Children Are Our Business Form: A Comprehensive Guide

Overview of the 'Children Are Our Business' Form

The 'Children Are Our Business' form is essential documentation for family-owned businesses that employ minors. This form helps establish a formal record of the child's involvement in the business. Understanding its significance is crucial for compliance with labor laws and tax regulations while also protecting the interests of both the child and the business.

This form is particularly important in family business scenarios, where the lines between familial and professional relationships can sometimes blur. By utilizing this form, businesses can ensure clarity and adherence to legal guidelines surrounding child employment.

Clarifies roles and responsibilities within the family business.

Helps maintain compliance with labor laws and tax requirements.

Facilitates transparent communication among family members and stakeholders.

Understanding the purpose of the form

The primary purpose of the 'Children Are Our Business' form is to outline the specific terms and conditions under which a child can be employed in the family business. Understanding the legal implications of employing minors is critical. According to the Fair Labor Standards Act (FLSA), there are strict guidelines about the type of work children can do, their working hours, and the conditions of employment.

The advantages of utilizing this form extend to effective tax management. Collecting accurate records of a child's earnings can offer potential tax deductions, benefiting the overall financial health of the business. However, misconceptions about child employment often lead to confusion. Many mistakenly believe that hiring a child in a family business is entirely exempt from labor regulations; this is not the case.

Ensures legal compliance when hiring minors.

Contributes to transparent business practices.

Provides potential tax benefits and deductions.

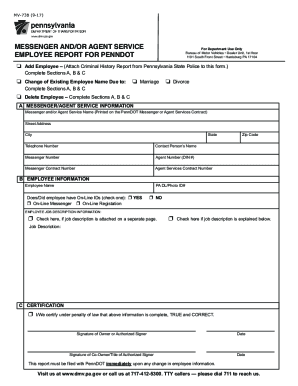

Step-by-step guide to filling out the form

Filling out the 'Children Are Our Business' form requires careful attention to detail. The process can be broken down into clear steps to ensure accuracy and compliance.

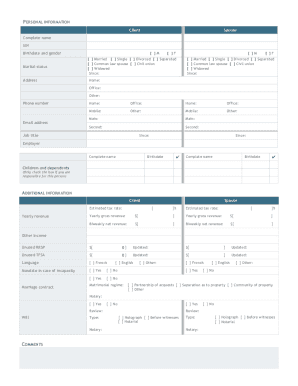

Gathering necessary information

Start by collecting the child's personal information, such as their name, age, and relationship to the business owner. It's also crucial to have the business information on hand, including the Employer Identification Number (EIN) and details about the business structure.

Section breakdown of the form

Each section of the form serves a purpose. For instance, personal details about the child must be coupled with specific job roles they are expected to fulfill. Observing common pitfalls, such as incomplete sections or inaccuracies in data entry, can avoid unnecessary delays.

Reviewing and finalizing the form

Before submission, verify all entries for accuracy and completeness. It's helpful to use a checklist to ensure that all critical information is included. Double-check names, dates, and the legality of the employment terms outlined in the form.

Interactive tools for managing your family business affairs

pdfFiller offers an array of editing tools to customize the 'Children Are Our Business' form to meet specific needs. Users can easily edit PDFs, add or remove sections, and collaborate with team members in real-time. These interactive features enhance efficiency and ease of use throughout the document management process.

The platform also supports digital signing capabilities, allowing for quick approvals without the need for physical paperwork. This feature is particularly beneficial for busy family business owners who are constantly on the go, ensuring that important documents are signed and filed promptly.

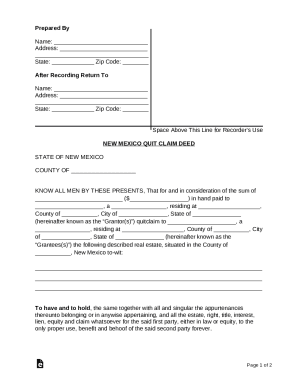

Legal considerations when hiring your children

It's critical to understand child labor laws when hiring minors in a family business. Each state has specific regulations regarding age restrictions and types of work that children can perform. Additionally, documentation requirements vary, so it's essential to familiarize yourself with local laws to ensure compliance.

Hiring your children can also offer tax benefits. Certain tax breaks for family employment can significantly alleviate financial burdens. Generally, the wages paid to your child may not be subject to social security or Medicare taxes if the business is a sole proprietorship. Understanding these nuances is vital for maximizing the financial advantages of employing family members.

Be aware of age-related restrictions on employment.

