Get the free Estate Tax Forms - RI Division of Taxation - RI.gov - tax ri

Get, Create, Make and Sign estate tax forms

How to edit estate tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate tax forms

How to fill out estate tax forms

Who needs estate tax forms?

Understanding Estate Tax Forms: A Comprehensive Guide

Understanding estate tax forms

Estate tax forms are crucial documents required for reporting and paying estate taxes to the federal government. These forms are used during the administration of a deceased person's estate, ensuring that all tax obligations are met before assets are distributed to heirs. Proper management of estate tax forms is essential in estate planning and can prevent future disputes among beneficiaries.

The importance of these forms lies not only in compliance but also in effective estate planning. When prepared meticulously, they help clarify the financial standing of the estate, ascertain tax liabilities, and facilitate the orderly transfer of assets. Understanding key terms like 'gross estate,' 'taxable estate,' and 'exemptions' is vital for anyone involved in estate management.

Types of estate tax forms

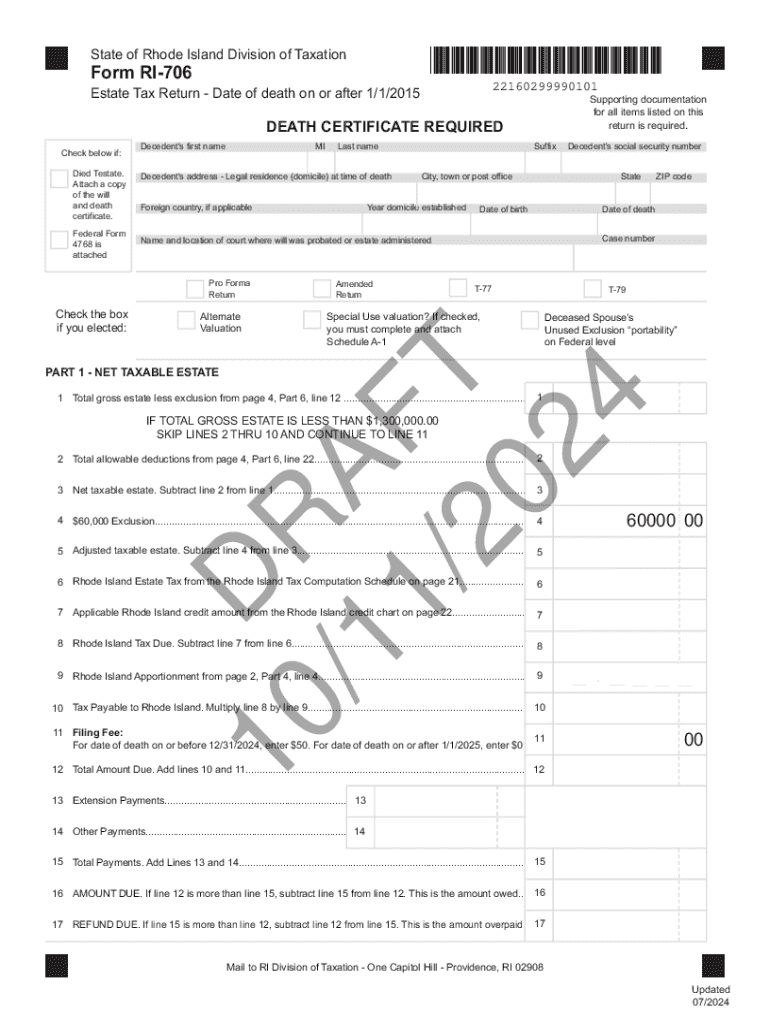

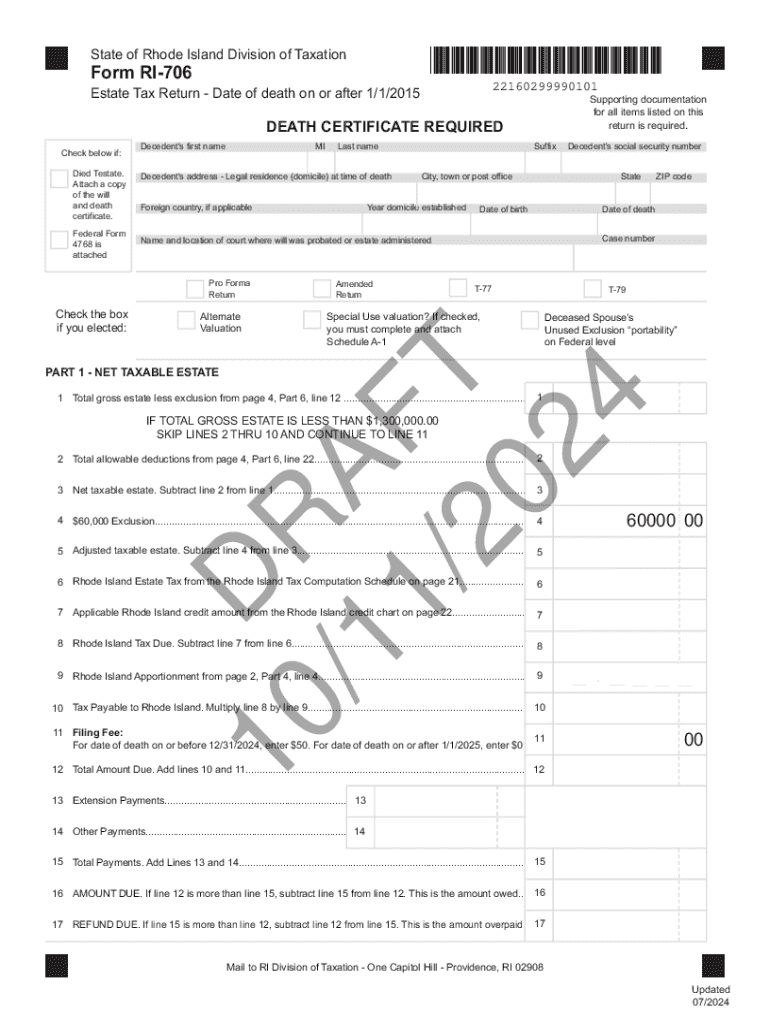

Estate tax forms are several, and each serves a unique purpose within the tax framework. Understanding the differences among them is essential for compliance. The most common forms include Form 706, Form 709, and Form 1041, each tailored to specific tax reporting requirements regarding estates and gifts.

