Get the free Instructions for Form 1024 (01/2022)

Get, Create, Make and Sign instructions for form 1024

How to edit instructions for form 1024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 1024

How to fill out instructions for form 1024

Who needs instructions for form 1024?

Instructions for Form 1024: A Comprehensive How-to Guide

Overview of IRS Form 1024

IRS Form 1024 serves a critical function in the realm of tax-exempt organizations. Specifically, it is used by organizations seeking recognition of their tax-exempt status under Section 501(c)(3) and other applicable sections of the Internal Revenue Code. Proper submission of this form is vital not only for compliance but also for ensuring that your organization can function without federal tax burdens.

When organizations fail to file Form 1024 accurately or timely, they risk costly delays or even denials that could significantly impact their operational capabilities. Consequently, understanding who needs to file is crucial. This form is primarily intended for charities, educational organizations, and other nonprofits that meet specific criteria.

Understanding the tax-exempt application process

Gaining tax-exempt status is an essential step for many organizations, providing financial relief and enhancing operational viability. Tax-exempt status is granted to organizations that the IRS recognizes as being organized and operated exclusively for exempt purposes. Thus, understanding this application process involves several steps that must be closely adhered to.

The application process typically encompasses three key phases: preparation, submission, and follow-up. First, thorough preparation involves gathering all necessary documentation, narratives, and supporting materials that demonstrate compliance with IRS requirements. Next, submission entails completing Form 1024 accurately and submitting it through the designated channels. Finally, follow-up requires monitoring the status of the application and proactively engaging with the IRS for any requests or clarifications.

