Get the free credit card authorization form telephone/ fax/ mail

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive How-To Guide

Understanding credit card authorization forms

A credit card authorization form is a crucial document that allows businesses to collect payments from customers using their credit cards. This form secures the transaction by obtaining permission from the cardholder to charge their card for specific products or services. It plays an essential role in preventing fraud and ensuring compliance with legal and financial regulations.

The primary purpose of a credit card authorization form is to confirm that the credit card holder is aware of the transaction, authorizing it by providing their signature and card details. This not only protects the merchant from chargebacks but also provides the customer with a secure means of purchasing.

Benefits of using a credit card authorization form

Utilizing a credit card authorization form presents numerous advantages for businesses and service providers. One of the foremost benefits is the prevention of chargeback abuse, which can occur when customers dispute legitimate charges. By securing explicit permission from cardholders ahead of time, businesses can defend against potential fraud.

Additionally, an authorization form enhances security during payment processing. It reassures customers that their financial information is being handled responsibly. As part of a streamlined transaction process, these forms can speed up payments, helping businesses to maintain efficient cash flow. Moreover, using a credit card authorization form fosters trust with customers who understand that their consent is required before any charges are made.

When should you use a credit card authorization form?

There are specific situations where employing a credit card authorization form becomes critical. Any business that fulfills orders after initial payment, such as subscription services or dealing with delayed deliveries, should use this form to secure payment prior to final invoicing. It’s essential in cases where products or services are rendered over an extended period.

Moreover, many service providers, such as hotels or rental companies, require a credit card authorization form to hold security deposits on bookings. Event organizers often utilize these forms to manage ticket sales and vendor services efficiently to ensure all financial commitments are legally documented.

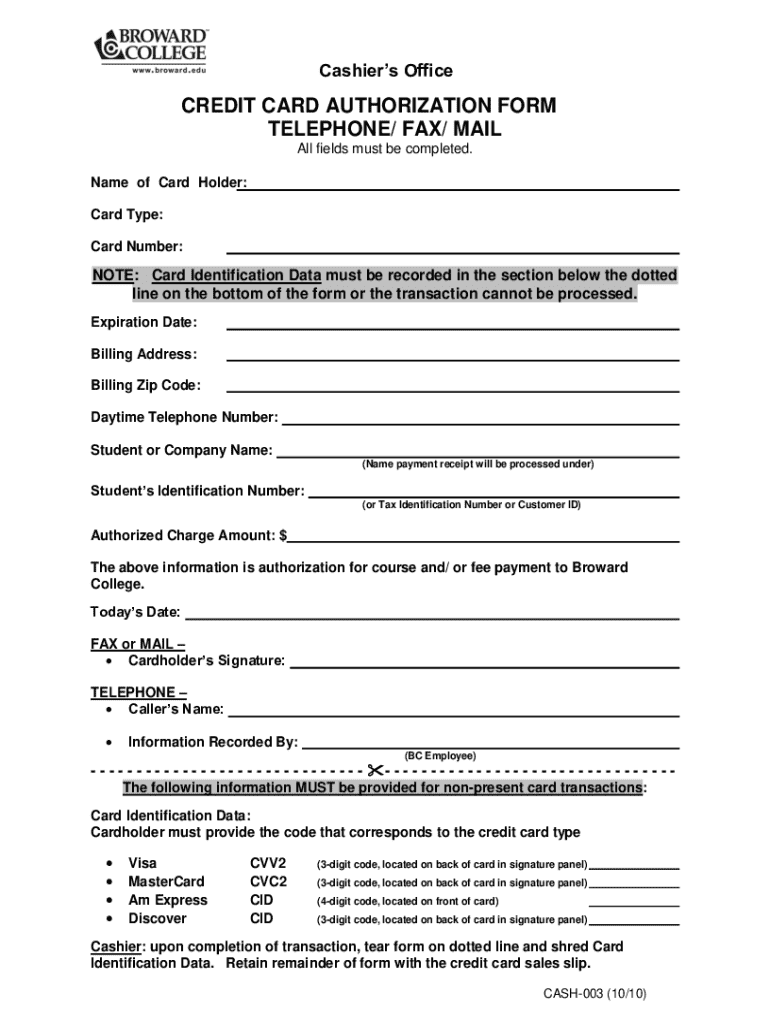

Components of a comprehensive credit card authorization form

A well-structured credit card authorization form must capture essential data accurately. Required fields typically include the cardholder's name, contact information, and complete payment details such as card number, expiration date, and CVV. The authorizing language must be clear and explicit, stating the cardholder's permission to charge their card, concluding with a designated area for the cardholder’s signature.