Understand specific local and federal labor laws.

Explore potential tax benefits of employing family members.

Best practices for employing children in your business

Setting ethical standards is paramount when employing children in your business. It's essential to create a safe, structured environment that prioritizes the child's well-being and development. Children should be aware of their job responsibilities, but it is equally important to maintain a healthy balance between work and family dynamics.

Establish open lines of communication to discuss expectations and experiences. Family businesses thrive when all members feel valued and heard, fostering a positive work atmosphere. Additionally, implementing reasonable working hours and task lists tailored to the child's abilities helps cultivate a balanced and supportive environment.

Establish clear roles and expectations for work-related duties.

Encourage open communication about workplace experiences.

Monitor working hours to prevent burnout and ensure well-being.

Tax implications and benefits of hiring children

Navigating the tax implications of employing children in a family business can significantly impact your overall financial strategy. Understanding the difference between taxable income and non-taxable benefits is critical. In most situations, income earned by a child can be reported as a business expense, effectively reducing the overall taxable income of the business.

Furthermore, there are tax breaks available for family business owners who employ their children. Deductions for wages paid may not be subject to the self-employment tax, allowing business owners to maximize their tax savings. Familiarizing yourself with how to report the income earned by your child ensures compliance and leverages potential advantages.

Understand taxable income vs non-taxable benefits for children's earnings.

Learn how to report your child's earned income appropriately.

Explore available tax breaks and deductions for business owners.

Real-life applications and case studies

Examining successful family businesses can provide valuable insights into effective practices regarding child employment. For instance, the Smith family bakery in Minnesota has successfully integrated their children into their business, fostering responsibility and teamwork while ensuring compliance with labor laws. Testimonials from family business owners reveal a mix of benefits and challenges associated with this practice.

Business owners often find that employing their children cultivates a strong sense of ownership and pride in the business. However, it can also blur boundaries between work and family life. Insights from these applications shed light on aligning business strategies with family values, exemplifying the potential for growth when children are involved.

Look at family-owned businesses that successfully employ minors.

Hear testimonials from owners on benefits and difficulties.

Explore how these practices impact overall business strategies.

Tools & resources for business owners

For effective management of the 'Children Are Our Business' form, users of pdfFiller have access to a variety of related forms and publications aimed at streamlining document management. By leveraging these resources, family business owners can ensure that they maintain compliance while fostering growth.

Moreover, additional resources for tax planning and legal guidance are invaluable. Engaging with professional services and publications can help business owners navigate complex regulations and ensure their operations are legally compliant. Utilizing available tools and resources supports ongoing success and growth for family businesses.

Access related forms and publications through pdfFiller.

Engage with resources for legal and tax planning.

Utilize tools for effective management of family business operations.

Related topics and further reading

The intersection between family businesses and tax legislation is an evolving subject requiring continuous attention. For those interested in exploring the broader implications of hiring youth in non-family-owned businesses, guidelines on employment laws are readily available and should be consulted. Additionally, reviewing child labor laws by state reinforces the need for compliance regardless of the business's nature.

Continuing to read about these topics not only aids in compliance with regulations but can also inspire innovative practices within family business structures. Exploring case studies from various industries will enrich your understanding of best practices.

Research family businesses' studies regarding tax legislation.

Understand guidelines for hiring underage employees in non-family businesses.

Review state-specific child labor laws for enhanced compliance.

Frequently asked questions (FAQs)

As you navigate the intricacies of the 'Children Are Our Business' form, several questions may arise. For instance, some may wonder, 'What forms do I need in addition to the 'Children Are Our Business' form?' or 'How can I audit my family business to ensure compliance with child labor laws?' These queries highlight the need for ongoing education and resource acquisition to support family business operations.

The long-term implications of employing children are also a valid concern. It is crucial to consider how these employment practices influence business culture and family dynamics over time. Addressing these questions provides clarity and assurance for family business owners, solidifying their knowledge foundation.

Explore additional necessary documentation beyond the main form.

Consider how to effectively audit compliance with laws.

Evaluate long-term impacts of employing children in a family business.

Subscribe for updates on related business forms and resources

Staying updated with changes in laws and regulations is imperative for family business owners. Subscribing to pdfFiller's newsletter provides valuable insights and access to exclusive resources. Regular updates ensure that family business leaders remain informed about pertinent changes that may affect their operations.

Moreover, staying connected through newsletters can pave the way for future growth opportunities, offering timely advice about best practices and compliance measures for employing children in family businesses.