Get the free ROTH Conversion - IRA Innovations Self Directed IRA Services

Show details

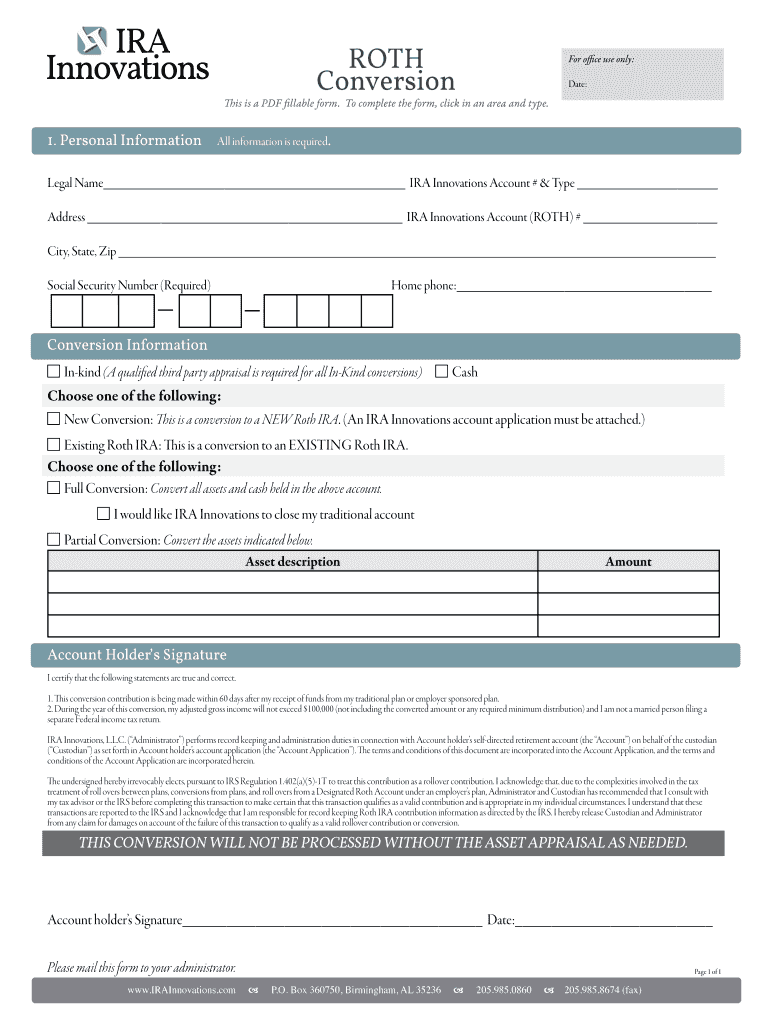

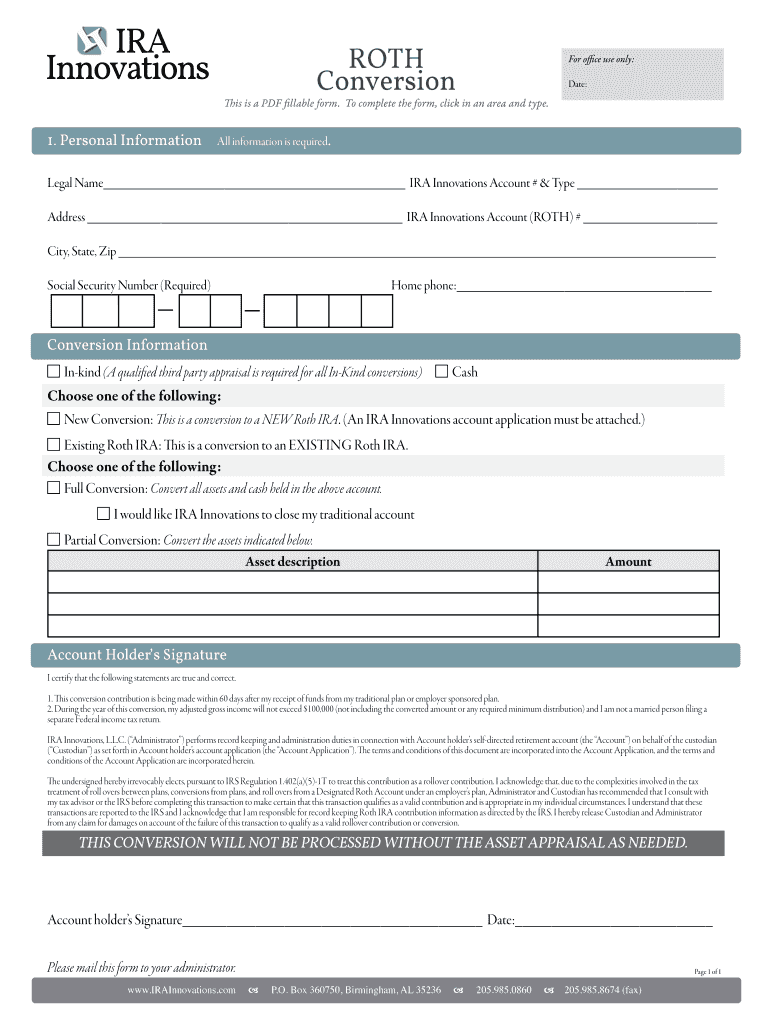

ROTH Conversion For office use only: Date: This is a PDF fillable form. To complete the form, click in an area and type. 1. Personal Information All information is required. Legal Name IRA Innovations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth conversion - ira

Edit your roth conversion - ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth conversion - ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit roth conversion - ira online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit roth conversion - ira. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth conversion - ira

01

Determine your eligibility: Before filling out a Roth conversion - IRA, it's essential to ensure that you meet the eligibility criteria. Generally, individuals with annual incomes below a certain threshold can convert their traditional IRA to a Roth IRA.

02

Gather necessary information: To fill out the Roth conversion - IRA form, you will need to gather specific information about your traditional IRA account, including account number, current balance, and any contributions or distributions made during the tax year.

03

Consult a financial advisor: It's always a good idea to consult a financial advisor or tax professional who specializes in retirement planning. They can provide guidance and help you understand the potential tax implications of a Roth conversion.

04

Complete the necessary forms: Contact your IRA custodian or financial institution to obtain the required forms for the Roth conversion. These forms may vary depending on the institution, so make sure to ask for the specific conversion form.

05

Provide accurate information: Fill out the Roth conversion form accurately, ensuring that you enter the correct details about your traditional IRA account, including the amount you wish to convert to a Roth IRA.

06

Review and double-check: Before submitting the form, review all the information you filled out to ensure its accuracy. Mistakes or inaccuracies could result in unnecessary paperwork or complications.

07

Submit the form: Once you have completed the Roth conversion form, submit it to your financial institution or IRA custodian as per their instructions. Some institutions may offer online submission options, while others may require you to mail or fax the form.

08