Optional additions can further enhance the usefulness of the form. Including a CVV section emphasizes the importance of card security, while special instructions or terms of service can clarify specific policies. It ensures that both parties understand the conditions under which the transaction will occur.

Drafting your credit card authorization form

Creating a credit card authorization form demands clarity and effectiveness. When drafting the document, use simple language and maintain a professional appearance without overwhelming the reader with excessive details. Ensure the layout allows for easy comprehension and does not appear cluttered; this encourages completion and reduces errors.

Be cautious of common mistakes, such as missing fields or unclear instructions, which can lead to significant issues in processing transactions. Customize the form to meet your specific needs or industry requirements to enhance its functionality. Tailored forms can address unique aspects of your business, be it in retail, online services, or hospitality.

eSignatures and cloud-based solutions

With the rise of technology, integrating eSignatures into credit card authorization forms is becoming increasingly common. Implementing eSignatures securely allows businesses to streamline the signing process and minimize paper usage. Solutions like pdfFiller ensure that eSignatures are legally binding and compliant with various regulatory standards, providing peace of mind to both the business and the customer.

Using cloud-based platforms such as pdfFiller offers several advantages, including accessibility from anywhere, which is essential in today's remote work environment. Additionally, collaborative editing and management features facilitate teamwork, allowing multiple stakeholders to engage in real-time document discussions. This efficiency promotes better communication and reduces turnaround time.

Storing and managing credit card authorization forms

Properly storing credit card authorization forms is crucial for maintaining data security and ensuring compliance with regulations such as PCI DSS. Implement strong measures to protect sensitive customer information, including encryption and secure access controls. Understanding legal requirements surrounding data retention will help you decide how long to keep signed forms; typically, retaining them for a period of three to seven years is advisable, depending on the jurisdiction.

Businesses need to choose effective storage solutions, balancing between physical and digital options. Digital storage is often more secure when utilizing reliable platforms that offer backup and quick retrieval options. Implementing a paperless system minimizes risk of physical theft or damage, allowing for more efficient management of documentation.

Frequently asked questions (FAQ)

Many businesses wonder if they are legally obligated to use a credit card authorization form. While not universally mandated, best practices in industries involving credit card transactions strongly recommend using them to protect against fraud and chargebacks. When a customer fails to complete the form properly, a merchant might face difficulties processing the transaction. It is essential to communicate clearly with customers regarding the required information and offer assistance if they have questions.

Disputes arising from authorization forms can usually be navigated by having solid documentation and evidence of proper authorization. In addition, understanding what 'card on file' means and how it works is fundamental. This refers to a practice where businesses save customer card information for future transactions, which can improve efficiency but must be handled with utmost security to protect sensitive data.

Alternatives and additional considerations

While credit card authorization forms are highly effective, there are alternative payment authorization methods. For recurring payments or subscriptions, businesses might consider using automated payment systems via payment gateways that securely store customer payment information with the cardholder's permission. This reduces the administrative burden of dealing with forms while maximizing convenience for customers.

Moreover, keeping open lines of communication with customers about payment processes and addressing their concerns is critical. Transparency fosters trust and minimizes the likelihood of disputes. Building an informative FAQ section or providing adequate customer support can help users understand how payments will be handled, making transactions smoother and more trustworthy.

Explore our templates and resources

At pdfFiller, we provide downloadable customizable credit card authorization form templates that allow you to tailor your forms to your specific needs effortlessly. Utilize our interactive tools for document creation that streamline the process of editing and signing forms online. Our step-by-step guide will help you navigate through the features of pdfFiller, ensuring you can manage your documentation efficiently, regardless of your location.

Related topics and further reading

Expanding your knowledge about payment processes is beneficial for your business. Consider exploring topics like ACH transactions, which are a crucial aspect of electronic payments, effective customer data management, and strategies for optimizing payment processing for small businesses. Gaining insights in these areas can enhance your overall understanding and improve your operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card authorization form from Google Drive?

How can I send credit card authorization form for eSignature?

How can I get credit card authorization form?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.