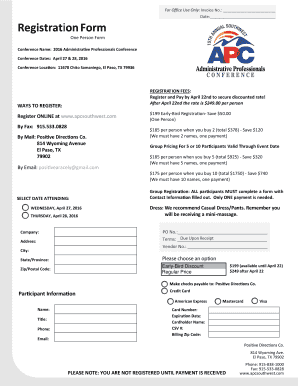

Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out hawaii tax form g-45

Who needs hawaii tax form g-45?

Hawaii Tax Form G-45: Your Comprehensive Guide

Overview of Hawaii Tax Form G-45

Hawaii Tax Form G-45 serves a critical purpose in the state’s taxation system, acting as the primary form for the reporting of General Excise Tax (GET) liabilities. As a state that relies heavily on tourism and local commerce, Hawaii has implemented the GET to ensure that both businesses and individuals contribute to the state's economy. The form is essential for tracking the income generated from various sources and ensuring compliance with state tax laws.

Entities required to file the G-45 form typically include businesses that earn revenue from services, sales, and rentals. This also extends to certain self-employed individuals, as they too may collect GET on their incomes. The frequency with which the G-45 must be filed can vary; businesses may be required to submit it monthly, quarterly, or annually, depending on their revenue and tax liabilities.

Understanding General Excise Tax (GET)

The General Excise Tax (GET) in Hawaii is a tax applied to all business income generated within the state. Unlike a sales tax, which is only charged at the point of sale to consumers, GET is levied on businesses themselves, making it a unique aspect of Hawaii's taxation model. This tax affects all sectors of the economy, pressing businesses—from retail shops to service providers—to manage their GET obligations effectively.

Many misconceptions surround GET, particularly regarding who is responsible for collecting and remitting it. A common belief is that only traditional businesses, like restaurants and retail shops, need to file the G-45 form. In reality, nearly any entity earning income in Hawaii, including freelancers and independent contractors, may indeed be responsible for GET filings.

Detailed breakdown of the G-45 form

The G-45 form is divided into sections, each requiring specific information crucial for accurate filing. Section A focuses on Business Information, where taxpayers must provide their name, address, and GET license number. This section allows the Hawaii Department of Taxation to identify the entity filing. Accurate details in this section are essential to avoid any delays or issues with processing.

In Section B, taxpayers report their activity details, categorizing income from various sources such as retail sales, professional services, or rental income. Proper categorization is vital since different types of income may be subject to varying tax rates. Lastly, Section C addresses Tax Calculation, allowing fiers to compute their GET liability. Each type of income will carry a specific tax rate, requiring careful mathematical application to determine the amount owed.

Step-by-step instructions for filling out the G-45 form

To ensure accurate filing of the G-45 form, preparation is key. Gather all necessary information, including income records and business details. Start by completing Section A, providing your business name, address, and GET license number. Accuracy here sets the tone for the entire filing process.

When moving to Section B, detail your income sources thoroughly. It is essential to categorize each income type appropriately, as misclassification may lead to errors in tax calculation. In Section C, calculate the GET owed based on the provided income categories. This step might involve applying tax rates to different income types, so double-checking back to correct rates is vital. Finally, review the entire form to catch any mistakes before submission.

Electronic filing options for the G-45 form

Electronic filing of the G-45 form offers a streamlined experience for taxpayers. Users can access the Hawaii Department of Taxation's website to submit their forms online, making it a convenient choice for busy business owners. The benefits of e-filing include faster processing times and immediate confirmation of successful submissions.

Additionally, for those preferring to work offline, the Hawaii Department of Taxation provides PDF fillable forms that allow users to complete their filings smoothly. This option combines accessibility with the desire to maintain records digitally. Furthermore, digital submissions help ensure that forms are legible and free from the errors that can occur with handwritten documents.

Payment options for General Excise Tax

Once the G-45 form is completed, businesses must also consider how they will make their General Excise Tax payment. Hawaii offers various methods for tax payment to accommodate all taxpayers. The online payment system is available through the Hawaii Department of Taxation website, making it quick and convenient. For those who prefer traditional methods, payments can also be submitted by mail or in-person at designated tax offices.

It's crucial to observe all payment deadlines to avoid penalties. Missing the due dates can incur late payment fees, resulting in unnecessary expenses. Establishing a calendar of due dates can help ensure timely submissions and payments, keeping businesses in compliance.

Tips for managing your tax records effectively

Proper tax record management is essential to ensure compliance and facilitate smooth filing processes in the future. Maintain detailed documentation related to G-45 filings, including income statements, receipts, and invoices. Implementing a reliable storage system—whether physical or digital—will make retrieving information easier during tax season or if an audit occurs.

Using tools like pdfFiller enhances the ability to manage tax documents. pdfFiller enables users to edit PDFs, eSign documents, and collaborate with team members in a secure cloud environment. This platform's storage options ensure records are backed up and easily accessible, minimizing the stress that can accompany tax obligations.

Frequently asked questions (FAQs) about the G-45 form

Tax filers often have questions regarding the Hawaii Tax Form G-45, especially concerning exemptions, filing errors, and eligibility. One frequently asked question is whether certain small businesses are exempt from filing. Generally, businesses with gross income below a certain threshold may be exempt, but it is crucial to verify with state guidelines.

In cases of mistakes on the form, filers should promptly address any errors by submitting a corrected form to the Department of Taxation along with an explanation. This proactive approach helps in maintaining good standing and can prevent issues in the future.

Additional considerations for business owners in Hawaii

Understanding tax obligations extends beyond filing the G-45 form. Business owners must also be aware of other related forms and taxes that may require attention, such as the G-49 form, which is needed for annual reconciliation of GET collected. Regularly updating tax knowledge is crucial, as Hawaii’s tax landscape can evolve, impacting how businesses function.

Additionally, business owners should keep an eye on local initiatives or changes that affect taxation policies, especially with the tourism sector being a significant part of Hawaii’s economy. Staying informed can help businesses manage their responsibilities proactively and avoid unnecessary penalties.

Insights on Hawaii's tax palate

Recent changes in tax laws can significantly influence Hawaii's tax environment and impact G-45 form filers. Keeping abreast of legislative adjustments related to tax rates or exemptions is essential for businesses. Resources like governmental announcements, tax seminars, or local news sources can provide valuable updates.

Businesses should actively seek out resources to aid in understanding their tax obligations. The Hawaii Department of Taxation website often has the latest information, but proactive measures in financial education are equally important to avoid falling behind on compliance.

Leveraging pdfFiller for an enhanced document experience

pdfFiller's platform provides an array of features designed to simplify tax document management, making it a beneficial tool for both individuals and businesses. Users can not only fill out the G-45 form but also utilize the platform's editing capabilities to adjust documents as needed. Furthermore, eSigning eliminates the delays associated with traditional signatures, streamlining the submission process.

Real-time collaboration is another feature that enhances productivity, as teams can work together on tax-related paperwork, ensuring accuracy and efficiency. With secure storage options, pdfFiller allows users to keep their tax documents organized and readily available, ensuring compliance with legal requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pdffiller form?

How do I edit pdffiller form in Chrome?

How do I edit pdffiller form on an Android device?

What is hawaii tax form g-45?

Who is required to file hawaii tax form g-45?

How to fill out hawaii tax form g-45?

What is the purpose of hawaii tax form g-45?

What information must be reported on hawaii tax form g-45?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.