Form 706 is used for reporting estate taxes, including any generation-skipping transfer taxes. It is vital for estates exceeding the exemption threshold, while Form 709 reports gift taxes for gifts exceeding the annual exclusion amount. Lastly, Form 1041 is utilized to report income generated by estates or trusts, which is necessary for filing income taxes on behalf of the estate.

Detailed insights on key forms

Understanding the key forms is essential for compliance and effective estate management. Let's dive deeper into each of these forms to clarify when and how to use them.

Form 706: What you need to know

Form 706 is primarily for estates with a gross value exceeding the federal exemption limit. In 2023, the limit stands at $12.92 million. If the gross estate surpasses this threshold, filing Form 706 is mandatory to determine the estate tax due. The form must be filed within nine months of the date of death, though an extension may be requested.

Common pitfalls include incorrect valuations of assets, failure to report all required information, and filing late. A step-by-step guide to completing Form 706 includes gathering necessary documentation, accurately valuating all estate assets, and filling out the form in accordance with IRS guidelines.

Form 709: Gift tax considerations

Form 709 addresses gift taxes applicable to individuals making significant financial gifts. If a gift exceeds the annual exclusion limit, which is set at $17,000 per recipient in 2023, Form 709 needs to be filed. This form also involves reporting any generation-skipping transfer taxes associated with gifts made to beneficiaries more than one generation below the giver.

Filing deadlines for Form 709 coincide with individual income tax returns, due on April 15, while an extension can be requested. Penalties may apply for negligence or late filing, emphasizing the importance of accurate and timely submission.

