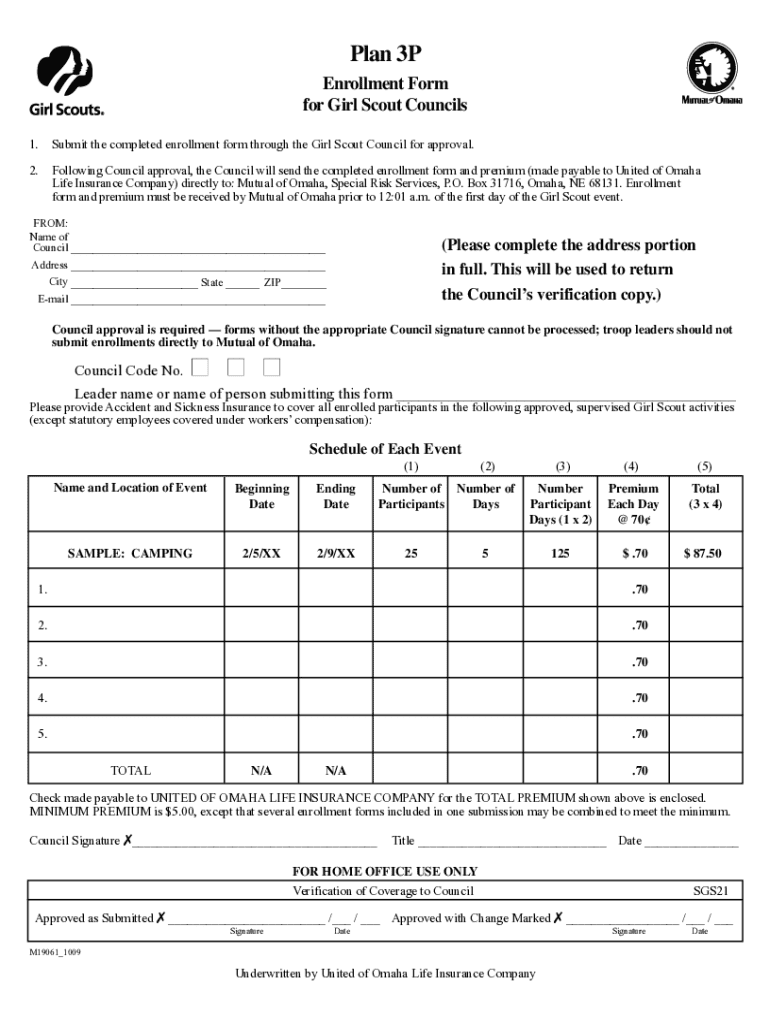

Get the free Mutual of Omaha Plan 3P. Submit this enrollment form for Mutual of Omaha Insurance

Get, Create, Make and Sign mutual of omaha plan

Editing mutual of omaha plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual of omaha plan

How to fill out mutual of omaha plan

Who needs mutual of omaha plan?

