Get the free Arizona Form 322 Credit for Contributions Made or Fees Paid to Public Schools 2014

Show details

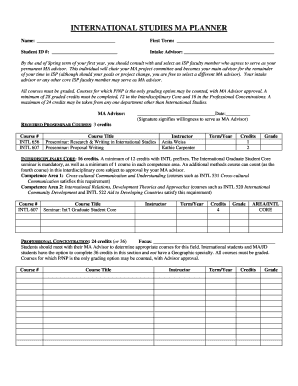

Arizona Form Credit for Contributions Made or Fees Paid to Public Schools 322 Include with your return. 2014 ? Do not use this form for contributions to private school tuition organizations. ? See

We are not affiliated with any brand or entity on this form

Instructions and Help about arizona form 322 credit

How to edit arizona form 322 credit

How to fill out arizona form 322 credit

Instructions and Help about arizona form 322 credit

How to edit arizona form 322 credit

To edit arizona form 322 credit, users can utilize PDF editing tools available in pdfFiller. This tool allows filers to make necessary changes to the form directly. It is vital to ensure that all entries are updated and accurate before submission.

How to fill out arizona form 322 credit

Filling out arizona form 322 credit requires careful attention to detail. Start by gathering all necessary financial documents, including income details and any relevant credits already claimed. Each section of the form should be completed accurately to ensure compliance with Arizona tax regulations.

Latest updates to arizona form 322 credit

Latest updates to arizona form 322 credit

Stay informed about the latest updates to arizona form 322 credit by regularly checking the Arizona Department of Revenue website. Updates may include changes in eligibility requirements, filing procedures, or credits available. Ensuring that you have the most current version of the form is essential for filing accurately.

All You Need to Know About arizona form 322 credit

What is arizona form 322 credit?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About arizona form 322 credit

What is arizona form 322 credit?

Arizona form 322 credit is a tax form used by individuals and businesses to claim the individual income tax credit for school tuition organizations. This form helps taxpayers receive credits for certain educational expenses, thus reducing their overall tax liabilities.

What is the purpose of this form?

The purpose of arizona form 322 credit is to facilitate the claiming of tax credits for donations made to school tuition organizations. These organizations provide scholarships to assist students attending private schools. By claiming this credit, taxpayers can directly enhance educational opportunities for students while reducing their own tax burden.

Who needs the form?

Taxpayers who make contributions to certified school tuition organizations require arizona form 322 credit to claim the corresponding tax credit. This includes individuals, corporations, and partnerships that wish to reduce their tax liability through eligible donations to these organizations.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out arizona form 322 credit if they do not make contributions to school tuition organizations or if their contributions do not meet the minimum threshold established by the Arizona Department of Revenue. Additionally, certain nonprofit entities that receive the contributions may also handle the filing, relieving individual donors of this requirement.

Components of the form

Arizona form 322 credit consists of several key components, including sections for taxpayer information, details about the contributions made, and the calculation of the credit. Each section must be completed accurately, including the taxpayer’s identification information and total contributions to the qualifying organizations.

Due date

The due date for submitting arizona form 322 credit coincides with the Arizona income tax return filing deadline. Taxpayers must ensure that the form is submitted along with their tax returns by the designated due date to ensure the credit is properly applied.

What payments and purchases are reported?

Arizona form 322 credit is specifically designed to report contributions made to school tuition organizations. Taxpayers must report the total dollar amount contributed, which will be used to calculate their eligible credit against state taxes.

How many copies of the form should I complete?

Typically, taxpayers need to complete one copy of arizona form 322 credit. However, multiple copies may be necessary if contributions are made to more than one school tuition organization. In such cases, each organization’s contribution details should be consolidated into the form.

What are the penalties for not issuing the form?

Failure to issue arizona form 322 credit when required can result in penalties imposed by the Arizona Department of Revenue. Taxpayers may face fines, and their tax credits may be disallowed, leading to an increased tax liability.

What information do you need when you file the form?

When filing arizona form 322 credit, taxpayers need their Social Security number or Employer Identification Number, details of the contributions made, and information about the school tuition organizations to which they contributed. Having these details readily available ensures a smooth filing process.

Is the form accompanied by other forms?

Arizona form 322 credit can be submitted alongside the primary Arizona income tax return forms. It may also be necessary to accompany other documentation proving contribution amounts to the school tuition organizations in question.

Where do I send the form?

Taxpayers should send arizona form 322 credit to the Arizona Department of Revenue. The specific mailing address can be found on the department's website or in the form’s instructions. It is vital to send the form to the correct address to avoid processing delays.

See what our users say