnership, include the Australian Company Number (ACN) or Australian Registered Body Number (ARBN) respectively.

06

If applicable, provide the Australian Company Number (ACN) or Australian Registered Body Number (ARBN) of the associate entity.

07

Declare whether the entity is carrying on an enterprise or not.

08

Complete the additional questions section, which includes details regarding whether the entity is an employer, importer/exporter, or if it is registered for other tax-related obligations.

09

Sign and date the application form.

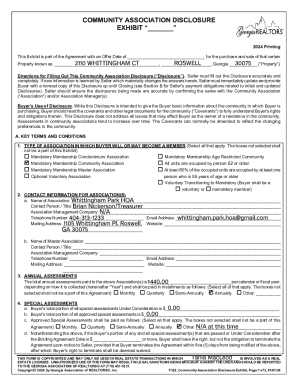

Who needs ABN 11 005 357:

01

Sole traders: Individuals who operate a business on their own without forming a company or partnership.

02

Companies: Business entities that are registered under the Corporations Act 2001 and have a unique Australian Company Number (ACN).

03

Partnerships: Legal business structures where two or more individuals or entities share ownership and responsibilities.

04

Trusts: Legal arrangements where a trustee manages assets for the benefit of others (beneficiaries).

05

Superannuation funds: Funds created for the purpose of providing retirement benefits to members.

06

Other entities engaged in business activities in Australia may also require an ABN.

Note: It is recommended to consult with a tax professional or visit the official ABR website for specific eligibility criteria and guidance on ABN application requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get abn 11 005 357?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the abn 11 005 357 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit abn 11 005 357 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing abn 11 005 357.

How do I complete abn 11 005 357 on an Android device?

Use the pdfFiller mobile app and complete your abn 11 005 357 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is abn 11 005 357?

ABN 11 005 357 is the Australian Business Number for a specific business entity.

Who is required to file abn 11 005 357?

Any business entity operating in Australia that is required to have an ABN is required to file ABN 11 005 357.

How to fill out abn 11 005 357?

ABN 11 005 357 can be filled out online through the Australian Business Register website or through a registered tax agent.

What is the purpose of abn 11 005 357?

The purpose of ABN 11 005 357 is to identify a business entity in its dealings with the Australian government and other businesses.

What information must be reported on abn 11 005 357?

ABN 11 005 357 typically requires information such as business name, address, contact details, and nature of business.

Fill out your abn 11 005 357 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Abn 11 005 357 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.