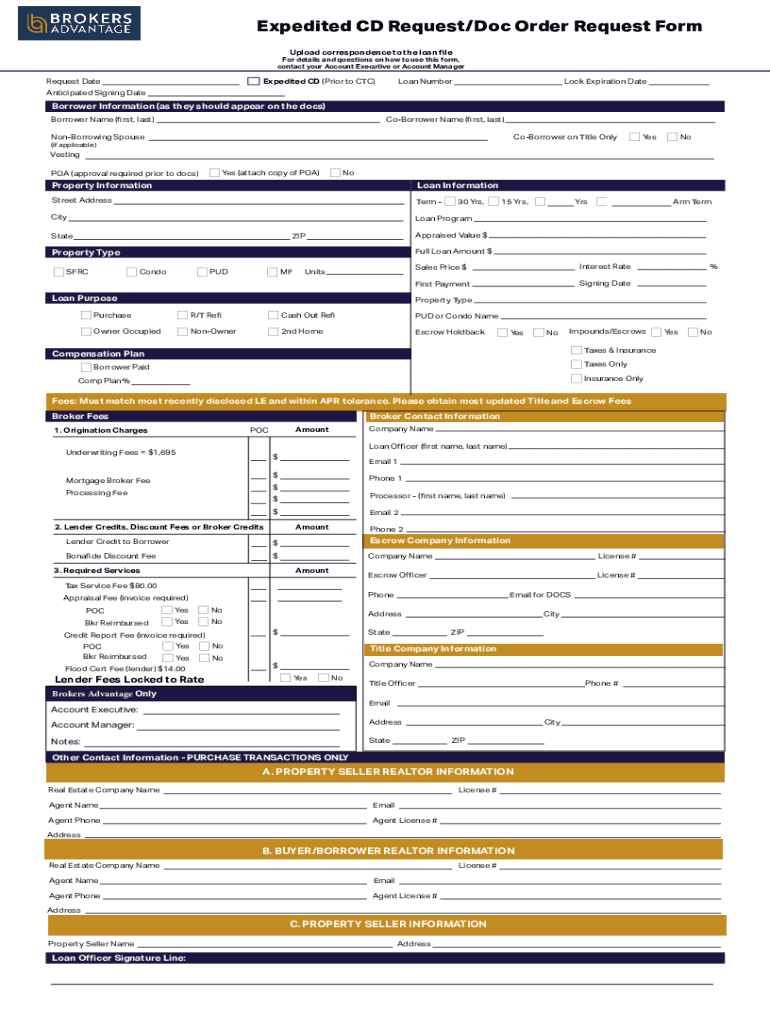

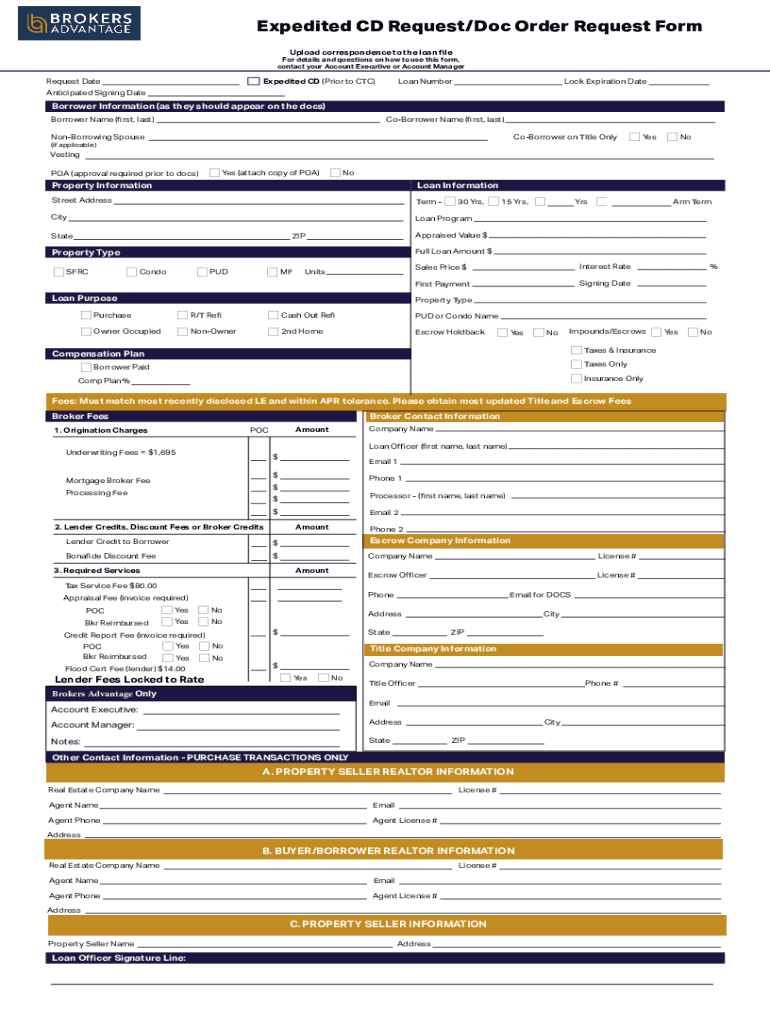

Detailed instructions for completing form 1024

Completing Form 1024 accurately is essential for a smooth application process. The form is divided into distinct parts, each requiring specific information to establish your organization’s eligibility for tax-exempt status. Here’s a section-by-section breakdown to simplify the process.

Part : Identification of applicant

This section requires the basic identifying information of your organization, including its name, address, and Employer Identification Number (EIN). Be meticulous in providing the correct EIN, as this is a common source of errors that could delay your application.

Part : Organizational structure

In this part, you will categorize your organization as a nonprofit entity and provide evidence of your structure. Eligible organizations might include corporations, trusts, or unincorporated associations. Supporting documents like articles of incorporation or bylaws must be included to establish your organizational structure.

Part : Specific activities

Detailing your organization’s intended activities is crucial. This section should clearly outline how your activities align with the requirements for tax-exempt status. Avoid vague language; instead, be specific about the programs and services your organization will offer. Clarity and detail are your best tools for ensuring the IRS understands your mission.

Part : Financial information

Accurate financial statements, including balance sheets and income projections, are necessary for this segment. The IRS requires this information to assess the organization’s operational scope and financial viability. Additionally, detailing projected budgets and proposed funding sources lays a transparent foundation for your request.

Part : Supplemental information

Supplemental information can bolster your application. Consider including letters of support, endorsements from community members, or previous tax-exempt determinations to demonstrate your organization’s legitimacy and commitment to its mission.

