Get the free CREDIT CARD ON FILE AGREEMENT - Advanced Dermatology

Get, Create, Make and Sign credit card on file

How to edit credit card on file online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card on file

How to fill out credit card on file

Who needs credit card on file?

Understanding the Credit Card on File Form: A Comprehensive Guide

Understanding the credit card on file form

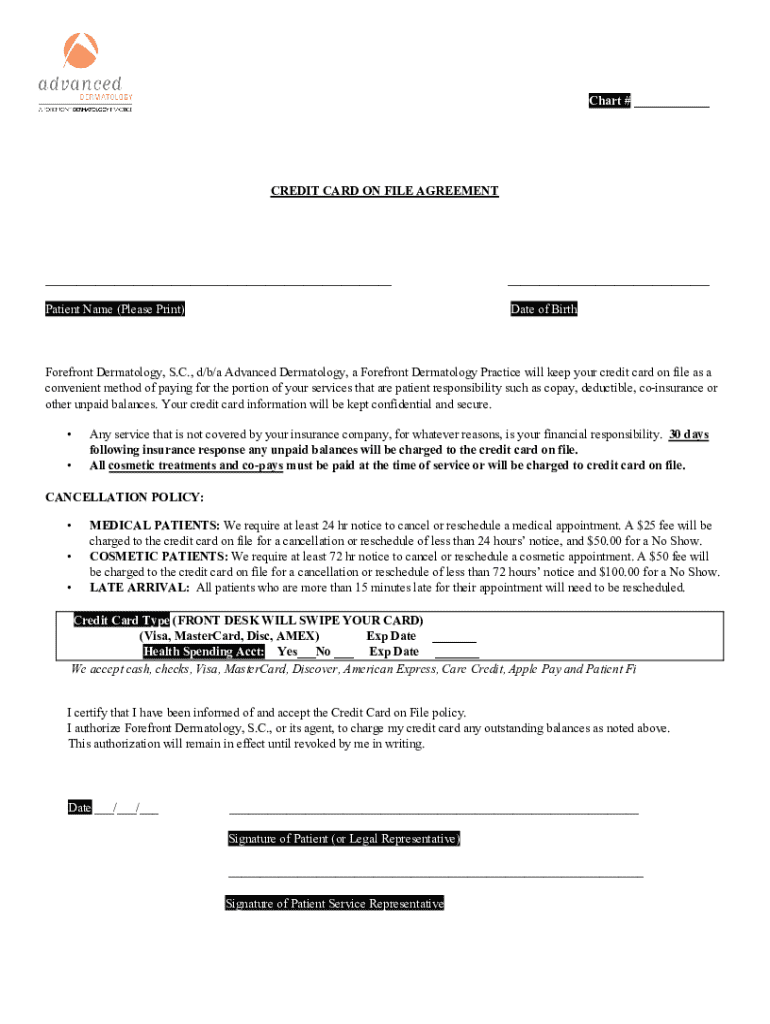

A credit card on file form is a document that stores customers' credit card details securely for future transactions. Typically used by businesses that require recurring payments, this form streamlines billing processes, making it more convenient for both the customer and the service provider.

The primary purpose of a credit card on file form is to simplify the payment process for regular transactions, such as memberships, subscriptions, or scheduled services. By having the customer's payment information readily available, businesses can reduce the friction involved in processing payments, ultimately enhancing customer satisfaction.

However, using such forms involves notable legal considerations. Businesses must comply with regulations regarding the secure storage of payment information, including guidelines set forth by the Payment Card Industry Data Security Standard (PCI DSS). Non-compliance can lead to significant fines and legal repercussions.

Importance of credit card on file forms for businesses

Credit card on file forms can significantly enhance operational efficiency. For businesses with recurring billing cycles, such forms eliminate the need for customers to re-enter payment details each billing cycle, streamlining the payment process. This improvement can dramatically reduce the time spent on billing issues and customer inquiries.

