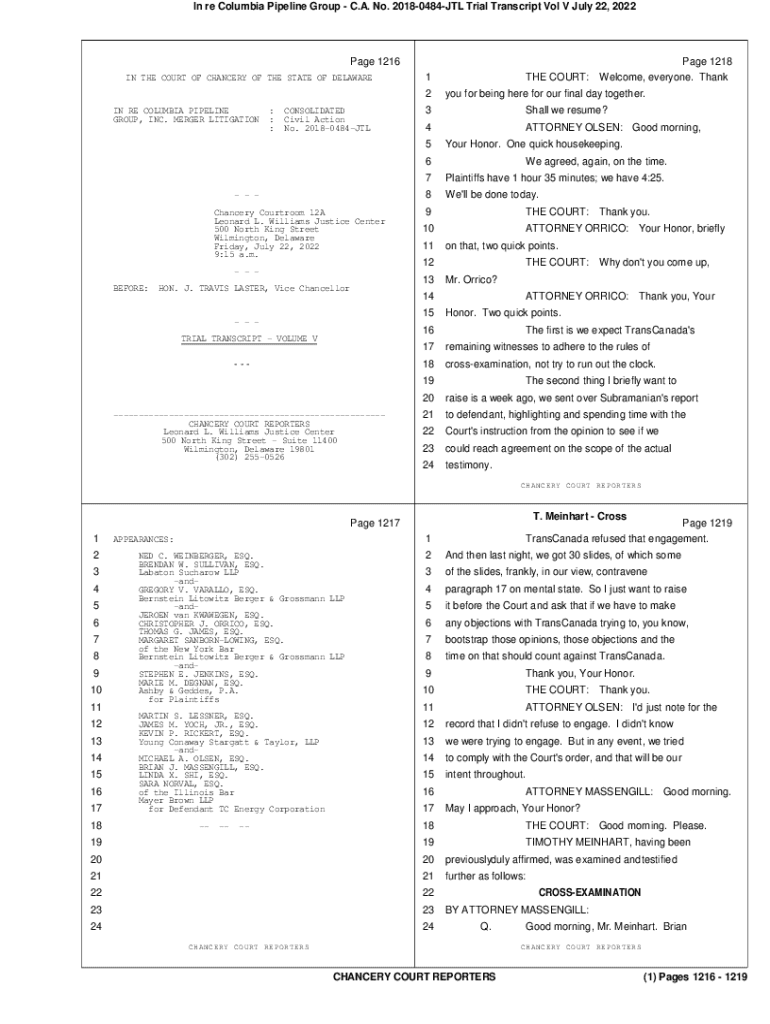

Get the free In re Appraisal of Columbia Pipeline Grp., Inc.

Get, Create, Make and Sign in re appraisal of

How to edit in re appraisal of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out in re appraisal of

How to fill out in re appraisal of

Who needs in re appraisal of?

In re appraisal of form: A comprehensive guide to effective document evaluation

Understanding the appraisal process

Appraisal in the context of documents refers to the systematic evaluation of forms and their components to ascertain their accuracy, completeness, and compliance with applicable standards. This process is crucial not only for maintaining the integrity of documents but also for ensuring that they serve their intended purpose effectively.

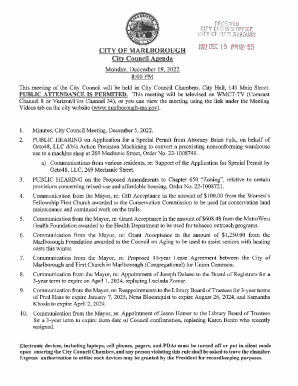

In every organization, the appraisal process is instrumental in asserting that documents such as contracts, financial reports, and application forms fulfill specific requirements. By doing so, organizations can mitigate risks associated with inaccuracies, enhance operational efficiency, and bolster stakeholder confidence.

