How to find a Tax on a Form

Understanding tax types

A Tax Identification Number (TIN) is an essential identifier used by the IRS for tax purposes. Knowing the correct type of tax ID is crucial for both individuals and businesses as it impacts everything from filing taxes to ensuring compliance with tax regulations. In the United States, there are several types of Tax IDs, including the Social Security Number (SSN) for individuals, the Employer Identification Number (EIN) for businesses, and the Individual Taxpayer Identification Number (ITIN) for those who do not qualify for an SSN.

Social Security Number (SSN): A nine-digit number assigned by the Social Security Administration, primarily used by individuals for tax reporting.

Employer Identification Number (EIN): Issued to businesses for tax purposes, essentially functioning as a business's SSN.

Individual Taxpayer Identification Number (ITIN): A tax processing number for individuals who are not eligible for an SSN but need to file taxes.

Understanding the types of Tax IDs is essential as the requirements and implications for filing and compliance differ significantly. Businesses must ensure their EIN is accurately reported on forms to avoid penalties, whereas individuals should safeguard their SSN to prevent identity theft.

Importance of knowing your tax

For individuals, knowing your Tax ID is vital for effective tax filing and eligibility for various government programs. Many financial institutions also require SSNs for account openings or loan applications. For businesses, the EIN is crucial not only for tax filings, but it also affects legal compliance, opening business bank accounts, and hiring employees. Failing to use the correct Tax ID could result in complications with the IRS that may lead to financial repercussions.

Furthermore, any discrepancies related to Tax IDs during audits can lead to severe penalties, making it essential to maintain accurate records and ensure that all documentation is up to date. For companies, it’s advisable to review your EIN regularly and keep it secure; your business’s financial health may depend on it.

Locating your tax

Finding your federal Tax ID or EIN can be straightforward if you know where to look. Here are some common documents where you can find this information:

Tax Returns: Check specific line numbers on your Form 1040 for individuals or Form 1065 for partnerships.

Business Registration Documents: Look for your EIN on Articles of Incorporation or Organization files that are submitted to the state.

Employer Documents: Review payroll reports, W-2s, and 1099s which will typically display your EIN.

Understanding where to locate your Tax ID on these vital documents can save you time and anxiety, especially during tax season.

Finding your individual TIN

Your Social Security Number can often be found on your Social Security card. This card is typically issued at birth or upon application. If you’ve misplaced it, a copy may be retrieved through the Social Security Administration's website or office. Additionally, IRS correspondence often lists your TIN, especially documents such as previous tax returns or sensitive letters regarding your tax status.

To enhance security, it's recommended that you store your Social Security card and other documents containing your SSN in a safe place to protect against identity theft. Only share your SSN with trusted entities that require it for legitimate purposes.

How to find your business’s EIN

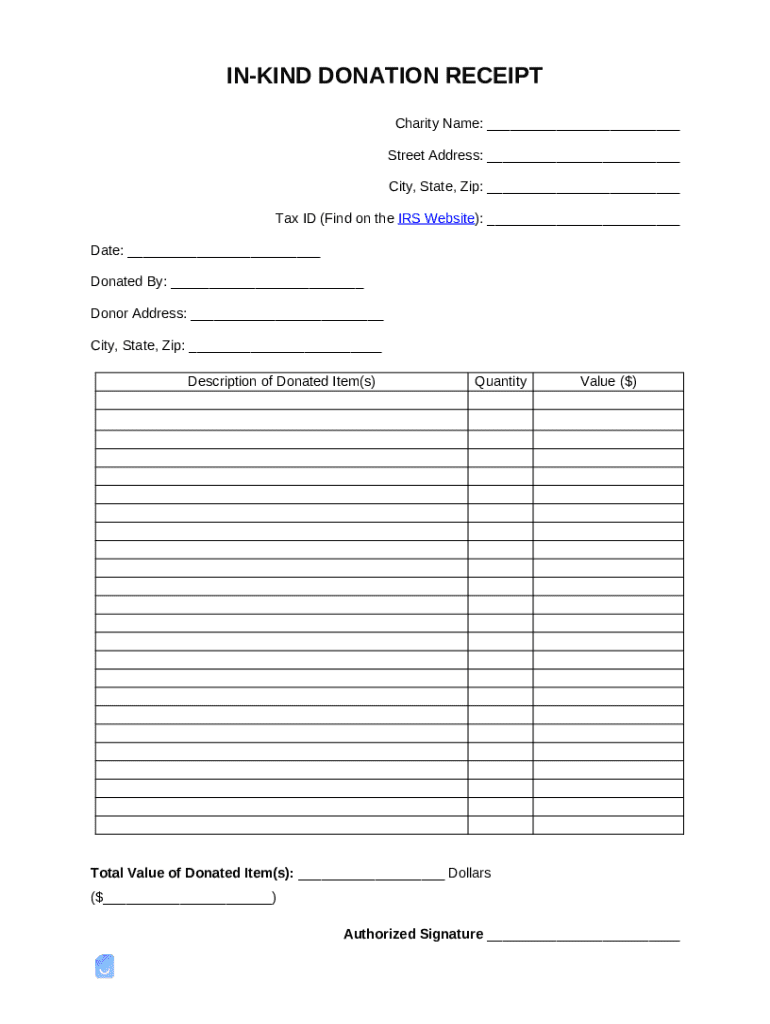

Locating your business's EIN is similarly straightforward. The EIN is usually found on tax-related documents generated by the IRS. Essential forms that carry your EIN include the following:

990 form: Nonprofit organizations must report their EIN here.

