CA CP10 1991 free printable template

Show details

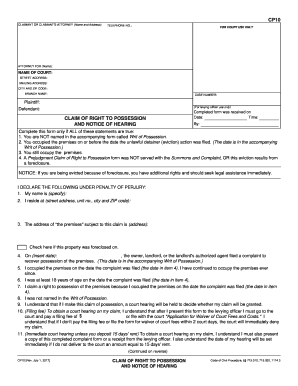

CLAIMANT OR CLAIMANT'S ATTORNEY (Name and Address): TELEPHONE NO.: FOR COURT USE ONLY ATTORNEY FOR (Name): NAME OF COURT: STREET ADDRESS: MAILING ADDRESS: CITY AND ZIP CODE: BRANCH NAME: To keep other

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CP10

Edit your CA CP10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CP10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CP10 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA CP10. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CP10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CP10

How to fill out CA CP10

01

Obtain a copy of the CA CP10 form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Ensure you have all necessary information including business details, tax identification number, and relevant financial records.

03

Start filling out the form by entering your business name and address in the specified fields.

04

Provide your account number as it appears on your previous correspondence from the CDTFA.

05

Fill in the details regarding your business activity and any income earned during the reporting period.

06

Report any tax due or overpayment by providing accurate figures according to your records.

07

Review the completed form for any errors or missing information before submission.

08

Sign and date the form, then submit it to the CDTFA by the specified deadline.

Who needs CA CP10?

01

Businesses operating in California that are subject to sales tax or other specific taxes administered by the CDTFA.

02

Taxpayers who are looking to report their tax liabilities or request a refund for overpayments.

03

Businesses that have received a notice from the CDTFA requiring them to complete the CA CP10 form.

Fill

form

: Try Risk Free

People Also Ask about

How do you serve a prejudgment claim of Right to Possession?

A Prejudgment Claim of Right to Possession is served with the Summons and Complaint. However, it is important to note that any only a Marshall, the Sheriff, or registered process server can serve a Prejudgment Claim of Right to Possession.

What is a writ of possession for personal property in California?

The purpose of the writ is to restore possession of specific item(s) of personal property to the judgment creditor. A Writ of Possession of Personal Property permits the levying officer to satisfy the judgment by seizing and delivering the specified property directly to the creditor.

How do you get a Writ of Possession in California?

After the creditor landlord obtains a judgment in an unlawful detainer action, the court may issue a Writ of Possession (real property) that authorizes the Sheriff to remove (evict) the occupants from the property. The eviction is scheduled as soon as possible after the expiration of the 5-day period.

What is a CP10 form?

Posted by a sheriff on a home along with a Notice to Vacate at the end of an eviction court case. Gives people who live in the home but weren't a part of the case a chance to add themselves into the case to say why they shouldn't be evicted. Get form CP10.

How long do I have to move after a writ of possession in California?

The sheriff will give the tenant 5 days to move This gives your tenant 5 days to move out. If they don't move, the sheriff will remove them from the home and lock them out.

What is a CP10 5 form?

5) Given by a landlord to a person they're trying to evict when they don't know their name. It gives the person a chance to add themselves to the eviction court case at the beginning to say why they shouldn't be evicted. Get form CP10.5.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my CA CP10 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your CA CP10 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the CA CP10 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign CA CP10 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete CA CP10 on an Android device?

Complete CA CP10 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CA CP10?

CA CP10 is a form used in California for reporting the cost of capital gains and losses to the state's tax authority.

Who is required to file CA CP10?

Individuals or entities that have capital gains and are subject to California state taxes are required to file CA CP10.

How to fill out CA CP10?

To fill out CA CP10, obtain the form from the California tax authority's website, complete the required taxpayer information, report your capital gains and losses, and ensure all calculations are accurate before submitting.

What is the purpose of CA CP10?

The purpose of CA CP10 is to report capital gains and losses for tax assessment and to ensure compliance with California tax laws.

What information must be reported on CA CP10?

CA CP10 requires reporting of taxpayer identification information, details of capital assets sold, acquisition dates, sale dates, amounts received, costs, and any related expenses.

Fill out your CA CP10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA cp10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.