Get the free Sole Proprietorships and Partnerships please

Show details

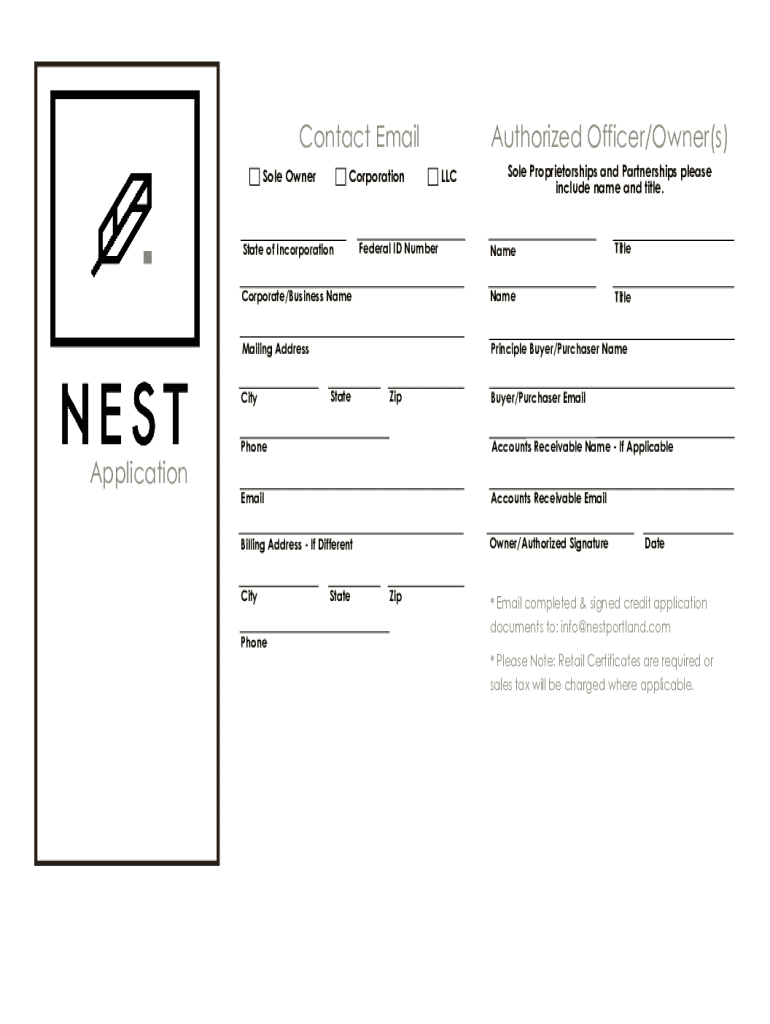

Contact Email

Sole OwnerCorporationLLCSole Proprietorship and Partnerships please

include name and title.

NameTitleCorporate/Business NameNameTitleMailing AddressPrinciple Buyer/Purchaser Namesake

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sole proprietorships and partnerships

Edit your sole proprietorships and partnerships form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sole proprietorships and partnerships form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sole proprietorships and partnerships online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sole proprietorships and partnerships. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sole proprietorships and partnerships

How to fill out sole proprietorships and partnerships

01

Determine if a sole proprietorship or partnership is right for your business structure.

02

Choose a business name that complies with your local regulations.

03

Register your business name with the appropriate government entity, if required.

04

Obtain any necessary permits or licenses specific to your industry.

05

Open a separate business bank account to keep personal and business finances distinct.

06

Set up accounting practices to track income, expenses, and profits effectively.

07

Understand your tax obligations, as sole proprietorships and partnerships are typically taxed at the individual level.

08

Keep accurate records of all business transactions and ensure compliance with local laws.

09

If applicable, create a partnership agreement outlining each partner's responsibilities and profit-sharing arrangements.

Who needs sole proprietorships and partnerships?

01

Individuals looking to start a small business with minimal startup costs.

02

Entrepreneurs who prefer to manage their own business without complex corporate structures.

03

Professionals such as freelancers or consultants offering services independently.

04

Groups of individuals wanting to collaborate and share profits through a partnership.

05

Business owners seeking simplicity in tax reporting and administration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sole proprietorships and partnerships?

With pdfFiller, it's easy to make changes. Open your sole proprietorships and partnerships in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit sole proprietorships and partnerships in Chrome?

Install the pdfFiller Google Chrome Extension to edit sole proprietorships and partnerships and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out sole proprietorships and partnerships using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign sole proprietorships and partnerships. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is sole proprietorships and partnerships?

A sole proprietorship is a business owned and operated by a single individual who is personally liable for all debts. A partnership involves two or more individuals who share ownership and responsibilities, as well as liabilities.

Who is required to file sole proprietorships and partnerships?

Owners of sole proprietorships and partnerships are required to file tax returns reporting their business income and expenses, typically on Schedule C for sole proprietorships and Form 1065 for partnerships.

How to fill out sole proprietorships and partnerships?

To fill out the tax forms for sole proprietorships and partnerships, gather all relevant financial documents, report income and expenses accurately, and ensure the correct forms are used, like Schedule C for sole proprietors and Form 1065 for partnerships.

What is the purpose of sole proprietorships and partnerships?

The purpose of sole proprietorships and partnerships is to allow individuals to operate a business, either autonomously or collaboratively, while providing a simple structure for managing income and expenses.

What information must be reported on sole proprietorships and partnerships?

Information that must be reported includes gross income, business expenses, and net profit or loss. For partnerships, details about each partner's share of income, deductions, and credits must also be provided.

Fill out your sole proprietorships and partnerships online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sole Proprietorships And Partnerships is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.