Get the free COMMITMENT FOR TITLE INSURANCE Issued by Fidelity National bb

Show details

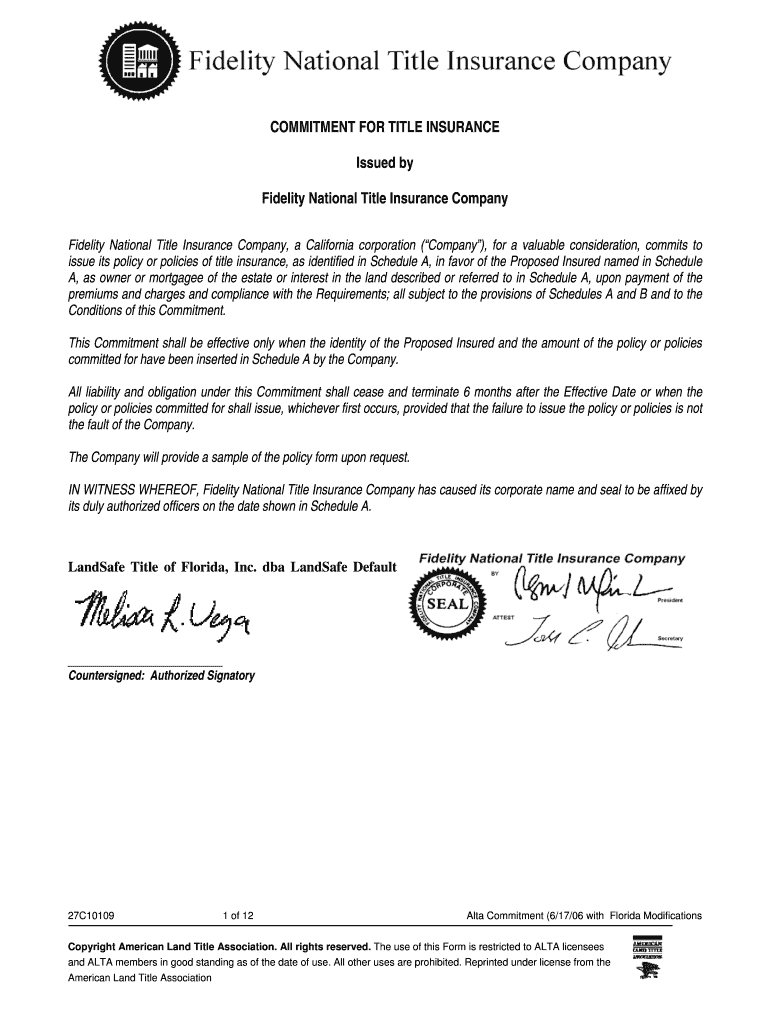

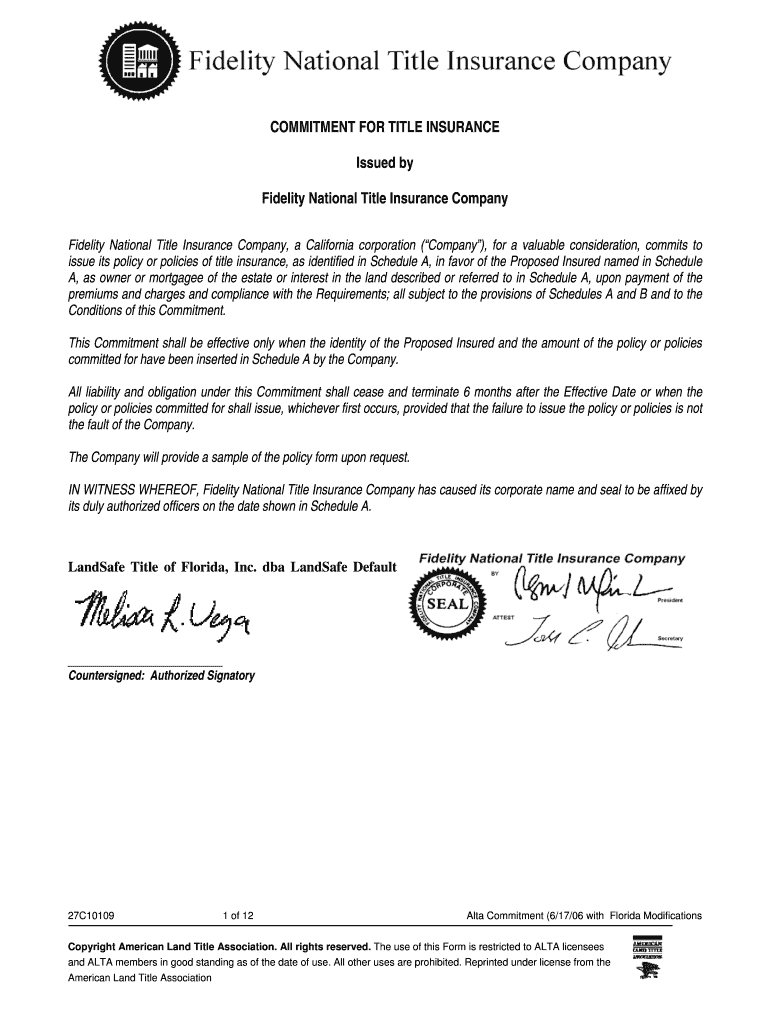

COMMITMENT FOR TITLE INSURANCE

Issued by

Fidelity National Title Insurance Company

Fidelity National Title Insurance Company, a California corporation (Company), for a valuable consideration, commits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commitment for title insurance

Edit your commitment for title insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commitment for title insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commitment for title insurance online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit commitment for title insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commitment for title insurance

How to fill out commitment for title insurance:

01

Begin by gathering all relevant information and documents related to the property. This may include the property's address, legal description, and any previous title insurance policies.

02

Identify the parties involved in the transaction, such as the buyer, seller, and lender. Make sure to accurately record their names, addresses, and contact information.

03

Fill out the commitment form with the necessary details. This typically includes the effective date of the commitment, the proposed insured (usually the buyer), and the amount of coverage requested.

04

Provide a thorough description of the property, including its legal description and any encumbrances or liens that may exist. This information helps the title insurance company assess the property's risk.

05

Include any specific requirements or conditions that need to be met before the title insurance policy can be issued. This could involve items like obtaining satisfactory survey results, paying off existing mortgages, or resolving any outstanding legal issues.

06

If there are any additional documents or disclosures required by the title insurance company, make sure to attach them to the commitment form.

07

Review the filled-out commitment form carefully for accuracy and completeness. Double-check all the information provided to ensure it is correct and consistent with the supporting documents.

08

Sign and date the commitment form, along with any other parties involved in the transaction, such as the seller and lender.

Who needs commitment for title insurance:

01

Buyers: Individuals or entities purchasing a property may need a commitment for title insurance to protect their investment. It provides them with assurance that the title is clear and free from any legal or financial issues.

02

Lenders: Mortgage lenders usually require a commitment for title insurance as a condition for approving a loan. It helps protect their collateral (the property) by ensuring there are no outstanding claims or liens that could jeopardize their security interest.

