Get the free CC Authorization Form download! - Oak Tree Hotel

Get, Create, Make and Sign cc authorization form download

Editing cc authorization form download online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cc authorization form download

How to fill out cc authorization form download

Who needs cc authorization form download?

Comprehensive Guide to Authorization Form Download Form

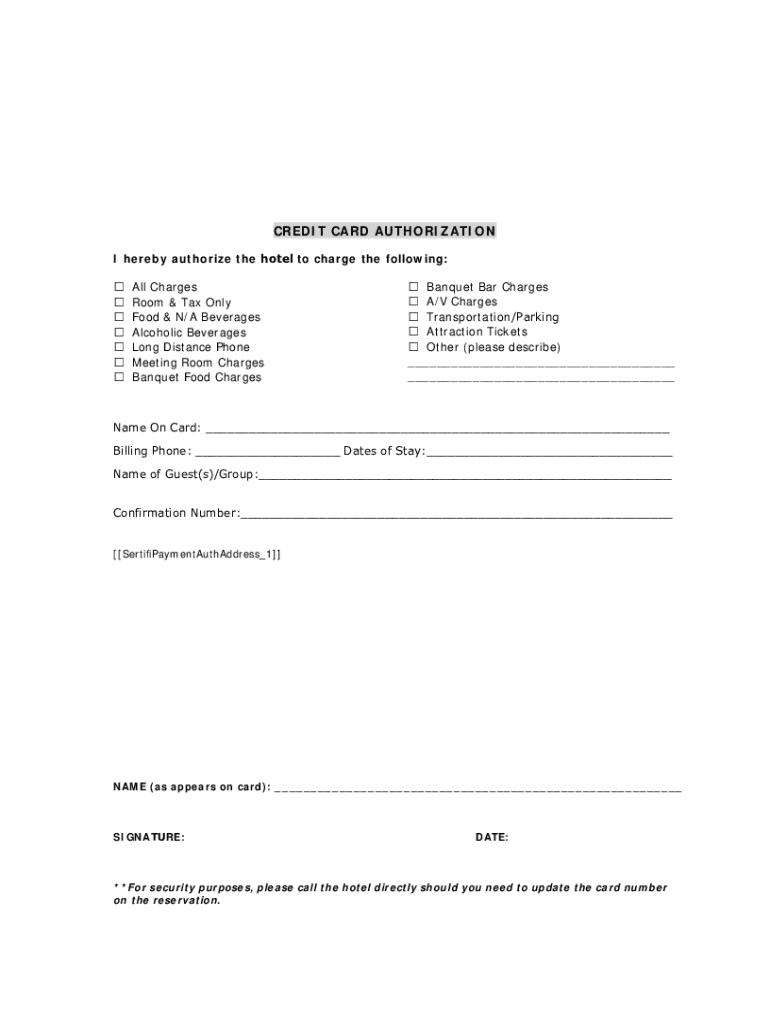

Understanding the credit card authorization form

A credit card authorization form serves as a critical document in financial transactions. This form allows businesses to obtain permission from customers to charge their credit cards for products or services rendered. By utilizing this form, businesses can ensure their transactions are secure and legitimate, thus minimizing potential disputes.

The importance of using an authorization form cannot be overstated. It not only facilitates effective payment processing but also acts as a legal safeguard for both the customer and the business. By clearly outlining the terms of the transaction, the form helps prevent misunderstandings and enhances customer trust.

How credit card authorization forms protect your business

One of the key benefits of implementing a credit card authorization form is the prevention of chargeback abuse. Chargebacks occur when a customer disputes a charge with their credit card company, leading to funds being reversed. By having an authorization form on file, businesses can challenge illegitimate disputes more effectively.

Additionally, these forms serve as a bulwark against fraudulent transactions. With an authorization form, businesses require customers to provide explicit consent to charge their card, which adds a layer of accountability. In turn, this helps reduce instances of unauthorized charges, ultimately protecting your revenue.

