Get the free Corporate Acc.Opening Form

Get, Create, Make and Sign corporate accopening form

How to edit corporate accopening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate accopening form

How to fill out corporate accopening form

Who needs corporate accopening form?

Corporate account opening form: How-to guide long-read

Overview of corporate account opening forms

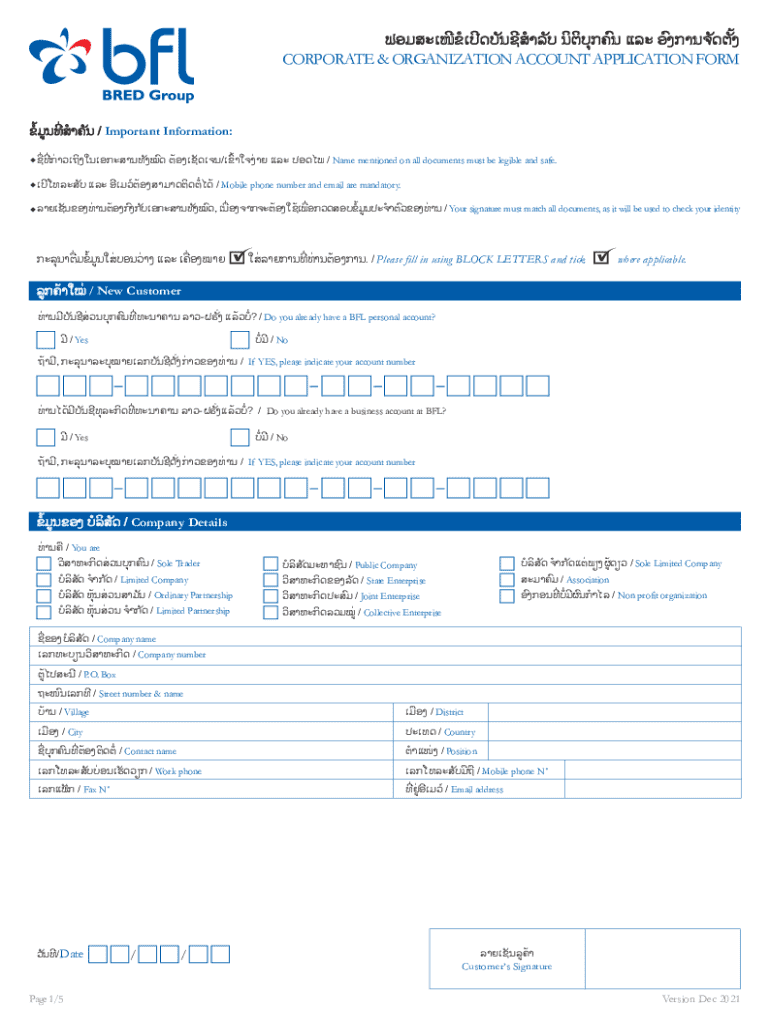

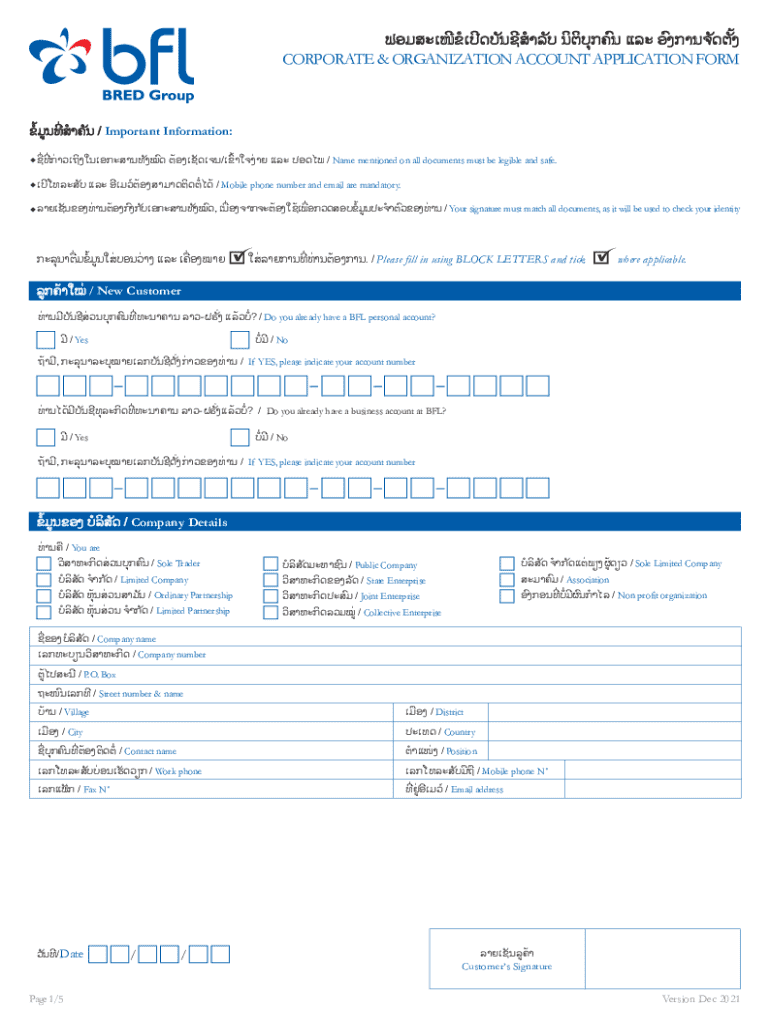

A corporate account opening form is an essential document for businesses seeking to establish bank accounts. Its primary purpose is to gather comprehensive information about the business entity, enabling banks to assess risk and compliance while ensuring proper record-keeping. The importance of this form cannot be overstated; it serves as a gateway for businesses to access vital financial services.