Types of forms subject to appraisal

Documents come in various shapes and forms, and they can be categorized based on their purpose. Understanding these categories is vital for any team involved in document appraisal.

Key considerations in the appraisal process

Before launching into an appraisal, it’s essential to establish a set of considerations that will guide the review process. Compliance with legal standards is a non-negotiable aspect; failing to adhere can lead to legal repercussions that compromise the validity of a document.

Further, accuracy and completeness must be scrutinized. Document appraisers should perform meticulous checks to ensure every required detail is present. Lastly, ethical considerations surrounding integrity and transparency are vital to maintaining the credibility of the appraisal process.

Steps to conduct an in-depth appraisal

Engaging in an effective appraisal requires a structured approach. The following steps outline the process to ensure thorough evaluation.

Common mistakes to avoid

Navigating the appraisal process can be tricky, and there are common pitfalls that many encounter. One significant mistake is overlooking details that seem trivial but can greatly affect the document's integrity.

Moreover, ignoring updates or changes, especially in legal or regulatory standards, can render an appraisal outdated. Finally, inadequate collaboration within teams often leads to incomplete evaluations, risking the accuracy and authenticity of the document being appraised.

Tools and resources for effective appraisal

Effective appraisal can be significantly enhanced through the use of modern tools and resources. For instance, pdfFiller offers innovative solutions that streamline document management, allowing users to edit, eSign, and collaborate effortlessly.

In addition to pdfFiller, various software options are available that help in document creation and appraisal, ensuring that your team remains efficient and organized. Adopting best practices for leveraging technology can greatly improve the appraisal process.

Case studies: Real-life examples of appraisal

Exploring successful appraisal implementations can provide valuable insights into best practices. Organizations that have integrated systematic appraisal processes often witness remarkable improvements in their document efficiency and collaboration.

Conversely, analyzing lessons learned from appraisal failures can highlight the consequences of neglecting the appraisal process, reminding professionals of the criticality of thorough evaluations.

Impact of effective appraisal on overall document management

The benefits of effective appraisal go beyond compliance; they ripple through an organization’s operations, yielding substantial efficiency gains. By streamlining workflows, teams can focus on high-priority tasks, thereby enhancing productivity.

Additionally, proper appraisal contributes to risk mitigation. Organizations can significantly lessen potential legal and financial risks through rigorous document evaluations. Moreover, appraisal encourages enhanced collaboration among team members as clear communication regarding expectations and standards is established.

Engaging with pdfFiller's solutions

Utilizing pdfFiller for document appraisal unlocks a realm of opportunities. The platform’s unique features allow users to efficiently assess various forms while ensuring compliance and accuracy.

Additionally, pdfFiller provides an array of tutorials and interactive guides aimed at empowering users to maximize their document appraisal capabilities. Engaging with the community feedback can also unveil shared experiences and strategies for improvement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send in re appraisal of for eSignature?

How do I fill out in re appraisal of using my mobile device?

How do I edit in re appraisal of on an iOS device?

What is in re appraisal of?

Who is required to file in re appraisal of?

How to fill out in re appraisal of?

What is the purpose of in re appraisal of?

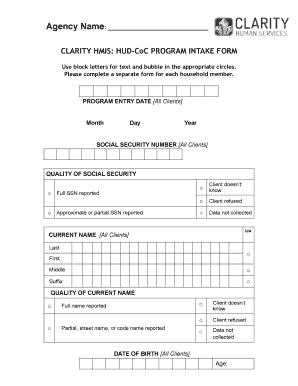

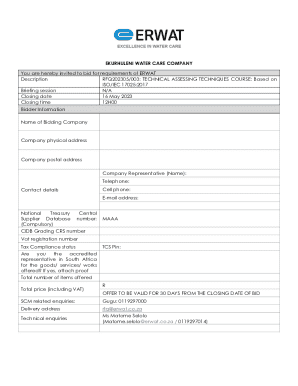

What information must be reported on in re appraisal of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.