Get the free Michigan Sales Tax Exemption Certificate - Youngstown

Get, Create, Make and Sign michigan sales tax exemption

How to edit michigan sales tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out michigan sales tax exemption

How to fill out michigan sales tax exemption

Who needs michigan sales tax exemption?

Michigan Sales Tax Exemption Form: A Comprehensive How-to Guide

Understanding the Michigan sales tax exemption

Sales tax exemptions are provisions allowing certain entities or individuals to purchase goods and services without the burden of sales tax. In Michigan, sales tax exemptions can significantly benefit qualifying organizations by reducing overall operational costs. Products or services purchased under this exemption are exempt from the 6% sales tax imposed by the state.

The importance of sales tax exemptions in Michigan spans various sectors, including non-profit organizations, government entities, and certain businesses engaged in manufacturing and resale. Understanding these exemptions can lead to substantial savings and allow organizations to allocate financial resources more efficiently.

Eligible entities for sales tax exemption in Michigan include:

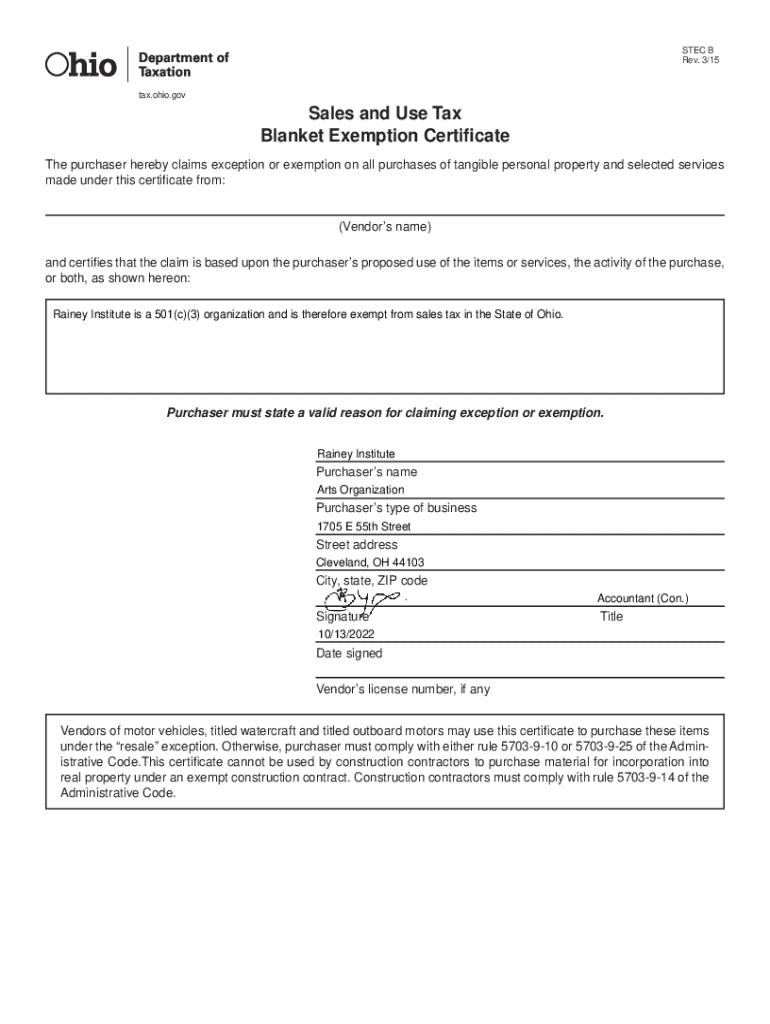

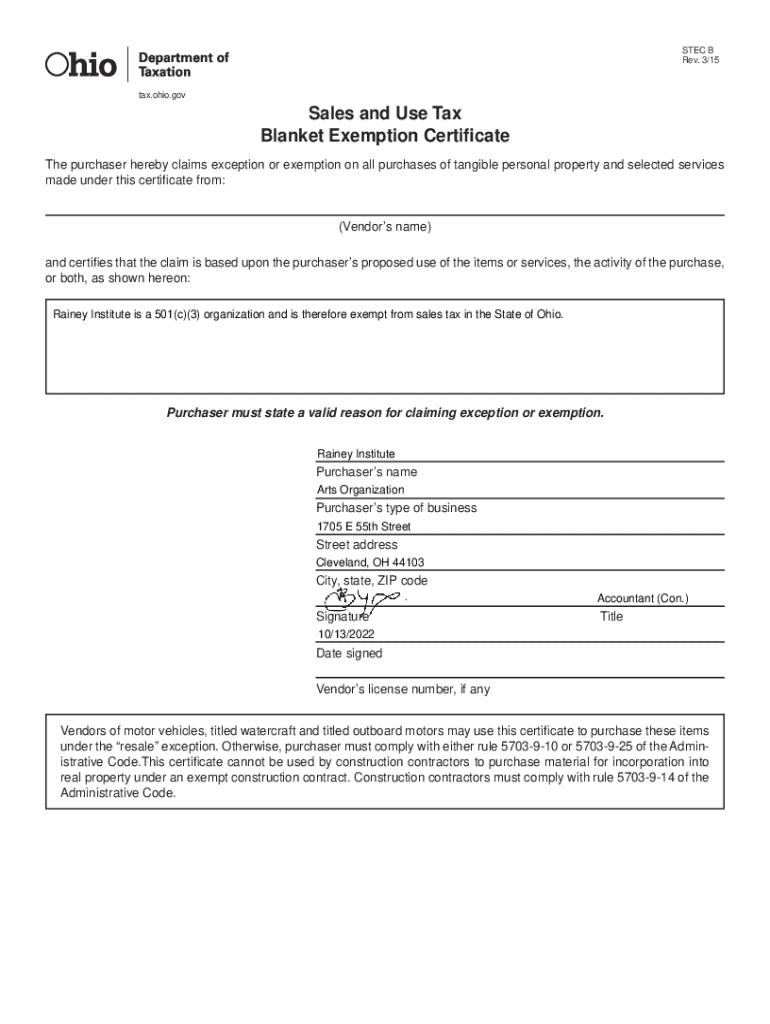

Overview of the Michigan sales tax exemption form

The Michigan sales tax exemption form is an official document used by qualified individuals and entities to claim their exemption from state sales tax when making purchases. This form provides both the buyer and seller a clear record of the tax-exempt status attributed to specific transactions.

The purpose of the form is crucial for maintaining compliance with state regulations while facilitating efficient transactions among qualifying buyers and sellers. Many businesses and organizations rely on this exemption to manage operating costs effectively, ensuring they can reinvest savings into community services or product improvements.

Types of purchases covered by the Michigan sales tax exemption form typically include:

How to obtain the Michigan sales tax exemption form

Obtaining the Michigan sales tax exemption form is a straightforward process, particularly with the availability of online resources. Users can easily access the form through pdfFiller, which features a user-friendly interface and tools tailored for form management.

Alternatively, individuals may choose to acquire the Michigan sales tax exemption form through traditional methods such as mailing or in-person requests at local tax offices. This option might be suitable for those who are unfamiliar with digital tools or prefer physical paperwork.

Key resources and links to consider when seeking the form include:

Step-by-step guide to filling out the Michigan sales tax exemption form

Completing the Michigan sales tax exemption form accurately is essential to prevent potential issues with tax authorities. The form consists of several key sections that require careful attention to detail.

Section 1 focuses on identifying information. You'll need to provide your name, address, and any related business information. This ensures that the exemption can be properly traced back to you as the claimant.

In Section 2, you must itemize the description of items purchased. Clearly listing each product or service will avoid confusion and provide clarity on what goods are being exempted.

Section 3 requires you to specify your reason for exemption. Familiarize yourself with common exemption categories to accurately complete this section, which may include manufacturing, resale, or educational purposes.

Lastly, in Section 4, you must certify that the information provided is true and complete. eSigning with pdfFiller simplifies this process with digital signatures that comply with legal standards.

Editing and customizing the Michigan sales tax exemption form

