Get the free excise tax collectors for the unorganized territory

Show details

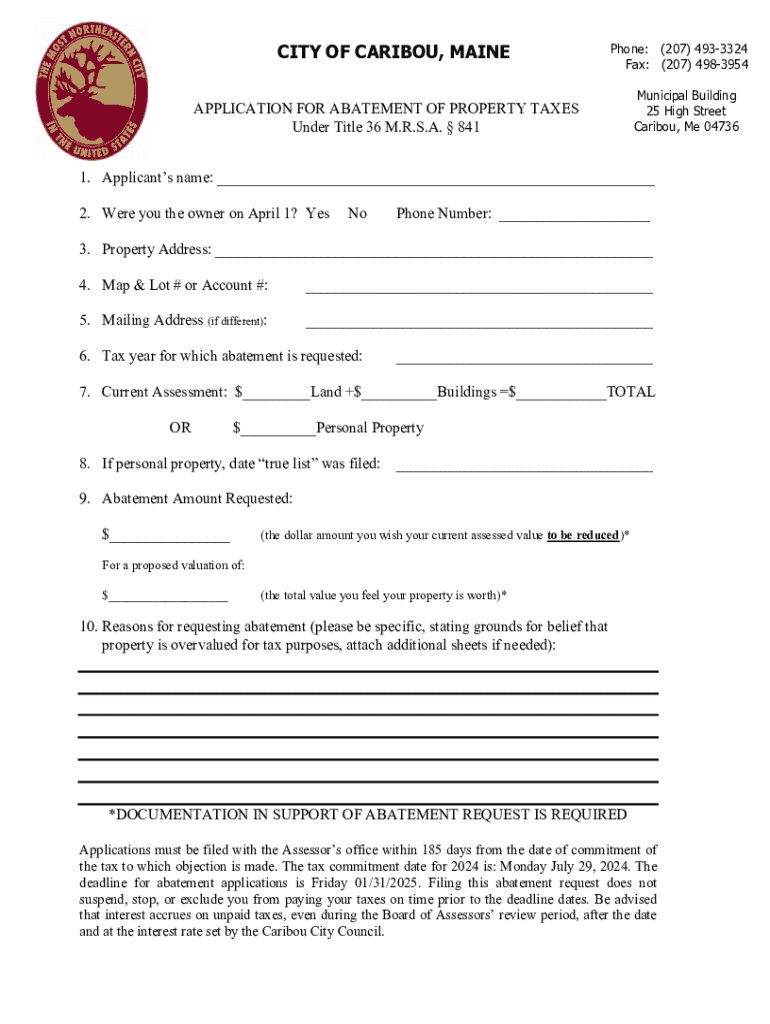

CITY OF CARIBOU, MAINEPhone: (207) 4933324 Fax: (207) 4983954APPLICATION FOR ABATEMENT OF PROPERTY TAXES Under Title 36 M.R.S.A. 841Municipal Building 25 High Street Caribou, Me 047361. Applicants

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign excise tax collectors for

Edit your excise tax collectors for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your excise tax collectors for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit excise tax collectors for online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit excise tax collectors for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out excise tax collectors for

How to fill out excise tax collectors for

01

Gather all relevant documentation related to the goods on which excise tax applies.

02

Determine the applicable excise tax rate for each type of good.

03

Complete the excise tax collectors form by entering the required information, including your business details and item descriptions.

04

Calculate the total excise tax owed based on the quantities and rates.

05

Submit the completed form along with any payment due to the appropriate tax authority by the deadline.

Who needs excise tax collectors for?

01

Businesses that manufacture or distribute goods subject to excise tax.

02

Importers of products that incur excise tax upon entry into the country.

03

Wholesalers and retailers selling products that are liable for excise tax.

04

Individuals or entities engaged in activities involving the sale of goods subject to excise tax, such as alcohol, tobacco, or fuel.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send excise tax collectors for to be eSigned by others?

When your excise tax collectors for is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit excise tax collectors for online?

With pdfFiller, it's easy to make changes. Open your excise tax collectors for in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit excise tax collectors for on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign excise tax collectors for right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is excise tax collectors for?

Excise tax collectors are responsible for collecting taxes on specific goods, services, and activities that are often considered harmful or luxury items.

Who is required to file excise tax collectors for?

Businesses and individuals involved in the manufacture, sale, or use of taxable goods or services are required to file excise tax collectors.

How to fill out excise tax collectors for?

To fill out excise tax collectors, individuals or businesses must complete the designated forms provided by the tax authority, providing information about the products or services subject to excise tax.

What is the purpose of excise tax collectors for?

The purpose of excise tax collectors is to generate revenue for the government, regulate certain industries, and discourage the consumption of harmful products.

What information must be reported on excise tax collectors for?

Information that must be reported includes the type of excise tax being paid, details of the transactions, quantities sold, and total amounts owed.

Fill out your excise tax collectors for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excise Tax Collectors For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.