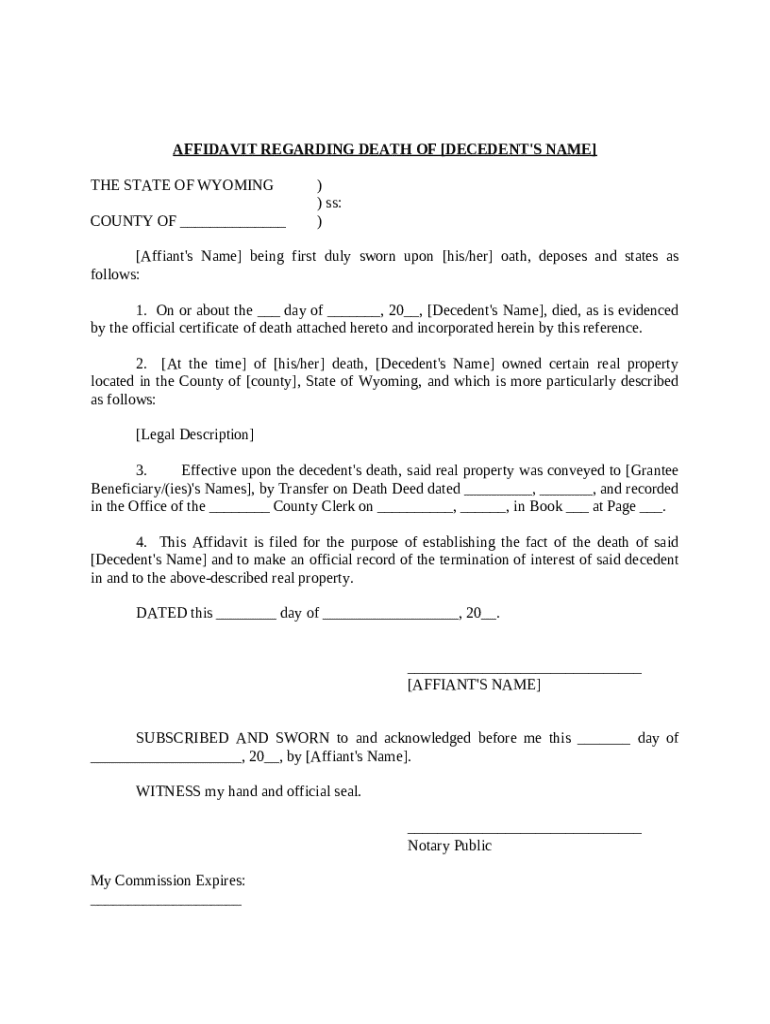

Comprehensive Guide to the TOD Deed Affidavit of Survivorship DOCX Template Form

Overview of the TOD deed affidavit of survivorship

A Transfer on Death (TOD) deed is a legal document that allows property owners to transfer real estate assets to a designated beneficiary automatically upon their death, avoiding the probate process. The TOD deed maintains full ownership rights during the owner's life, ensuring flexibility and control over the property until death.

The affidavit of survivorship is essential in confirming the death of the original property owner, validating the rights of the beneficiary, and facilitating the legal transfer of property. This document is vital in ensuring that beneficiaries can claim ownership without unnecessary legal hurdles.

Key components of a TOD deed affidavit of survivorship

Understanding the components of a TOD deed affidavit of survivorship is crucial to effectively filling out the document. Each section plays a significant role in establishing the legal transfer of property.

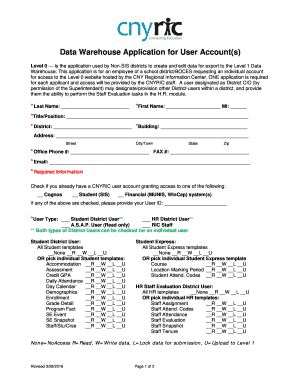

Affiant Information: This section includes the name, address, and contact details of the person completing the affidavit, typically a surviving owner.

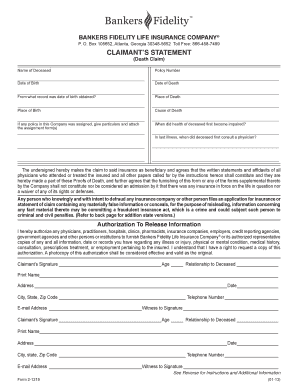

Deceased Owner Information: Here, you must provide the full name, date of birth, and date of death of the deceased property owner to establish their identity and confirm their passing.

Current Owner Information: All surviving owners or grantors of the TOD deed must be listed, providing their names and any additional details necessary to prove their ownership.

Legal Description of Property: This section is critical, detailing the exact location of the property, including lot numbers and parcel numbers, which can usually be found on tax statements or title documents.

