Get the free Counting of Funds

Get, Create, Make and Sign counting of funds

How to edit counting of funds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out counting of funds

How to fill out counting of funds

Who needs counting of funds?

Counting of funds form: A comprehensive how-to guide

Understanding the need for a counting of funds form

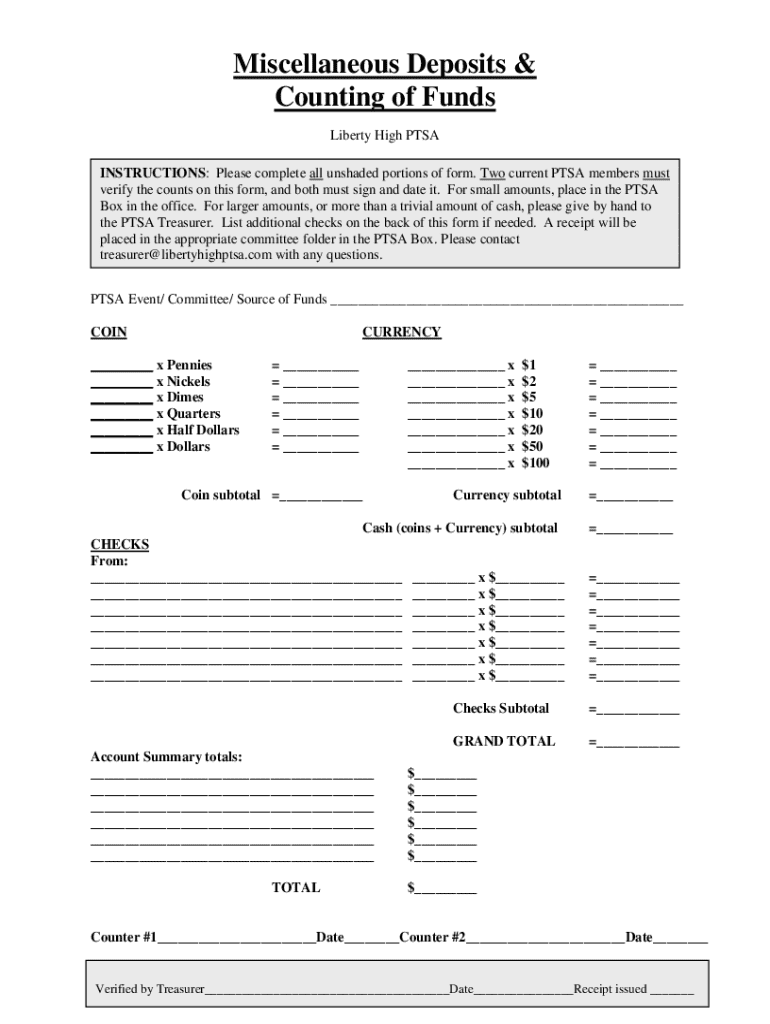

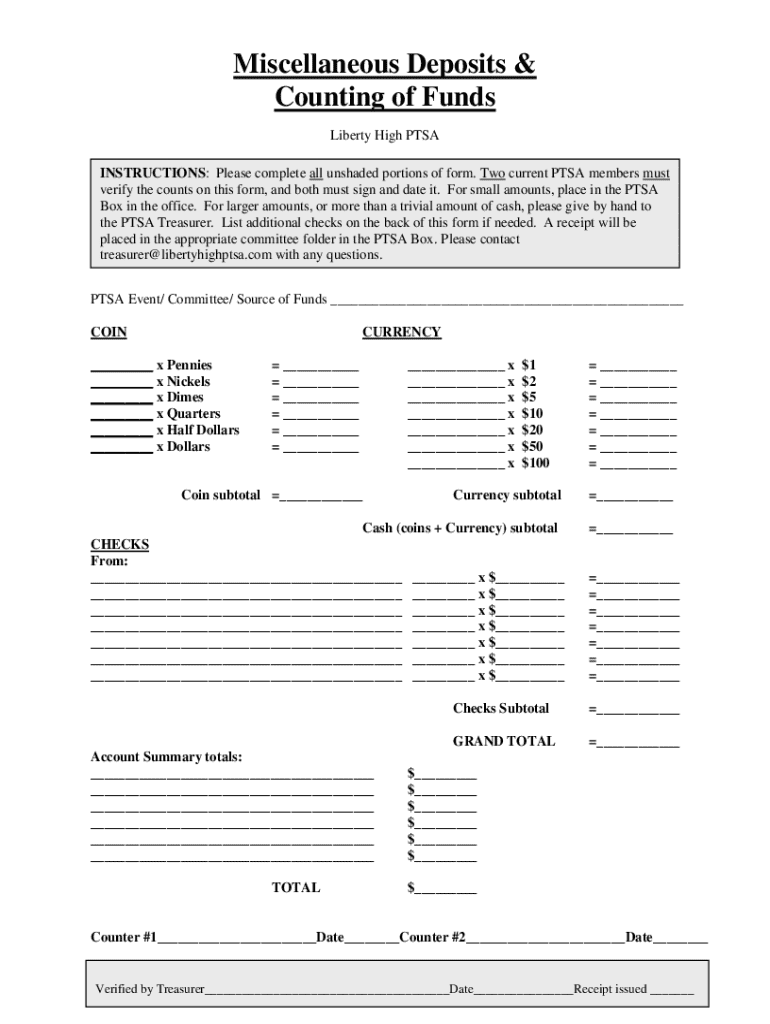

A counting of funds form is a critical document used primarily for accurately tracking cash and checks collected during various events or daily operations. It serves as an official record that helps organizations manage their finances transparently and efficiently.

