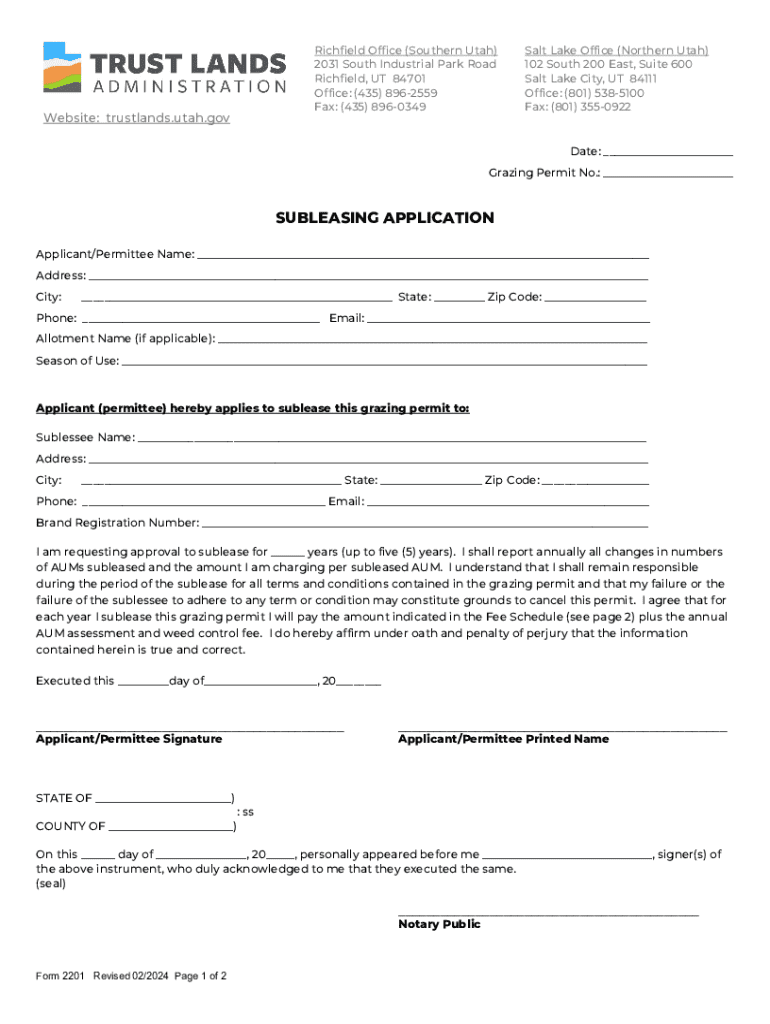

Get the free Contact - Utah Trust Lands Administration - trustlands utah

Get, Create, Make and Sign contact - utah trust

How to edit contact - utah trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contact - utah trust

How to fill out contact - utah trust

Who needs contact - utah trust?

