Get the free CASH DRAWER AUDIT

Show details

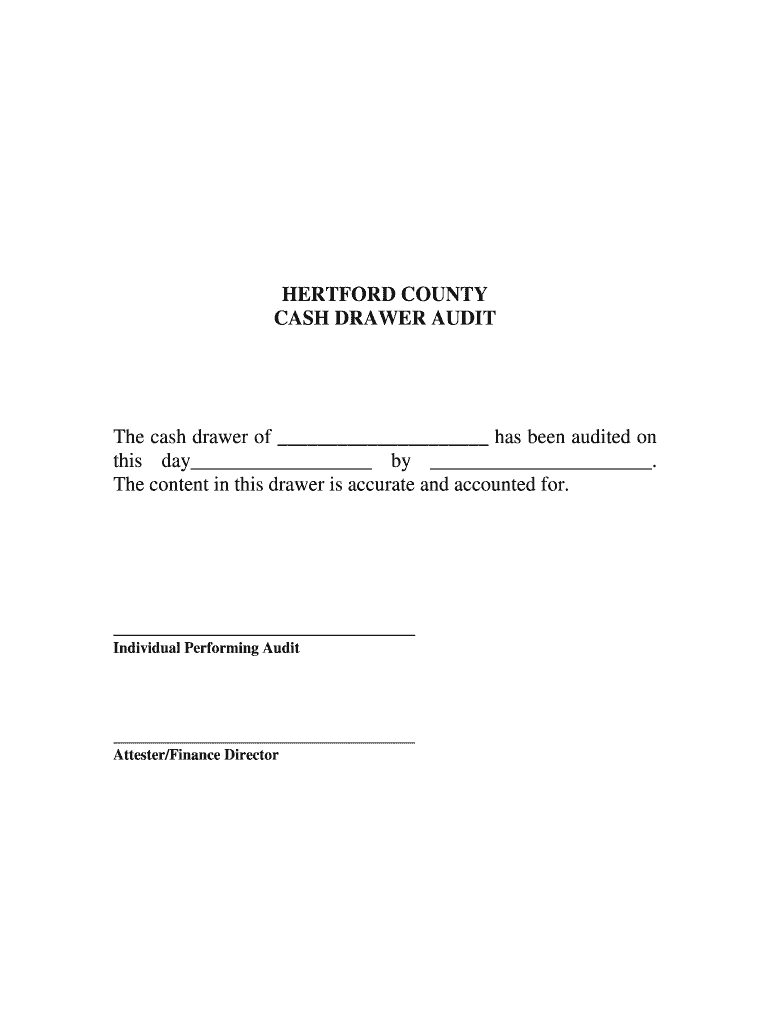

HARTFORD COUNTY CASH DRAWER Auditee cash drawer of has been audited on this day by. The content in this drawer is accurate and accounted for. Individual Performing Audit Attester/Finance Director.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash drawer audit

Edit your cash drawer audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash drawer audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cash drawer audit online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cash drawer audit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash drawer audit

How to fill out cash drawer audit:

01

Start by gathering all necessary documents and tools. This includes the cash drawer audit form, a calculator, and a pen or pencil.

02

Begin by recording the starting cash balance in the designated section of the audit form. This is the amount of money that should be in the cash drawer at the beginning of the business day.

03

Throughout the day, accurately record all cash inflows and outflows on the audit form. This includes cash sales, payments received, and any petty cash expenses. Make sure to be as detailed as possible, noting the amount, source, and purpose of each transaction.

04

At the end of the business day, count the cash remaining in the drawer and record it on the audit form under the "Ending Cash Balance" section. This is the amount of money that should be in the drawer at the end of the day.

05

Calculate the total cash sales for the day by adding up all the cash inflows recorded on the audit form. This will give you an accurate picture of the cash transactions made during the day.

06

Compare the ending cash balance recorded on the audit form with the actual cash remaining in the drawer. The two amounts should match. If there is a discrepancy, thoroughly investigate and reconcile any discrepancies before completing the audit.

07

Once you have completed all sections of the cash drawer audit form and verified its accuracy, sign and date the form to indicate that you have completed the audit.

Who needs cash drawer audit:

Cash drawer audits are essential for businesses of all sizes that handle cash transactions regularly. Various individuals and entities may require cash drawer audits, including:

01

Business owners and managers: Performing regular cash drawer audits ensures that cash handling procedures are being followed correctly and helps identify any discrepancies or potential issues.

02

Accountants and auditors: Cash drawer audits provide crucial information for financial reporting and auditing purposes. They help verify the accuracy of cash transactions, detect fraudulent activities, and ensure compliance with accounting standards.

03

Financial institutions: Cash drawer audits may be required by banks or lenders as part of loan applications or ongoing monitoring of a business's financial health. Accurate and well-documented cash drawer audits demonstrate financial responsibility and reliability.

In summary, filling out a cash drawer audit involves accurately recording cash transactions throughout the day, reconciling cash balances, and ensuring the accuracy of financial records. Cash drawer audits are necessary for business owners, accountants, auditors, and financial institutions to maintain financial integrity and monitor cash handling practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cash drawer audit?

A cash drawer audit is a process of verifying the amount of cash in a cash register or drawer to ensure that all transactions are accurately recorded.

Who is required to file cash drawer audit?

Typically, cash drawer audits are required to be filed by businesses that handle cash transactions, such as retail stores, restaurants, and other establishments that accept cash payments.

How to fill out cash drawer audit?

To fill out a cash drawer audit, one must count the cash in the register, compare it to the recorded transactions, and make sure all discrepancies are properly documented.

What is the purpose of cash drawer audit?

The purpose of a cash drawer audit is to prevent theft, fraud, and errors in cash handling, and to ensure that all cash transactions are accurately recorded.

What information must be reported on cash drawer audit?

The information reported on a cash drawer audit typically includes the total amount of cash counted, any discrepancies found, and any explanations for those discrepancies.

How do I edit cash drawer audit online?

The editing procedure is simple with pdfFiller. Open your cash drawer audit in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit cash drawer audit on an Android device?

You can make any changes to PDF files, such as cash drawer audit, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete cash drawer audit on an Android device?

Use the pdfFiller mobile app and complete your cash drawer audit and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your cash drawer audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Drawer Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.