Understanding the SEC Powers Submission Checklist Form

Understanding the SEC Powers Submission Checklist Form

The SEC Powers Submission Checklist Form is a critical resource for any entity involved in submitting documents to the U.S. Securities and Exchange Commission (SEC). This form is designed to outline the necessary steps and required information that ensure a compliant submission process. Its primary purpose is to facilitate and streamline the collection of data needed by the SEC during regulatory reviews.

Compliance is paramount when dealing with SEC submissions. The SEC mandates meticulous adherence to regulations to maintain the integrity of financial reporting and investor protection. The checklist helps alleviate the burden of compliance by clearly enumerating the required elements, reducing the likelihood of omissions or errors that could lead to delays or penalties.

By utilizing the SEC Powers Submission Checklist Form, users can follow a structured approach to preparing their submissions. This organization enhances efficiency, allowing individuals and teams to focus on critical aspects of their filings rather than becoming bogged down in potentially intricate details.

Key components of the SEC Powers Submission Checklist Form

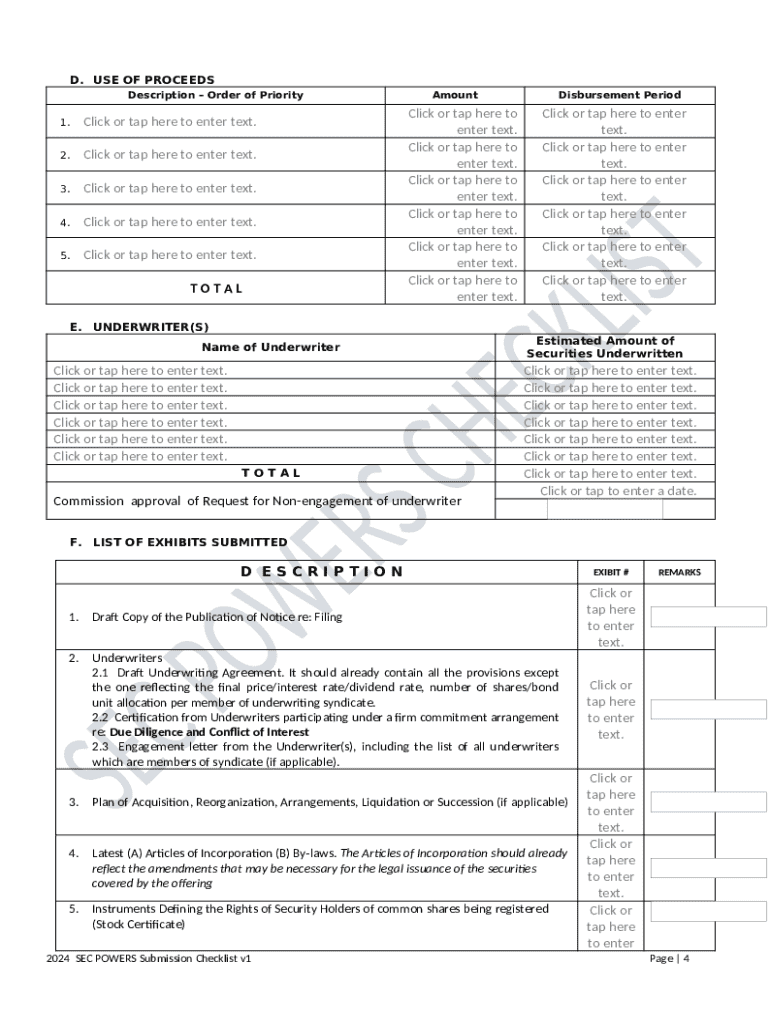

Understanding the components of the SEC Powers Submission Checklist Form is essential for a successful submission. The form typically encompasses various sections that collectively provide a comprehensive view of the submission requirements. Below is an overview of the required information and a breakdown of the different sections that need to be completed.

Personal Information Section: This section requires details about the individual submitting the form, including name, contact information, and any relevant identification numbers.

Business Information Section: Here, users must provide details about the entity involved, including its legal name, address, and business structure. This section often includes specific identifiers such as the CIK number.

Compliance Data Section: This section focuses on the necessary compliance documentation, encompassing regulatory filings, disclosures, and any specific compliance requirements stipulated by the SEC.

Step-by-step instructions for completing the SEC Powers Submission Checklist Form

Completing the SEC Powers Submission Checklist Form may seem daunting at first; however, following a structured approach can simplify the task immensely. Below are detailed instructions that guide you through each step.

Gather necessary documentation: Collect all required documents before starting to fill out the form. This includes identification, business registration documents, and compliance filings essential for your situation.

Filling out personal information: Carefully enter your details in the personal information section. Double-check for accuracy in spelling and formatting, as errors may affect the validity of your submission.