Key components of a corporate account opening form typically include the company’s details, identification for authorized signatories, and regulatory compliance information. Differences between corporate and personal account opening forms lie primarily in their complexity and requirements. While personal forms may only demand identification and basic personal information, corporate forms often necessitate extensive documentation to verify the legitimacy and compliance of the business operations.

Preparing to fill out the corporate account opening form

Before filling out the corporate account opening form, organizations should prepare by gathering required information and documentation. Essential details include company registration certificates, identification for authorized signatories, and any relevant business licenses or permits. Knowing what is needed in advance can streamline the completion process.

Understanding your corporate entity structure is crucial. Different structures, such as Limited Liability Companies (LLCs), corporations, or partnerships, have varying requirements. For instance, LLCs may need to provide operating agreements, whereas corporations typically need to present articles of incorporation. Educating yourself about your entity's requirements can prevent unnecessary delays in the submission process.

Step-by-step instructions for completing the corporate account opening form

Completing a corporate account opening form can be straightforward if approached systematically. Start with Section 1, which requires detailed business information. This includes the official company name, address, contact information, and a brief description of the nature of the business and its activities.

Section 2 focuses on authorized signatories. Organizations must declare who holds signing authority, which typically includes key management personnel. For each person named, details such as full name, position, and identification must be provided. In Section 3, businesses express their banking preferences, including the type of accounts desired (checking, savings, etc.) and details regarding the initial deposit.

Lastly, Section 4 addresses compliance and regulatory information. Here, required disclosures, such as Tax Identification Numbers (TIN) and ownership structure, need to be submitted. Additionally, banks may request details in adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, necessitating transparency about the business's financial activities.

Tips for a smooth submission process

To ensure a smooth submission process, it's vital to avoid common mistakes such as overlooking signature requirements, missing documentation, or providing incorrect information. Companies often benefit from using tools designed for editing and signing documents. For instance, pdfFiller offers functionalities that aid users in eliminating errors effectively.

Furthermore, thoroughly reviewing document details ensures all required sections are correctly filled out. Planning a checklist of needed information and confirming that all documentation is attached can expedite the processing time, helping your corporate account to be opened without hitches.

Utilizing pdfFiller's tools for corporate account form management

pdfFiller simplifies document management with its comprehensive tools tailored for corporate account forms. The platform allows easy document editing, enabling users to make quick changes and corrections seamlessly. Imagine not having to print, fill out by hand, and scan again; with pdfFiller, everything can be done online.

Collaboration is also enhanced through pdfFiller, where team members can access the same document concurrently, providing inputs and edits in real-time. When it comes to signing your corporate account opening form, the digital signature feature safeguards your documents and guarantees they are legally binding, streamlining the overall submission process.

Use cases: when you need a corporate account opening form

Several scenarios necessitate the completion of a corporate account opening form. Startups and new businesses seeking initial funding and banking services must fill out this form as part of their foundational steps. Additionally, existing businesses expanding operations often require new accounts to manage increased cash flow or new projects.

Transitioning from personal accounts to corporate accounts is another common use case. As businesses grow, maintaining a clear distinction between personal and business finances becomes essential to streamline budgeting, accounting, and tax purposes. Establishing a corporate account ensures compliance and fosters better financial management.

Exploring other related templates for business operations

Beyond corporate account opening forms, several other templates serve various business needs. For instance, a business account closing form is vital when dissolving accounts no longer in use. A corporate loan application form aids businesses seeking external funding to support their growth plans.

Other useful documents include corporate tax return forms and financial consultation registration forms that aid in fiscal compliance and advisory services. Budget approval forms help businesses manage their finances effectively. Access to such templates ensures all aspects of business operations are covered, reducing the risk of missed documentation.

Frequently asked questions (FAQs) about corporate account opening forms

When filling out a corporate account opening form, mistakes may happen. It's essential to know that most banks allow corrections by marking the changes and, if necessary, submitting a new form. Processing times for corporate account openings can range from a few days to several weeks, largely dependent on the bank’s internal requirements and the complexity of the submitted information.

Many businesses inquire about fees associated with opening a corporate account. While this varies by institution, it's common for banks to charge maintenance fees, minimum balance requirements, or transaction fees linked to corporate accounts. Understanding these potential fees before submission can prevent any surprises later.

Conclusion: empowering your business with the right tools

Successfully managing corporate account opening forms is pivotal for businesses seeking to establish their financial standing. Utilizing a cloud-based solution like pdfFiller enhances accessibility, promotes collaboration, and ensures better document management. This not only simplifies the account opening experience but also empowers organizations to remain organized and efficient in their operations.

Investing the time to understand and complete corporate account opening forms with the proper tools allows businesses to focus on growth, ultimately leading to enhanced financial opportunities and success. With pdfFiller at your side, navigating document management has never been easier.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my corporate accopening form in Gmail?

Can I create an electronic signature for signing my corporate accopening form in Gmail?

How do I edit corporate accopening form on an Android device?

What is corporate accopening form?

Who is required to file corporate accopening form?

How to fill out corporate accopening form?

What is the purpose of corporate accopening form?

What information must be reported on corporate accopening form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.