Special considerations and common pitfalls

Filing Form 1024 may seem straightforward, but organizations often encounter several pitfalls that can lead to delays or denials. Common errors include incomplete forms, missing signatures, lack of supporting documents, and failure to respond adequately to additional information requests from the IRS. Adhering to best practices can help avoid these challenges.

To mitigate these risks, always double-check your application before submission. Ensure that every part is filled out correctly and that you have adhered to IRS guidelines. Records must be meticulously maintained, with correspondence documented and copies of submitted forms retained for future reference.

Navigating form 1024 submission options

Once Form 1024 is complete, organizations have several options for submission. The IRS allows for both electronic submissions and paper filings, with electronic submissions being the preferred method for their speed and efficiency. Organizations should also be aware of the fees associated with submitting Form 1024, which must be paid upon filing, and the deadlines relevant to their applications.

Be mindful of IRS deadlines, as these can vary based on the type of organization applying. Generally, applications should be submitted early to allow ample time for potential inquiries from the IRS. Understanding these timelines ensures that your organization doesn’t miss related opportunities.

Post-submission: What happens next?

After submitting Form 1024, organizations enter the IRS review process, which can be lengthy. It's crucial to understand the next steps, including how to monitor the status of your application and what to expect during the IRS review. Organizations may receive requests for additional information, which must be addressed promptly and thoroughly.

Typically, the IRS's review process could take several months, depending on their backlog and complexity of your submission. During this period, remaining proactive and responsive to any inquiries will help facilitate a smoother review process.

Frequently asked questions about form 1024

When dealing with IRS Form 1024, many common queries arise concerning eligibility and application nuances. Addressing these questions helps organizations navigate the complex landscape of tax-exempt applications more smoothly.

For example, many applicants wonder about the differences in filing depending on the organization’s size or structure, or whether previous denials can impact current applications. Understanding these nuances provides necessary clarity for applicants.

Tools and resources for managing IRS form 1024

Utilizing the right tools can significantly streamline the process of completing and filing IRS Form 1024. pdfFiller offers various features that help simplify the form completion process. Users can easily edit PDFs, eSign documents, collaborate with team members, and manage documentation all from a single cloud-based platform.

Some standout features include interactive tools designed to assist in filling out IRS forms, offering templates and guidance that enable users to focus on compliance rather than administrative burdens. These tools enhance efficiency and ensure that every submission is thorough and correct.

Best practices for maintaining tax-exempt status

Securing tax-exempt status is just the beginning. To maintain this privileged position, organizations must comply with ongoing IRS regulations. Routine evaluations and updates to documentation must be scheduled regularly to demonstrate adherence and awareness of tax laws.

Record keeping is not only vital for compliance but can also facilitate the renewal processes as needed. Organizations should establish a comprehensive document management system that tracks modifications to operational activities or changes in membership, ensuring that all relevant documentation is at the organization's fingertips.

Case studies: Real-life experiences with form 1024

Examining real-life experiences with Form 1024 provides insight into potential challenges and successes. Many organizations have successfully obtained their tax-exempt status by following best practices, detailing their mission effectively, and responding thoroughly to IRS inquiries.

However, some organizations have faced reinstatement challenges due to incomplete applications or failure to comply with IRS mandates. Learning from both stories equips new applicants with the knowledge and strategies to effectively navigate the process.

Conclusion: Maximizing your tax-exempt application efforts

Successfully navigating the submission of IRS Form 1024 requires careful planning, thorough preparation, and proactive communication with the IRS. By leveraging the insights shared in this guide, organizations can improve their chances of approval and avoid common pitfalls.

pdfFiller stands ready to assist organizations throughout this process, offering comprehensive document solutions that enhance organization, simplify submissions, and streamline compliance efforts. By using these tools effectively, organizations can focus more on their missions rather than the administrative aspects of their tax-exempt application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete instructions for form 1024 online?

How do I edit instructions for form 1024 online?

How do I edit instructions for form 1024 straight from my smartphone?

What is instructions for form 1024?

Who is required to file instructions for form 1024?

How to fill out instructions for form 1024?

What is the purpose of instructions for form 1024?

What information must be reported on instructions for form 1024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.