Legal standing of credit card authorization forms

When it comes to the legal obligation of using credit card authorization forms, the requirement can vary by jurisdiction. While there may not be a universal mandate, it is generally considered best practice for businesses to utilize these forms, particularly in card-not-present transactions. They help clarify consent and serve as a protective measure in disputes.

Customers also have rights that are safeguarded by these forms. By signing the document, customers are made aware of the payment being processed and the specific terms, which fosters transparency in the transaction.

What to include in a credit card authorization form

A well-structured credit card authorization form must contain several essential components to ensure its effectiveness. First, customer information gathering is crucial. This includes the customer’s name, billing address, phone number, and email, allowing for identification and communication.

Next, specifying the payment amount is necessary. Clearly outline the total to be charged, along with a detailed description of the product or service provided, ensuring that there are no ambiguities regarding the transaction.

An authorization signature section is essential as it provides explicit permission from the customer to process the payment. Without this signature, the validity of the transaction may be questioned.

Optional add-ons

In addition to these essentials, optional features can enhance your credit card authorization form. For example, including a CVV field allows for added security by requiring customers to supply the three-digit security code from the back of their card. This helps further verify the authenticity of the transaction.

Recurring payment options are also beneficial for businesses that offer subscription services. This allows customers to authorize automatic payments, providing convenience and ensuring timely transactions.

How to complete a credit card authorization form

Completing a credit card authorization form correctly is crucial for effective payment processing. Here’s a step-by-step guide to help you through the process:

Ensuring accuracy and security is paramount. Common mistakes include failing to collect sufficient customer information or neglecting to obtain a signature. Additionally, clear communication with customers is essential to minimize confusion and foster trust during the transaction process.

Downloading our credit card authorization form template

For those who prefer convenience, our credit card authorization form download form offers an easy fillable template designed for both efficiency and legal compliance. This template simplifies the process, allowing you to create a professional-looking authorization form in minutes.

The benefits of using our template include:

To download our credit card authorization form, follow these simple steps: visit our pdfFiller website, locate the CC authorization form download form section, and click on the download button. Within seconds, you will have your customizable template ready to use.

Best practices for storing signed authorization forms

After collecting signed credit card authorization forms, the next crucial step is ensuring their secure storage. It is essential to utilize secure storage solutions, such as encrypted digital storage or locked cabinets for physical copies, to protect sensitive customer information.

You should also determine how long to retain signed forms. Typically, retaining them for a minimum of three to five years is advised for both compliance and reference purposes. This duration can vary based on local regulations and business policies.

Data protection guidelines

Compliance with data protection regulations, such as GDPR or CCPA, is crucial when handling customer data. Businesses must ensure that all stored credit card authorization forms are safeguarded against unauthorized access. Implementing password-protection and encrypting sensitive files are effective strategies to maintain customer data privacy.

Additionally, consider regular audits of your storage practices to ensure ongoing compliance and security. This not only protects your business but also builds confidence and trust with your customers.

Frequently asked questions (FAQ)

To clarify common concerns regarding credit card authorization forms, here are a few frequently asked questions:

Related resources and further reading

For those eager to learn more about payment processing and protecting your business from chargebacks, consider exploring educational articles and insights on handling disputes. Our website also offers additional document templates, including:

Personalize your experience

At pdfFiller, we value your unique needs. By filling out a brief questionnaire, we can help you discover tailored resources and document solutions specific to your business requirements.

Subscribe to our newsletter

Stay updated with the latest trends in payment solutions by subscribing to our newsletter. Get exclusive tips and resources delivered directly to your inbox.

Explore more on document management with pdfFiller

Discover the benefits of using pdfFiller for your document needs, such as the ability to edit and eSign PDFs seamlessly. Our cloud-based collaboration tools make document management easy and efficient, enhancing your workflow significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cc authorization form download in Chrome?

Can I edit cc authorization form download on an Android device?

How do I complete cc authorization form download on an Android device?

What is cc authorization form download?

Who is required to file cc authorization form download?

How to fill out cc authorization form download?

What is the purpose of cc authorization form download?

What information must be reported on cc authorization form download?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.