Get the free ConnecticutPersonal Income Tax

Get, Create, Make and Sign connecticutpersonal income tax

Editing connecticutpersonal income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out connecticutpersonal income tax

How to fill out connecticutpersonal income tax

Who needs connecticutpersonal income tax?

Connecticut Personal Income Tax Form - How-to Guide

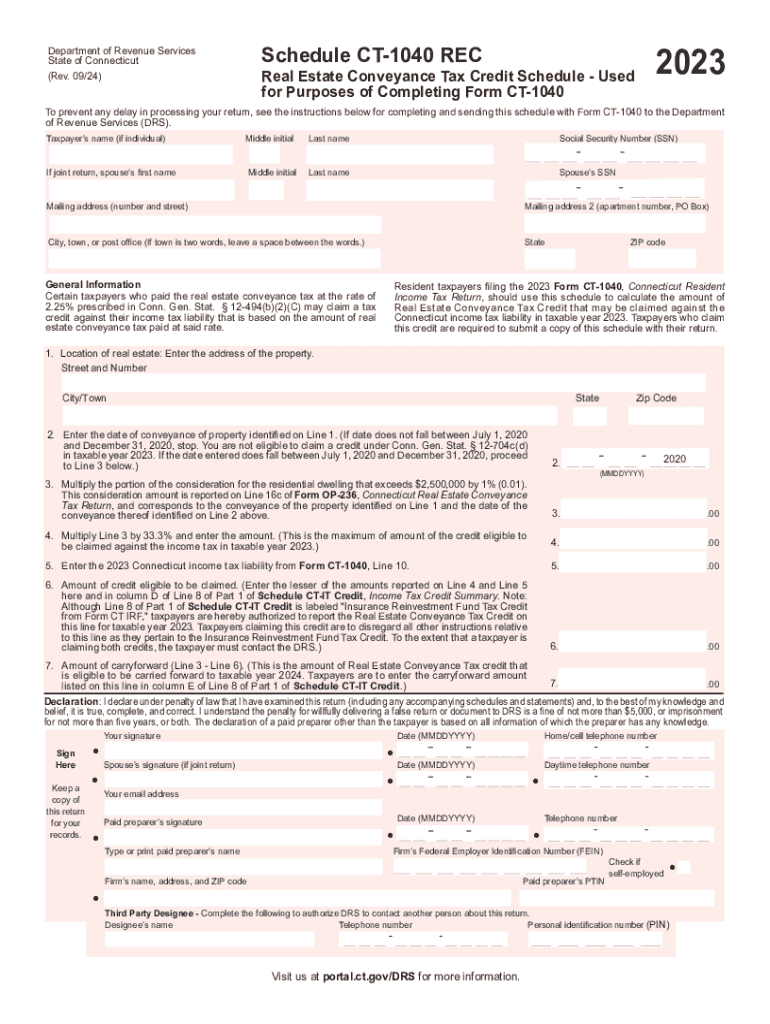

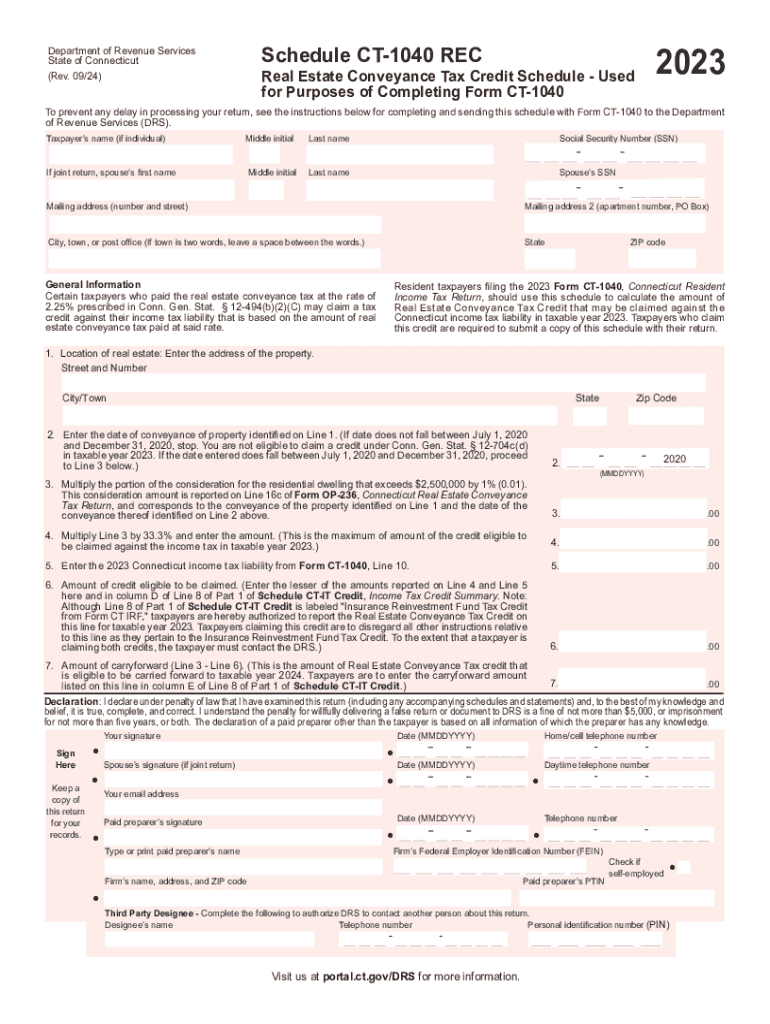

Overview of Connecticut personal income tax

The Connecticut personal income tax is a state-level tax imposed on the income of individuals, including wages, salaries, and other earnings. Its primary purpose is to fund various state programs, services, and infrastructure that benefit residents. Filing the correct form is crucial, as it ensures that your income is accurately reported and that you are in compliance with state tax laws.

Connecticut uses a progressive tax system with multiple tax brackets, meaning that the tax rate increases as income increases. For the current tax year, the rates range from 3% to 6.99%, depending on your income level. Understanding these rates and how they apply to your financial situation is vital for effective tax planning and compliance.

Types of Connecticut personal income tax forms

In Connecticut, different forms are used depending on your residency status and income circumstances. The primary form for filing individual income tax is the CT-1040, but it's essential to choose the appropriate form to avoid delays or errors.

Who needs to file a Connecticut state tax return?

Filing a Connecticut state tax return is required for individuals based on their residency status and income. Understanding these criteria is crucial to determine whether you need to file.

Determining your Connecticut state tax filing status

Your filing status in Connecticut influences how your tax is calculated. There are several statuses, and understanding them can help maximize your deductions and credits.

Detailed instructions for filing your Connecticut personal income tax

Filing your Connecticut personal income tax doesn’t have to be overwhelming. By following a step-by-step approach, you can easily navigate the process.