03

Real estate professionals: Professionals involved in the real estate industry, such as real estate agents and brokers, may need a commitment for title insurance to guide them in assisting their clients with property transactions.

04

Investors: Individuals or businesses investing in real estate properties may also obtain a commitment for title insurance to evaluate the property's title and assess any potential risks before making their investment.

05

Developers and builders: Those involved in property development and construction may require title insurance commitments to ensure that the property's title is clear and that all legal and financial matters are resolved before the project begins.

In summary, anyone involved in a real estate transaction, including buyers, lenders, real estate professionals, investors, developers, and builders, may need a commitment for title insurance to protect their interests and ensure the clear and marketable title of the property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is commitment for title insurance?

Commitment for title insurance is a document issued by a title company that shows the conditions under which they will issue a title insurance policy.

Who is required to file commitment for title insurance?

Typically, the title company is responsible for filing the commitment for title insurance.

How to fill out commitment for title insurance?

To fill out a commitment for title insurance, you will need to provide information about the property, any outstanding liens, and any potential title issues.

What is the purpose of commitment for title insurance?

The purpose of a commitment for title insurance is to outline the conditions under which the title company will issue a title insurance policy.

What information must be reported on commitment for title insurance?

Information such as property details, ownership details, any outstanding liens, and potential title issues must be reported on the commitment for title insurance.

How can I manage my commitment for title insurance directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign commitment for title insurance and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute commitment for title insurance online?

pdfFiller has made it easy to fill out and sign commitment for title insurance. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit commitment for title insurance on an iOS device?

Create, modify, and share commitment for title insurance using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your commitment for title insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commitment For Title Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.