Providing business information: When filling out the business information section, ensure that all details match official documents. Common pitfalls include incorrect or outdated legal names and addresses.

Completing the compliance data section: This is where you detail your compliance-related documents and any specific regulatory requirements you must fulfill. Ensure all referenced documents are current and available.

Reviewing the completed form: Conduct a self-check against the checklist to verify completeness and accuracy. It may be helpful to have a colleague review the submission before finalizing it.

Tips for successful submission of the SEC Powers Submission Checklist Form

Successfully submitting the SEC Powers Submission Checklist Form involves more than just filling it out correctly; it requires adherence to best practices throughout the process. Here are five essential tips that can help ensure your submission goes smoothly.

Best practices for form submission: Always be precise and thorough when completing each section. Make use of available guidance or FAQs from the SEC.

Importance of meeting deadlines: SEC submissions often have specific due dates. Missing these deadlines can result in significant delays or rejections, so mark your calendar with important dates.

Utilizing PDF editing tools: Using tools like pdfFiller not only aids in filling out forms but also allows you to correct errors quickly and convert documents when necessary.

Keeping electronic copies: After submission, keep a digital copy of your completed form and any accompanying documents for your records. This can be vital for future reference.

Ask for help if needed: Don’t hesitate to reach out for assistance from colleagues or consult regulatory experts if you have specific questions about the form or content.

Managing and storing your SEC Powers Submission Checklist Form

Once the SEC Powers Submission Checklist Form is submitted, it's vital to manage and store it efficiently. Proper document management practices ensure that you can easily locate and reference documents as needed.

Best practices for document management: Implement a filing system that categorizes documents by type and submission date. This will help streamline future retrieval processes.

How pdfFiller enhances document storage: pdfFiller allows users to store their forms securely in the cloud and access them from anywhere, simplifying document management.

eSignature integration: Leverage pdfFiller's eSignature feature to streamline the approval and finalization processes, ensuring all necessary parties have signed off promptly.

Common questions and troubleshooting

Questions often arise when preparing the SEC Powers Submission Checklist Form. Addressing common queries can help mitigate confusion and streamline the submission process.

Frequently asked questions about SEC Powers submission: Review commonly asked questions on the SEC website or consult resources directly related to the checklist.

Troubleshooting common issues during submission: Be prepared for potential technical difficulties, and have a backup plan, such as trying a different browser or contacting SEC technical support.

Contacting support for assistance: If you run into issues not covered in FAQs, reach out to SEC support or your in-house compliance team for direct assistance.

Ensuring future compliance and updates

Once the SEC Powers Submission Checklist Form has been submitted, it is crucial to stay informed and proactive about compliance. Future submissions and regulatory changes require continuous attention.

Staying informed on SEC regulatory changes: Regularly check the SEC website for updates that may affect your future submissions, especially changes in compliance requirements.

Importance of regular document review: Periodically revisit your submitted forms and related documentation to ensure all information remains accurate and compliant with ongoing regulatory changes.

Setting reminders for upcoming submission dates: Use calendar tools or reminders to stay on top of deadlines for future SEC submissions to ensure compliance and accuracy.

Leveraging interactive tools for enhanced submission experience

Interactive tools can significantly enhance the process of completing and submitting the SEC Powers Submission Checklist Form. These tools not only offer practical benefits but also make the process more user-friendly.

Features of pdfFiller that improve form completion: With tools for easy editing, collaboration, and cloud access, pdfFiller ensures that users can complete forms quickly and efficiently.

Utilizing cloud-based collaboration for team submissions: pdfFiller allows multiple users to work on a document simultaneously, making team submissions more seamless.

How to access the SEC Powers Submission Checklist Form easily: You can easily find and access the form on platforms like pdfFiller, where it is readily available for immediate use.

Real-world examples and case studies

Learning from others’ experiences can provide valuable insights into the submission process. Analyzing successful SEC submission stories and compliance challenges faced can be educational.

Successful SEC submission stories: There are numerous case studies where organizations have adeptly navigated the submission process, often leading to positive regulatory outcomes.

Lessons learned from SEC compliance challenges: Review instances where submissions were rejected and identify common issues that led to these problems for better preparedness.

Conclusion: The impact of a reliable submission process

Utilizing the SEC Powers Submission Checklist Form effectively can have lasting benefits for individuals and businesses. A well-structured and consistent approach to submissions not only minimizes errors but also builds a foundation for regulatory compliance and operational efficiency.

By empowering yourself with the right tools like pdfFiller, you can enhance your document management strategies and ensure that your submissions are always on point. This reliable process ultimately leads to smoother interactions with regulatory bodies, paving the way for improved trust and transparency in your business dealings.