Understanding different forms of ownership

When discussing TOD deeds, it’s essential to understand the different forms of property ownership. Each form has distinct legal implications for the transfer of property.

Joint Tenancy: In this form, all owners have equal rights to the property, and upon the death of one owner, their share automatically goes to the surviving owners.

Tenancy by the Entirety: Recognized in some states, this form is similar to joint tenancy but is specifically for married couples, offering additional protections.

Tenancy in Common: Multiple owners hold shares in the property, which do not pass automatically on death. Here, a TOD deed validates a designated beneficiary's right to the deceased's interest.

Preparing the TOD deed affidavit of survivorship

Gathering necessary information and documents is the first step in preparing your TOD deed affidavit of survivorship. Subsequently, you'll need to fill out the affidavit form accurately.

Gather Required Documents: You'll need several documents ready, such as the death certificate, the current deed, and identification of all parties involved.

Complete the Affidavit Form: Using the pdfFiller platform, you can interactively fill out the form. Ensure every section is completed accurately to avoid delays.

Review for Accuracy: Before finalizing, check every detail against your gathered documents. Create a checklist to confirm that all information reflects current records.

Signing and notarization process

Once the TOD deed affidavit is filled out, signing and notarization is essential for the document's validity. Both steps serve as a safeguard against potential disputes.

Requirements for Signing: Ensure all signatories, including any surviving property owners, are present to sign the document.

Notarization Steps: After signing, a notary public must witness the signatures and affix their seal, confirming the authenticity of the document.

Submission and recording of the affidavit

Timely submission and recording of the completed affidavit of survivorship are crucial to formally establish the new ownership of the property. Not performing this step can result in confusion and potential legal issues.

How to Submit: Deliver the notarized affidavit to the appropriate county office, which could be the Recorder’s Office or a similar local authority.

Importance of Timely Recording: Submitting the affidavit promptly ensures that the beneficiary’s ownership rights are documented, protecting them from claims by creditors or other potential heirs.

Associated Fees: Be aware of any recording fees that may apply. These fees vary by jurisdiction, so check with your local office beforehand.

Common questions and challenges

Navigating property transfer can raise several questions, especially regarding joint ownership and alternate beneficiaries. Understanding these scenarios can save time and reduce stress.

What if the deceased owned property jointly? In this case, rights of survivorship typically dictate that the surviving owner automatically inherits the deceased’s share, simplifying the transfer process.

Addressing Predeceased Beneficiaries: If a designated beneficiary passes before the owner, the document can specify alternate beneficiaries, ensuring there's no lapse in ownership.

Formalizing Changes in Ownership: Following the transfer, make sure to update all property records to reflect the new ownership status and avoid future disputes.

Calculating potential complications

While the process for using a TOD deed affidavit is straightforward, multiple complications might arise, particularly around co-ownership and contested heirs.

Understanding Potential Legal Disputes: Complications may arise if there are conflicting claims to the property from heirs or other parties; legal consultation may sometimes be necessary.

Handling Complications with Co-ownership: When multiple individuals are involved, clear communication and agreements should be reached regarding the future management and transactions associated with the property.

Utilizing pdfFiller for streamlined document management

pdfFiller offers valuable tools for individuals and teams looking to manage their documents efficiently, providing a seamless experience from form filling to signing and collaboration.

Benefits of Using pdfFiller: Users can easily fill out, edit, and send documents, minimizing paperwork hassle while ensuring clarity and compliance.

Features for Collaboration: The platform allows users to share documents for collective input and feedback, which is especially useful when multiple parties are involved in property transfer.

Accessing Documents from Anywhere: As a cloud-based solution, pdfFiller ensures that documents can be accessed and managed from any device, at any time.

Final review process

Before the final submission of the TOD deed affidavit of survivorship, conducting a thorough review is essential to ensure compliance with legal standards and to affirm the accuracy of the information.

Important Considerations: Review every page of the document, cross-referencing it with your original papers to confirm that all details are correctly entered.

Recommendations for Maintaining Legal Documentation: After filing, store copies of all submitted documents in a secure location and ensure that any necessary parties are informed of the record changes.

Interactive tools and resources

To enhance your experience and ease the process of documenting and submitting the TOD deed affidavit, several interactive tools and resources are available.

Template Download Section: Access the TOD deed affidavit DOCX template directly from pdfFiller, allowing for easy editing and filling out.

Video Walkthroughs and Tutorials: Utilize links to instructional content that provides step-by-step guidance on filling out and submitting the affidavit.

Expert Assistance and Customer Support: If further help is needed, options for professional support are readily available to assist in the document management process.