Special considerations in Connecticut tax filing

Certain scenarios may require additional attention when filing your Connecticut taxes. Knowing about these can alleviate potential issues.

Frequently asked questions about Connecticut personal income tax filing

Navigating tax filing can lead to many questions. Here are some of the most common inquiries that residents face regarding Connecticut income tax.

Common tax filing pitfalls to avoid

Being aware of common tax mistakes can save you stress and money during the filing process.

Support resources for Connecticut tax filers

Navigating tax documents can sometimes require additional support. Resources are available to help you through the process.

Understanding tax treaties and their impact on Connecticut income tax

Tax treaties can play a significant role for individuals earning income from foreign sources. Understanding their implications is essential for accurate tax reporting.

Tax treaties can provide exemptions or reductions in taxes due, and when applicable, treaty income must be reported correctly on Connecticut tax returns to remain compliant.

Filing taxes while residing in another state

Working or residing in multiple states can complicate tax filing obligations. Here’s what Connecticut residents need to know.

Tips for a stress-free tax filing experience

Preparation is key to making the tax filing experience smoother and less stressful. Here are some effective strategies.

Additional support for Connecticut tax filers

During tax season, additional support resources can provide the guidance you need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send connecticutpersonal income tax for eSignature?

How do I complete connecticutpersonal income tax online?

Can I sign the connecticutpersonal income tax electronically in Chrome?

What is connecticutpersonal income tax?

Who is required to file connecticutpersonal income tax?

How to fill out connecticutpersonal income tax?

What is the purpose of connecticutpersonal income tax?

What information must be reported on connecticutpersonal income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.