Moreover, having a credit card on file can foster customer retention. When payment is seamless, customers are less likely to experience disruptions in service. This convenience often leads to higher satisfaction rates, which is key to building long-term relationships. Maintaining these relationships is crucial in an increasingly competitive marketplace.

In terms of cash flow management, credit card on file forms provide businesses with predictable payment schedules. Recurring billing allows for better forecasting and financial planning, enabling businesses to allocate resources more effectively.

Key components of a credit card on file form

Creating a secure credit card on file form requires careful consideration of its components. Essential fields that must be included in the form are:

To enhance security, consider including optional fields, such as the CVV and an authorization clause. The CVV adds an extra layer of security by ensuring that the customer is in possession of the card during the transaction.

How to create a credit card on file form

Crafting a credit card on file form can be straightforward when utilizing pdfFiller. Follow these steps to design your custom form:

Best practices for filling out a credit card on file form

Customers should approach filling out a credit card on file form with care. Here are some best practices to ensure secure completion of the form:

These tips aim to protect customers from identity theft and unauthorized charges, ensuring that their data remains confidential.

Managing credit card information securely

Security is paramount when dealing with credit card information. Compliance with PCI DSS is not optional; it is a legal requirement for all businesses handling credit card transactions. This set of security standards ensures that businesses protect customer card data during processing and storage.

Data encryption should be employed to render card information unreadable to unauthorized parties. Furthermore, storage solutions must be adequately secure, including physical security measures for paper records and firewalls for digital data.

Regularly updating card information is also a best practice to mitigate risks associated with data breaches. Encourage customers to update their credit card details proactively to minimize potential disruptions.

Addressing common concerns and FAQs

Understanding the nuances of credit card on file forms can help mitigate concerns. Here are some frequently asked questions that provide clarity:

Alternatives to credit card on file forms

While credit card on file forms offer various advantages, alternatives also exist. Digital wallets, for example, are becoming increasingly popular for their convenience and security. These platforms allow users to store their payment information securely, often providing additional layers of authentication.

A comparison of security features reveals that digital wallets often employ tokenization and biometrics, enabling a level of security that can reduce fraud risks. In situations where businesses operate on a less frequent billing cycle, it may be unnecessary to keep credit card information on file, thus prompting the consideration of one-time payment solutions.

Case studies: Successful implementation of credit card on file forms

Many businesses have successfully implemented credit card on file forms to streamline their payment processes. For instance, a subscription-based service reported a 30% increase in customer retention rates after introducing the secure storage of payment information. This move reduced churn and fostered a more reliable revenue stream.

Another case highlights a healthcare provider that integrated credit card on file forms, which significantly decreased outstanding balances. By simplifying payment for routine visits, the practice not only improved cash flow but also increased patient satisfaction. These implementations underscore the importance of a carefully considered approach to customer payment management.

Interactive tools for managing credit card on file forms

pdfFiller offers several interactive tools that simplify the creation and management of credit card on file forms. Users can easily create, edit, and manage forms within a single cloud-based platform, minimizing workflow disruptions.

The platform also supports eSignature options, allowing for quick, effective authorization of the submitted forms. Furthermore, advanced analytics features can track form submissions and user engagement, providing businesses with valuable insights into their payment processes.

Conclusion on the future of payment processing

The landscape of payment processing continues to evolve, with emerging trends focusing on convenience, speed, and security. The future will likely see even more advanced systems for managing credit card information, including AI-driven analytics and enhanced encryption measures.

As digital forms and compliance regulations develop further, tools like pdfFiller will play a crucial role in helping businesses adapt. By offering seamless document management solutions, pdfFiller empowers organizations to streamline their operations, ensuring they remain competitive in a rapidly changing marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card on file without leaving Google Drive?

How can I get credit card on file?

Can I sign the credit card on file electronically in Chrome?

What is credit card on file?

Who is required to file credit card on file?

How to fill out credit card on file?

What is the purpose of credit card on file?

What information must be reported on credit card on file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.