Monitor the conversion process: After submitting the form, keep track of the conversion process and ensure that the funds are correctly transferred from your traditional IRA to the Roth IRA account.

Who needs Roth conversion - IRA?

01

Pre-retirees planning for tax-efficient withdrawals: Roth conversion - IRA can be beneficial for individuals who anticipate being in a higher tax bracket during retirement. By converting to a Roth IRA now, they can potentially reduce future tax liabilities and enjoy tax-free withdrawals in retirement.

02

Individuals with a long-term investment horizon: Those who have many years until retirement can benefit from a Roth conversion - IRA. This allows them to take advantage of the tax-free growth potential of the Roth IRA, giving their investments more time to compound.

03

Investors wanting to minimize required minimum distributions (RMDs): Traditional IRAs typically require individuals to start taking mandatory withdrawals, known as Required Minimum Distributions (RMDs), once they reach a certain age. By converting to a Roth IRA, individuals can potentially minimize or eliminate RMDs altogether, providing more flexibility and control over their retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is roth conversion - ira?

Roth conversion-ira is a process of transferring assets from a traditional IRA to a Roth IRA.

Who is required to file roth conversion - ira?

Individuals who wish to convert their traditional IRA to a Roth IRA are required to file roth conversion - ira.

How to fill out roth conversion - ira?

To fill out roth conversion - ira, individuals must complete a conversion form provided by their financial institution.

What is the purpose of roth conversion - ira?

The purpose of roth conversion - ira is to potentially benefit from tax-free withdrawals in retirement.

What information must be reported on roth conversion - ira?

The amount converted, the year of conversion, and any taxes paid on the conversion must be reported on roth conversion - ira.

How do I edit roth conversion - ira in Chrome?

roth conversion - ira can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my roth conversion - ira in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your roth conversion - ira and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit roth conversion - ira straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing roth conversion - ira.

Fill out your roth conversion - ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Conversion - Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.