Schedule C: Sole proprietors file this along with their personal tax returns.

Various tax accounts and monthly filings often display your EIN.

In case you have forgotten or misplaced your EIN, the IRS offers online retrieval options that require an account verification process to ensure security.

Accessing tax via electronic records

In the digital age, several platforms facilitate the retrieval and management of tax IDs. Tools like pdfFiller allow users to store and access all relevant tax documents, including forms containing your TIN securely online. With this capability, users can edit important documents, eSign them, and even collaborate with tax professionals remotely.

Using electronic records not only simplifies the process of finding your Tax ID but also enhances the overall organization of your tax documents. Digital tax filing services ensure your information is secure and provide a streamlined experience, allowing you to focus on what matters most— managing your finances.

Step-by-step process to locate your tax

Retrieving your Tax ID can feel overwhelming, but following a systematic approach can make it easier. Here’s a step-by-step guide to assist you:

Gather relevant documents such as tax returns, business registration documents, and any IRS correspondence.

Review key sections of each document to isolate where your Tax ID is listed.

Access IRS online tools if needed, especially if you cannot find your EIN.

By following this structured approach, you can effectively locate your Tax ID with minimal hassle.

Recovering a forgotten or lost tax

If you've lost your Tax ID, don’t panic; steps are in place to recover it. This typically involves contacting the IRS directly. If you're a business owner looking for your EIN, you can use IRS Form SS-4 to request a replacement or look it up online through the IRS web portal. Keep in mind that having accurate records is vital for the retrieval process.

It’s important to ensure that all requests for information align with IRS procedures. For individuals, consider keeping your Tax ID documented in both digital and hardcopy formats, ensuring you can access it when needed.

Expert Q&A on tax common questions

Many questions arise regarding Tax IDs, especially when individuals cannot locate theirs or misidentify their EIN. Common queries include what to do if you can’t find your Tax ID or how to rectify a situation if an EIN is incorrectly used. If you find yourself in either problematic scenario, reviewing the IRS guidelines or consulting with a tax professional could provide clarity.

Being informed about the correct procedures in these instances can save considerable time and reduce stress. Understanding the nuances can significantly improve compliance and alleviate concerns.

Practical tips for efficient tax management

Managing your Tax ID efficiently can make a significant difference during tax season and beyond. Ensure that you organize tax documents securely by using digital storage solutions. Utilizing platforms like pdfFiller helps to keep everything in one place and ensures that sensitive documents are protected. Regularly performing audits on your tax records can also go a long way in maintaining accurate records.

Cloud-based solutions offer convenience, allowing you to access vital documents from anywhere and to share them securely with tax professionals.

Interactive tools and calculators for tax identification

In today’s digital environment, various calculators and tools can assist with estimating tax responsibilities, including TIN and EIN-related tasks. For those needing quick solutions, pdfFiller provides tools that help create and manage documents effectively.

Interacting with these resources not only facilitates the creation and management of tax forms but also ensures all documents are accurate, up-to-date, and compliant with IRS regulations.

Video guide: how to navigate tax retrieval resources

For visual learners, video resources can greatly simplify the process of navigating tax ID retrieval. A quick tutorial showcasing how to use pdfFiller for efficient document management and retrieval can save you time and effort. Watching a step-by-step guide can clarify complex processes, making them more accessible.

These guides ensure users stay informed about the best practices for managing their Tax IDs and related documents.

Understanding related tax terms

When dealing with Tax IDs, familiarizing yourself with certain terminologies can further your understanding of the topic. Some key terms include:

Employer Identification Number, a unique number assigned to businesses.

Tax Identification Number, general term for various tax identification types.

Internal Revenue Service, the U.S. government agency responsible for tax collection.

A reduction in the amount of taxable income.

Understanding these terms can help demystify the process of dealing with your Tax ID and filing taxes.

Finding assistance and support for tax issues

Should you encounter issues with your Tax ID, several resources can provide assistance. The IRS employs hotlines for taxpayers and provides online information. Additionally, consulting tax professionals can clarify complex issues or guide you through the process of resolving problems regarding Tax IDs.

Community resources are also available, offering free or low-cost tax assistance to help ensure your questions are addressed efficiently.

Real-life case studies on tax challenges and solutions

Understanding how others have successfully navigated challenges with Tax IDs can offer valuable insights. For example, many business owners have shared their experiences with effective retrieval of their EIN using pdfFiller. Testimonials highlight how organized document management improved their compliance and reduced anxiety tied to tax filings.

These case studies serve as reminders that proper documentation and informed processes can make a significant difference in your management of tax-related issues.

this article help you? Share your experience!

Finally, we encourage you to share your experiences related to finding your Tax ID. Your insights could help others navigate similar challenges or inspire better organizational practices. Whether success stories or lessons learned, your input is valuable.