Get the free Form PV: Massachusetts Income Tax Payment Voucher

Get, Create, Make and Sign form pv massachusetts income

Editing form pv massachusetts income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form pv massachusetts income

How to fill out form pv massachusetts income

Who needs form pv massachusetts income?

Understanding and Managing Form PV: Massachusetts Income Form

Understanding Form PV: What is it?

Form PV, or the Massachusetts Income Tax Payment Voucher, serves as an essential component in the tax filing process for individuals and businesses operating in Massachusetts. This form is utilized primarily to remit payments to the Massachusetts Department of Revenue (DOR) when taxpayers choose to file their taxes electronically or by mail. The main purpose of Form PV is to streamline the payment process and to ensure that income taxes owed are properly recorded. Filing this form accurately is crucial as it not only aids in the timely assessment of your tax dues but also mitigates the risk of penalties that arise from misinformation or late payments.

In summary, understanding Form PV is pivotal for all Massachusetts taxpayers wishing to comply with state tax regulations efficiently. Accurate filing means avoiding potential mistakes that can complicate your tax situation.

When and who should use Form PV?

Eligibility for using Form PV is structured around specific circumstances regarding income tax payments. Taxpayers should utilize Form PV if they owe tax payments and are making these payments separately from their tax return. Situations that necessitate the submission of this form include estimated tax payments, tax liabilities from business income, as well as fines and penalties prior to the tax return filing deadline. For individuals, filing Form PV is especially critical for those who fall under certain income brackets or have other specific tax obligations.

Key deadlines for filing Form PV coincide with Massachusetts’ income tax deadlines, typically falling on April 15th for most taxpayers. It's essential to remain aware of this timeline to avoid late fees and ensure compliance with state tax laws.

Step-by-step guide to filling out Form PV

Filling out Form PV correctly is vital for proper tax processing. The first step is to gather the necessary information, which includes personal details and financial data crucial for completing the form accurately.

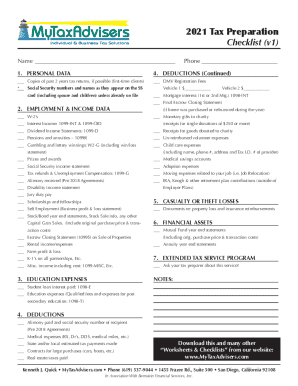

3.1 Gathering required information

Start by collecting your personal information, including your name, address, Social Security Number (SSN), and any relevant details that might affect your tax calculations. Additionally, gather financial information such as your total income, estimated tax liability, and any deductions or credits that you intend to claim. A checklist of supporting documents includes W-2s, 1099 forms, and previous year tax returns.

3.2 Detailed instructions for each section of Form PV

3.3 Common mistakes to avoid while completing Form PV

A few common pitfalls occur when tax filers misreport their personal information or make calculation errors regarding their payments or deductions. Double-checking your details and computations can save you from issues down the line, such as delayed processing or increased penalties.

Electronic payment options for Massachusetts income tax

When it comes to paying your Massachusetts income tax, electronic payment options offer convenient alternatives to traditional mail methods. Various ePayment methods include direct bank transfers, credit card payments, and payment through online tax services. Each option comes with its benefits and considerations.

To pay Massachusetts income tax electronically, you can visit the Massachusetts DOR website where you can choose your preferred method. While electronic payments are generally faster, enabling quicker processing of your tax payments, they may incur processing fees depending on the method selected.

Consequences of not using Form PV

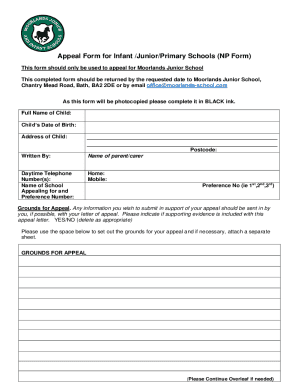

Failure to use Form PV can lead to several repercussions. Key among these is the potential for penalties imposed for late or missed payments, which can accumulate interest over time. Additionally, neglecting to submit the form can complicate your future tax filings, potentially leading to audits or further financial scrutiny.

If you realize that you have not submitted Form PV when required, it is advisable to address the situation promptly. You may be able to resolve the issue by preparing the form and submitting it as soon as possible to mitigate penalties.

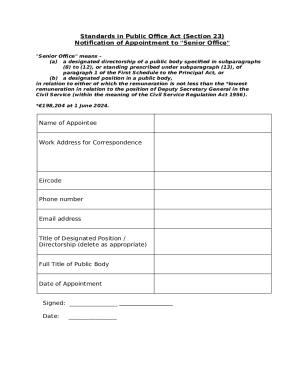

Accessing and managing your Form PV

To manage your Form PV efficiently, you can find both current and past versions of the form directly on the Massachusetts DOR website. For ease of use, pdfFiller allows you to edit and save your forms electronically, ensuring you maintain organized documentation over the years.

Collaboration features on pdfFiller further enhance the experience, allowing teams to share and modify documents seamlessly, ensuring that everyone involved is on the same page and minimizing the risk of errors.

Frequently asked questions about Form PV

Massachusetts tax information and resources

For Massachusetts taxpayers, numerous resources are available. The DOR website is packed with information regarding tax rates, filing guidelines, and a plethora of other related tax resources. Additionally, the site provides contact information for various state tax departments so you can get direct assistance when needed, be it through phone or email.

Tools such as tax calculators and online forms further aid in the document creation and management process, helping taxpayers prepare their filings in an organized manner.

Utilizing pdfFiller for seamless document management

pdfFiller stands out as a powerful platform for managing Form PV and other tax documents. The platform enhances the user experience through easy editing features, eSignature options, and collaborative tools allowing teams to work together efficiently on document preparation.

In a time when flexibility is key, pdfFiller offers secure cloud-based management, letting users access their documents from anywhere. The combination of accessibility, collaboration options, and rigorous security measures ensures that your important tax documents remain protected while being conveniently manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form pv massachusetts income in Gmail?

How can I fill out form pv massachusetts income on an iOS device?

How do I edit form pv massachusetts income on an Android device?

What is form pv massachusetts income?

Who is required to file form pv massachusetts income?

How to fill out form pv massachusetts income?

What is the purpose of form pv massachusetts income?

What information must be reported on form pv massachusetts income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.