CA F04-01A 2014-2026 free printable template

Show details

Protected A when completed F04-01A Application for Import Permit A. APPLICANT Name Address City Province / State Telephone Fax Postal / ZIP Code Email Address B. CUSTOM BROKER (when applicable) Broker

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign canada vehicle import form 1 pdf

Edit your vehicle import form form 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your import license canada form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit import licence application form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit import license sample form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out import permit form

How to fill out CA F04-01A

01

Gather the necessary personal and financial information required for the form.

02

Start filling out the identification section with your name, address, and contact information.

03

Provide details about your income sources and amounts in the income section.

04

Fill in any relevant deductions or credits you may be eligible for.

05

Review the completed information for accuracy and completeness.

06

Sign and date the form to certify that the information provided is true and correct.

07

Submit the completed CA F04-01A form as instructed, either online or by mail.

Who needs CA F04-01A?

01

Individuals who are applying for certain state benefits in California may need to fill out CA F04-01A.

02

Also, individuals who have had changes in financial circumstances that could affect their eligibility for state aid.

Fill

import and export license canada

: Try Risk Free

People Also Ask about import permit sample

How much is an import permit in Canada?

Fees Annual Import Permit$164 plus $20 for each 1,000 kg NEQ imported subject to a maximum fee of $1,324, calculated :(b) on the basis of the quantity imported during the most recent year, for any subsequent applicationSingle Use Import Permit$164Export and In Transit PermitsNo Fees3 more rows • Apr 25, 2022

What are the different types of import permits in Canada?

Import Controls Under the EIPA , there are two types of import permits: General Import Permits ( GIP s) and Specific Import Permits. 4. Importations of certain agricultural goods included on the ICL are controlled under the EIPA by way of tariff rate quotas ( TRQ s).

How much can I import from USA to Canada without paying duty?

Goods must be in your possession and reported at time of entry to Canada. If the value of the goods you are bringing back exceeds CAN$800, duties and taxes are applicable only on amount of the imported goods that exceeds CAN$800. A minimum absence of 48 hours from Canada is required.

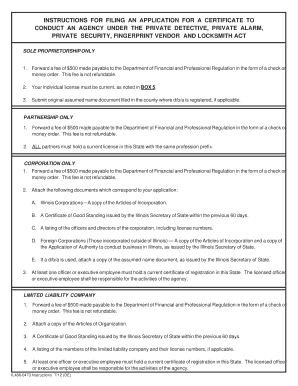

What documents do I need to import to Canada?

Shipping to Canada: Customs documents simplified Canada Customs Invoice, or a Commercial Invoice. Bill of Lading. Manifest or Cargo Control Document. Shipper's Export Declaration.

What are the three 3 main documents required for import customs clearance?

Imports must have the following documentation: Invoice (unless a commercial sample under $25 in value) Ocean bill of lading, inland bill of lading, through bill of lading, air waybill (air cargo) Proof of insurance.

How do I get an import permit in Canada?

To obtain one, applicants must fill out the form Application for an Export and Import Permits Act (EIPA) File Number and provide DFAIT with the following: the applicant's name, title, firm name, address, postal code, telephone number, facsimile number and business number issued by Canada Revenue Agency (CRA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit import export license canada from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your export permit canada into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find cfia permit?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific export import license canada and other forms. Find the template you need and change it using powerful tools.

How do I fill out the import licence import license sample form on my smartphone?

Use the pdfFiller mobile app to fill out and sign CA F04-01A. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is CA F04-01A?

CA F04-01A is a form used by the California Department of Tax and Fee Administration for reporting and paying various state taxes.

Who is required to file CA F04-01A?

Businesses and individuals who are liable for certain taxes imposed by the state of California are required to file CA F04-01A.

How to fill out CA F04-01A?

To fill out CA F04-01A, provide accurate information regarding your business details, taxable transactions, applicable deductions, and calculate the amount owed or overpayment before submitting it to the California Department of Tax and Fee Administration.

What is the purpose of CA F04-01A?

The purpose of CA F04-01A is to report taxable sales, pay due taxes, and ensure compliance with California tax regulations.

What information must be reported on CA F04-01A?

Information that must be reported on CA F04-01A includes the business name, address, sales amounts, applicable tax rates, and any deductions or exemptions claimed.

Fill out your CA F04-01A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA f04-01a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.