After obtaining the Michigan sales tax exemption form, you might need to edit or customize it. pdfFiller offers a range of document editing tools that facilitate quick adjustments without compromising clarity or accuracy.

Utilizing features like text insertion, highlight, and annotation can enhance the document. One might need to add additional information or specific notes that clarify exemptions further for the supplier's understanding.

Here are some tips for efficient use of pdfFiller’s features:

Submitting the Michigan sales tax exemption form

Once you have completed the Michigan sales tax exemption form, submission is the next step. Knowing how and where to submit it can influence how efficiently your claim is processed.

You can submit the form electronically via pdfFiller, streamlining the process and reducing the chance of lost documents. Alternatively, you can opt to print and physically mail it to the appropriate tax office or deliver it in person.

Common pitfalls to avoid during submission include:

Managing your sales tax exemption documentation

Keeping track of submitted exemption forms and managing related documents is crucial for compliance. pdfFiller provides tools for easy document tracking, letting you monitor the status of your exemption claims at any time.

Maintaining copies of all your forms is also essential. Best practices for record-keeping include:

Moreover, pdfFiller's collaborative features allow teams to engage, edit, and review together, which can streamline the process of managing exemption documentation.

Frequently asked questions about the Michigan sales tax exemption form

As you navigate the Michigan sales tax exemption form, you may encounter common questions regarding its usage and associated processes. One pressing concern might be what to do if your exemption request is denied.

If your request is denied, reviewing the reasons provided will help you respond appropriately. Understanding the renewal process for exemptions is also vital; many exemptions require periodic renewal to maintain their validity.

You may also need to modify the form later on. Process changes related to business structure or operations can necessitate amendments to your exemption form, and knowing how to do so ahead of time can prevent complications.

Resources and support

For further questions regarding the Michigan sales tax exemption form, accessing customer support can be invaluable. Many online platforms, like pdfFiller, offer dedicated customer service to assist users with form inquiries.

Interactive tools available on pdfFiller enable users to engage directly with support professionals while exploring document features, allowing for a comprehensive understanding of the form and its uses.

Additionally, tapping into government resources and trading partner links can provide up-to-date information and guidelines regarding sales tax exemptions.

Final thoughts on utilizing the Michigan sales tax exemption form

The process of filing for a Michigan sales tax exemption is not just about saving money; it’s also about maintaining compliance with state regulations. Accurately completing the form ensures that you leverage these tax benefits appropriately.

Utilizing pdfFiller's capabilities can significantly streamline your experience, empowering you to manage documents seamlessly. With its array of features focused on efficiency and ease, pdfFiller stands out as a robust solution for anyone handling the Michigan sales tax exemption form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit michigan sales tax exemption from Google Drive?

Can I create an eSignature for the michigan sales tax exemption in Gmail?

How do I fill out michigan sales tax exemption using my mobile device?

What is Michigan sales tax exemption?

Who is required to file Michigan sales tax exemption?

How to fill out Michigan sales tax exemption?

What is the purpose of Michigan sales tax exemption?

What information must be reported on Michigan sales tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.