A comprehensive guide to the Mutual of Omaha plan form

Understanding the Mutual of Omaha plan form

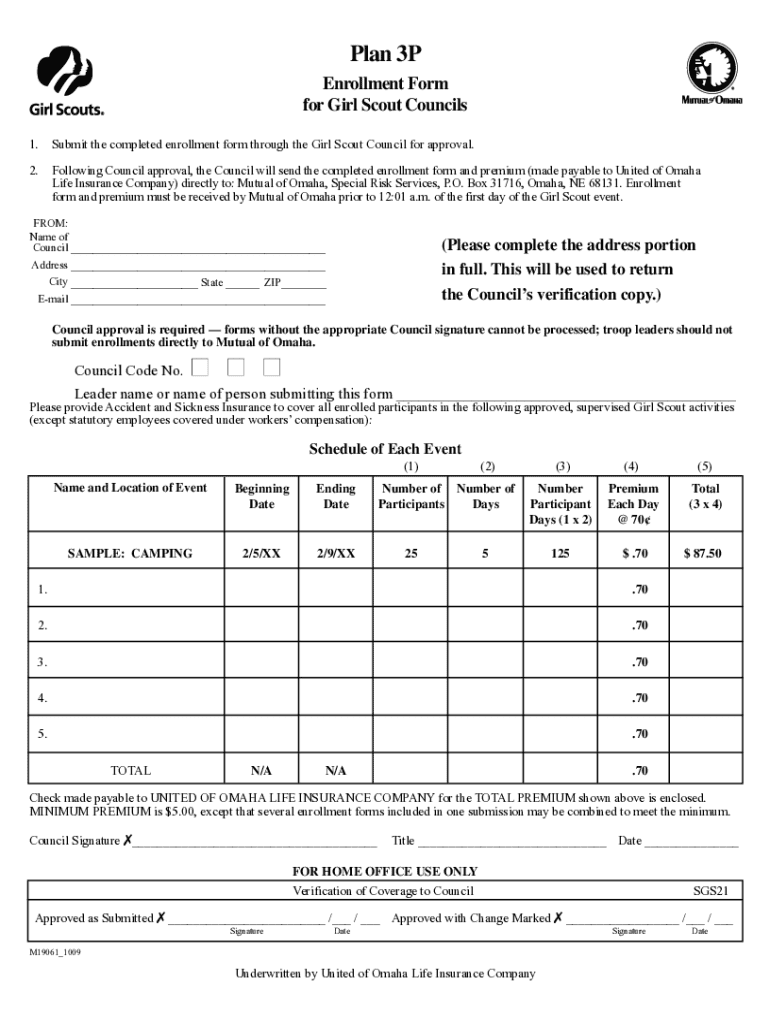

The Mutual of Omaha plan form serves as a crucial document in the insurance process, primarily aimed at gathering essential information from prospective policyholders. It plays a significant role in determining eligibility for various insurance plans, including health, life, and accident coverage. By dissecting this form's sections, you can prepare yourself to provide the necessary information accurately and efficiently, streamlining the application process.

Accuracy is paramount when filling out the Mutual of Omaha plan form, as even minor errors can lead to significant delays or miscommunication regarding your coverage. Furthermore, precise information helps in ensuring your plans meet your specific needs, avoiding the pitfalls of inadequate or incorrect coverage. Inaccuracies can also result in claims being denied, rendering your insurance ineffective when you need it the most.

Common scenarios necessitating the completion of the Mutual of Omaha plan form include applying for new health insurance plans, making adjustments to existing ones, or enrolling in Medicare supplements. Understanding when and why you need to use this form can save valuable time and protect you from potential missteps.

Preparing to fill out the Mutual of Omaha plan form

Before diving into the complexities of the Mutual of Omaha plan form, it's essential to gather all necessary information and documents. Typically, you will need your personal identification, Social Security number, medical history, and details of existing health plans. Providing a comprehensive set of accurate data will not only ease your workload but also ensure your submission reflects your current health status and insurance needs.

Familiarity with common insurance terminology found in the form can also save time and prevent misunderstandings. Terms like 'deductible,' 'premium,' and 'copayment' are integral to your plan selection and should be well understood before filling out the form. Additionally, recognizing the submission process is vital; knowing how to send your application and what to expect in terms of evaluation can contribute significantly to a smoother experience.

Step-by-step instructions for completing the form

The following sections break down the Mutual of Omaha plan form into manageable parts, offering detailed guidance on completing each segment.

Common errors include misreporting health information or failing to disclose relevant medical details that could affect your coverage application. Avoiding these mistakes is vital for ensuring that your insurance remains valid.

Editing and managing your Mutual of Omaha plan form

Once you've completed the Mutual of Omaha plan form, reviewing and editing your responses is essential. Utilizing tools like pdfFiller allows for easy modification of your form. Import your document into pdfFiller, where you can edit fields, add notes, and correct any errors seamlessly.

Furthermore, pdfFiller offers collaboration features that enable you to invite teammates or advisers to review the form before submission. This collaborative process ensures completeness and accuracy, giving you peace of mind that your application is ready for evaluation.

Signing and submitting the Mutual of Omaha plan form

With the form accurately completed and reviewed, the next step is to sign it. PdfFiller provides advance electronic signature options, allowing you to eSign the document securely. Depending on your preference, you can choose between drawing your signature or uploading a scanned signature image.

As for submission, Mutual of Omaha offers various channels, including online submission, email, or standard mail. Choosing the most convenient method for you can ensure your application is processed quickly.

Post-submission: what to expect

After submitting your Mutual of Omaha plan form, tracking the status of your application becomes vital. Keeping a record of your submission confirmation allows you to follow up effectively. Depending on the volume of applications, it may take some time for the institution to process your request, so patience is necessary.

Be prepared for requests for additional information as the underwriting process may reveal uncertainties or require clarification. Respond to these inquiries promptly to avoid unnecessary delays in your application.

Troubleshooting common issues

In the unfortunate event that your submission is denied or you experience processing delays, understanding the first steps to take can assist you in resolving the situation. Contacting Mutual of Omaha for clarification on the reasons for the rejection can provide insight into rectifying any mistakes or misunderstandings.

For further assistance, Mutual of Omaha offers customer support options, including phone support and online chat functionality. Being proactive and reaching out for help can often lead to a swift resolution to any issues concerning your plan form.

Additional tools and resources offered by pdfFiller

PdfFiller allows users to access documents from virtually anywhere through its mobile and cloud-based platform, enhancing the flexibility of handling your Mutual of Omaha plan form. You can edit, sign, and share documents quickly, allowing you to manage your insurance paperwork efficiently.

Additionally, pdfFiller integrates with other platforms, ensuring that your document management process is smooth and coherent. You can enjoy secure data management, knowing that sensitive information related to your health insurance documentation is encrypted and protected against unauthorized access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in mutual of omaha plan?

Can I edit mutual of omaha plan on an iOS device?

How do I edit mutual of omaha plan on an Android device?

What is mutual of omaha plan?

Who is required to file mutual of omaha plan?

How to fill out mutual of omaha plan?

What is the purpose of mutual of omaha plan?

What information must be reported on mutual of omaha plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.