Get the free loan confirmation letter

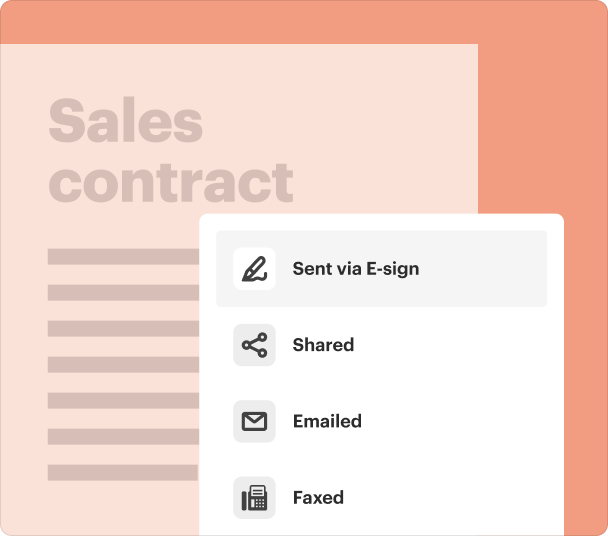

Fill out, sign, and share forms from a single PDF platform

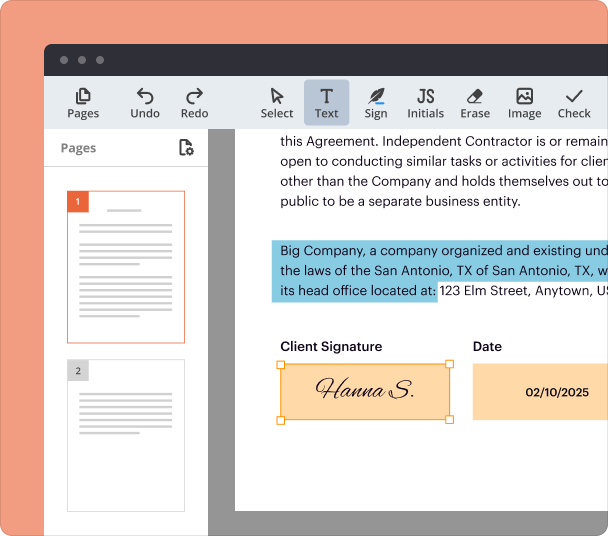

Edit and sign in one place

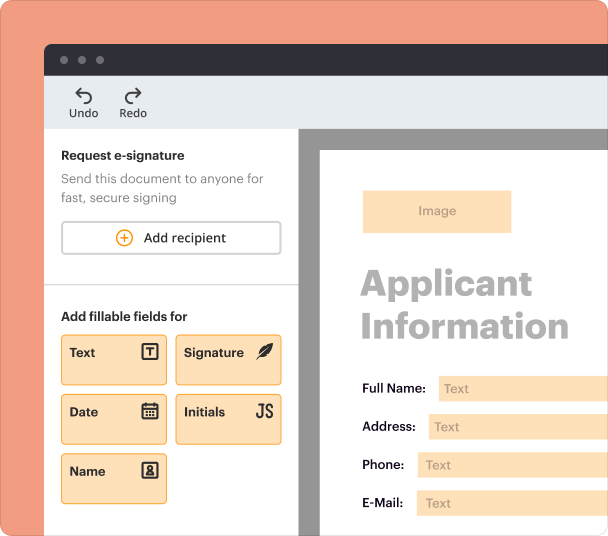

Create professional forms

Simplify data collection

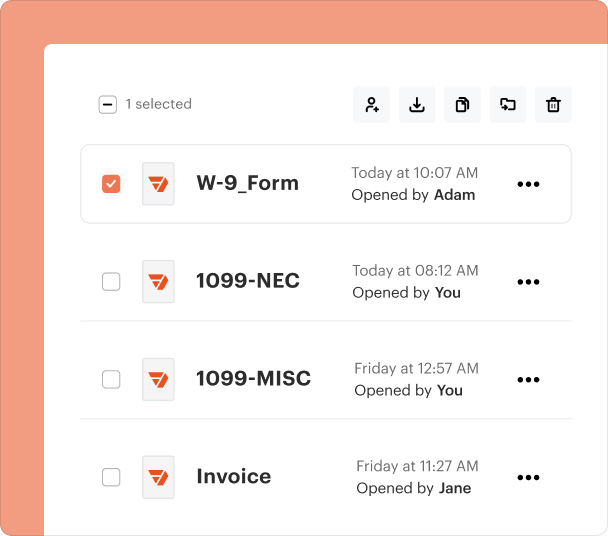

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the Loan Confirmation Letter Format

What is a loan confirmation letter?

A loan confirmation letter is a formal document provided by lenders to verify the details of a loan. This letter serves to confirm the existence and specifics of the loan agreement, including loan amounts, repayment terms, and any other relevant conditions.

Key Features of the Loan Confirmation Letter

Loan confirmation letters typically include essential information such as the borrower's name, loan amount, interest rate, repayment schedule, and contact details of the lender. These features help clarify the terms of the loan for both parties involved.

When to Use a Loan Confirmation Letter

This document is used during various stages of the loan process. It is particularly important when seeking loan approvals, confirming existing loans for financial transactions, or providing evidence for tax purposes. Knowing when to issue or request this letter is crucial for accurate financial documentation.

How to Fill Out the Loan Confirmation Letter

To complete a loan confirmation letter, start with the correct header, including the lender's name and address, followed by the date. Include specific details about the borrower and loan, such as the loan ID, amounts, and repayment terms. Ensure that all information is accurate to avoid future disputes.

Best Practices for Preparing a Loan Confirmation Letter

When preparing a loan confirmation letter, focus on clarity and comprehensiveness. Double-check all financial figures and terms for accuracy. Use professional language, and be sure to maintain a clear structure, which enhances readability and ensures the document serves its intended purpose.

Common Errors to Avoid in Loan Confirmation Letters

Errors in loan confirmation letters can lead to misunderstandings and financial disputes. Common mistakes include incorrect figures, missing signatures, or omitting vital information. It is essential to proofread thoroughly to minimize these errors and ensure compliance with applicable regulations.

Frequently Asked Questions about loan confirmation form

What should be included in a loan confirmation letter?

A loan confirmation letter should include the borrower's name, loan amount, interest rate, repayment schedule, and lender's contact information.

Who uses the loan confirmation letter?

Borrowers and lenders use the loan confirmation letter to confirm the details of a loan agreement for various financial and tax purposes.

pdfFiller scores top ratings on review platforms