The importance of accurately tracking funds cannot be overstated. For both individuals and organizations, maintaining financial integrity involves keeping precise records to avoid discrepancies and ensure accountability. This is especially vital in fundraising contexts, where donor trust hinges on financial transparency.

Key elements of a counting of funds form

A counting of funds form typically includes several essential sections that contribute to its overall effectiveness. Understanding these components is crucial for accurately documenting financial data.

The header should state the organization name and the date of the fund count. This establishes a clear context for the data recorded. The initial funds section displays the starting balance, allowing users to track changes precisely.

Optional sections might include donations, special notes about discrepancies, or additional comments to clarify irregularities in the count. Tools like pdfFiller offer customization options for users to create forms that meet their specific requirements.

Step-by-step instructions for filling out the counting of funds form

Preparing to fill out a counting of funds form requires specific materials. Ensure you have a calculator, a pen, and a secure place to count funds. It’s beneficial to gather all cash and checks in one area to streamline the process.

1. Start by entering your organization’s name and the date at the top of the form. This provides a clear context.

2. Document your initial funds accurately in the designated section, noting the starting balance.

3. When recording cash, utilize counting tools such as a cash counter to ensure accuracy. List the cash amounts carefully in the Cash Count Section and total them.

4. For check counts, format your list by including the check number, amount, and source, making it easier to cross-reference.

5. Calculate total funds by summing the cash and checks to confirm an accurate overall total.

6. Secure verification signatures from two individuals to strengthen accountability and trust in your financial reporting.

Interactive tools for managing your counting of funds form

pdfFiller provides seamless tools for editing your counting of funds form. You can upload your form, make needed edits, and save it in various formats—all in one user-friendly platform.

A feature in pdfFiller allows users to create templates for recurring events, facilitating future use across similar contexts, such as monthly fundraisers. This automation helps reduce time spent on document creation and ensures consistency.

Best practices for accurate fund counting

Common pitfalls when counting funds can lead to significant errors. It’s crucial to double-check your calculations by having another person independently verify the totals. This reduces mistakes and builds trust among team members.

Maintaining transparency with team members is essential for accountability. Ensure that everyone involved is aware of the process and any discrepancies observed. Clearly document any issues, as open communication fosters a culture of honesty.

Applications of the counting of funds form across different contexts

Fundraising events serve as a primary application for the counting of funds form. Nonprofits utilize these forms to document donations and provide transparency to donors, which is crucial for sustaining their support. Implementing proper procedures enhances credibility, leading to better fundraising outcomes.

In schools, these forms help organize and manage funds from events like bake sales or charity drives. Having a standardized approach makes tracking easier and encourages students and parents to engage in fundraising initiatives.

Small businesses benefit by using the counting of funds form for day-to-day cash flow management. It helps owners see fluctuations in income and identify trends that can influence financial decisions.

Case studies: Successful implementation of counting of funds forms

A nonprofit organization successfully implemented a counting of funds form during a recent fundraising gala. By ensuring accurate documentation, they built trust among attendees, leading to higher engagement and donations. The transparent nature of their financial reporting encouraged repeat support in subsequent years.

Similarly, a local school successfully utilized the form to improve transparency in managing school activity funds. By engaging students in the process and encouraging them to understand financial responsibilities, they fostered an environment of accountability and learning.

Across these case studies, the common theme is the positive impact of implementing an accurate counting of funds form to bolster trust and strengthen community relations.

Feedback and continuous improvement

Gathering feedback on the counting process is vital for refining techniques and forms. After each event, solicit input from team members to identify challenges faced and areas for improvement.

Incorporate user suggestions into future updates for the counting of funds form. A form that evolves based on real usage experiences can better serve its purpose and enhance user interaction.

Troubleshooting common issues with counting funds forms

When using a counting of funds form, users may encounter frequent errors such as miscalculations or discrepancies between recorded and actual totals. Establishing a routine for addressing these issues can minimize their impact.

To resolve discrepancies in total calculations, cross-verify figures with another person’s count to enhance accuracy. If persistent issues occur, consider consulting an accounting professional for guidance.

Support and warranty information for users of pdfFiller

pdfFiller provides a robust customer support framework for users utilizing the counting of funds form. With multiple support options, including FAQs, live chat, and email support, any challenges can be effectively addressed.

In addition to support, pdfFiller offers warranties and guarantees for its services, ensuring users feel confident in their document management solutions. Community resources further empower users by providing shared experiences and advice on best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my counting of funds directly from Gmail?

How can I send counting of funds to be eSigned by others?

Can I sign the counting of funds electronically in Chrome?

What is counting of funds?

Who is required to file counting of funds?

How to fill out counting of funds?

What is the purpose of counting of funds?

What information must be reported on counting of funds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.