Comprehensive Guide to Contacting About the Utah Trust Form

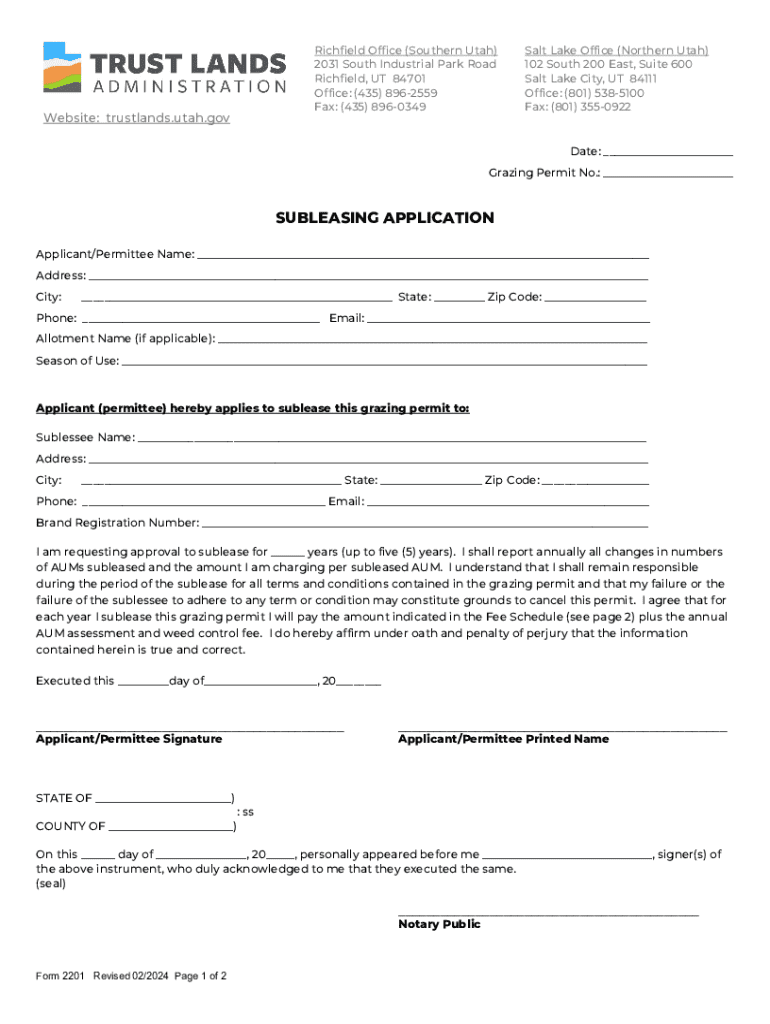

Overview of Utah trust forms

Trust forms are vital legal documents that allow individuals to manage their assets effectively while planning for the future. In Utah, these forms hold significant importance in estate planning, helping individuals specify how their assets will be distributed upon death. Trust forms can provide benefits such as avoiding probate, minimizing taxes, and ensuring the proper management of assets for minors or individuals with special needs.

Commonly used types of trust forms in Utah include:

In Utah, the formation of trusts must comply with specific legal requirements, including having a written document, identifying the grantor, beneficiaries, and trustee, and clearly stating the terms of the trust.

Navigating pdfFiller for Utah trust forms

pdfFiller is a versatile, cloud-based document management platform that simplifies the process of creating, editing, and managing trust forms. With its user-friendly interface, individuals can access their documents from any device, making it an ideal tool for those working on estate planning and other legal matters.

The benefits of using pdfFiller for managing Utah trust forms include:

Step-by-step guide to completing a Utah trust form

Completing a Utah trust form effectively requires selecting the appropriate document based on individual estate needs. pdfFiller offers intuitive form-filling tools that can help streamline this process.

Here’s a detailed walkthrough on completing a Utah trust form using pdfFiller:

To minimize errors, it’s essential to double-check all entries and confirm that all required fields are completed before submitting the form. Taking advantage of pdfFiller’s validation features can also help ensure accuracy.

Editing and customizing your trust form

pdfFiller shines with its extensive editing features, enabling users to customize their trust forms beyond just filling in the blanks. This level of flexibility allows for more personalized documents.

Here are some key editing functions you can utilize:

Signing your Utah trust form electronically

The legality of e-signatures in Utah is well-established, providing a straightforward way to sign important documents without needing to print them out. This process is simple and convenient with pdfFiller.

Follow these steps to e-sign your form using pdfFiller:

Managing and storing your trust documents in pdfFiller

Storing your trust documents securely is as important as creating them. pdfFiller offers comprehensive management options that keep your documents organized and accessible.

Here are several ways to manage your trust documents effectively:

Frequently asked questions about Utah trust forms

Individuals often have questions when it comes to creating and managing trust forms. Here are some frequently asked questions:

Contacting support for assistance with trust forms

Navigating the process of creating trusts can be complex. pdfFiller provides a robust support system to assist users in managing trust forms.

If you need help, consider the following options:

Additional considerations for creating trusts in Utah

Creating a trust can often involve intricate legal considerations. Individuals are encouraged to consult knowledgeable advisors to navigate specific complexities.

Moreover, it’s crucial to understand the implications of trust creation on taxes and overall estate planning. Consider engaging with professionals who can provide tailored advice based on your unique financial circumstances.

For those looking to expand their knowledge about trust management and law, various resources are available, including workshops, legal services, and educational materials online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the contact - utah trust electronically in Chrome?

How do I fill out contact - utah trust using my mobile device?

How do I complete contact - utah trust on an Android device?

What is contact - utah trust?

Who is required to file contact - utah trust?

How to fill out contact - utah trust?

What is the purpose of contact - utah trust?

What information must be reported on contact - utah trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.