Form 1041: Income tax for estates and trusts

Form 1041 is required for estates and trusts that generate income during their administration. Estates that do earn income—such as rental income, dividends, or interest—must file Form 1041 to report this income along with any associated deductions. Understanding who needs to file Form 1041 can save potential tax issues down the line.

Income must be reported accurately to avoid penalties, and deductions available for estates include administrative expenses and certain distributions to beneficiaries. Completing Form 1041 typically involves a comprehensive understanding of estate income sources, applicable tax brackets, and specific deductions applicable during the tax year.

Interactive tools for managing estate tax forms

Utilizing tools for managing estate tax forms can significantly simplify the often intricate process of preparing and filing these documents. pdfFiller offers a robust platform for creating, editing, and signing estate tax forms securely from anywhere. The document creation and editing features enable users to tailor forms to meet individual estate needs while ensuring compliance with tax regulations.

eSigning documents allows for a quick turnaround that is essential given the often tight filing deadlines associated with estate taxes. Collaborating with financial and legal advisors becomes seamless through pdfFiller's sharing capabilities, ensuring that all stakeholders are aligned. Furthermore, managing and safely storing documents aids in maintaining compliance and organization.

Instructions for filling out estate tax forms

Filling out estate tax forms correctly requires a meticulous approach. General tips for all types of estate tax forms include ensuring that all information is accurate and complete, as missing or incorrect data can lead to delays or penalties. Accurate record-keeping is instrumental in providing the necessary documentation for each form.

Avoiding common errors such as discrepancies in asset valuations or incomplete information can save time and prevent complications with the IRS. Make a checklist of information required for each form, and double-check figures before submission to ensure compliance with tax regulations.

Frequently asked questions (FAQs) about estate tax forms

Navigating estate tax forms can lead to numerous questions. Here are some common queries individuals may have regarding estate tax forms in the context of managing their estates.

Utilizing pdfFiller for estate tax forms

pdfFiller is an invaluable resource for individuals managing estate tax forms. Its user-friendly platform offers templates specifically designed for federal and state estate tax forms, simplifying the completion process. Accessing templates through pdfFiller enables you to tailor forms to your specific situation, ensuring that all required information is collected accurately.

Enhancing the filing process is made easier with interactive guides and tools on pdfFiller, which are designed to assist users through each stage of filling out estate tax forms. This functionality alleviates stress and fosters confidence, allowing users to focus on their estate planning needs without the burden of complex paperwork.

Special considerations

Handling complexities in estate tax filings requires a nuanced understanding of tax regulations and the specifics surrounding your unique situation. If you are dealing with multiple estates or have combined estate considerations, the requirements might differ significantly, making it crucial to approach the process with diligence. Additionally, trusts with varying tax statuses can complicate the filing further.

In such cases, consulting a tax professional or estate lawyer can provide clarity and ensure that all aspects of the estate are managed effectively. They can also help in navigating the different tax obligations associated with estate and gift taxes, saving you from potential pitfalls.

Conclusion

Utilizing the proper estate tax forms is critical to manage the complexities of estate planning and tax obligations effectively. pdfFiller empowers users to handle these forms efficiently, transforming the daunting task of paperwork into a manageable process. By leveraging interactive tools and comprehensive templates, individuals can ensure they meet their estate's tax requirements with confidence.

Related topics to explore

Keeping up-to-date

Estate tax legislation can change frequently, impacting your obligations and available exemptions. Subscribing to updates regarding changes in estate tax laws ensures that you remain informed and compliant. Additionally, exploring new features on pdfFiller for estate tax documentation can streamline your filing process and enhance your overall experience with document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute estate tax forms online?

How do I edit estate tax forms in Chrome?

Can I sign the estate tax forms electronically in Chrome?

What is estate tax forms?

Who is required to file estate tax forms?

How to fill out estate tax forms?

What is the purpose of estate tax forms?

What information must be reported on estate tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.