Account Deposit 100 Connect Form: A How-to Guide

Overview of the account deposit process

Understanding the account deposit process is crucial for both new and existing customers seeking to streamline their banking experience. The Account Deposit 100 Connect Form provides a straightforward approach to depositing funds into your account, offering both convenience and efficiency. Direct deposit is particularly important, especially for individuals who receive regular payments, as it ensures funds are deposited securely and promptly without manual intervention.

Using a connect form for deposits offers several benefits, such as eliminating the need for physical checks, reducing the risk of lost deposits, and ensuring quicker access to funds. Additionally, banks often provide incentives for new deposits, such as a $100 bonus for first-time users, which is an attractive offer for new customers looking to establish their accounts.

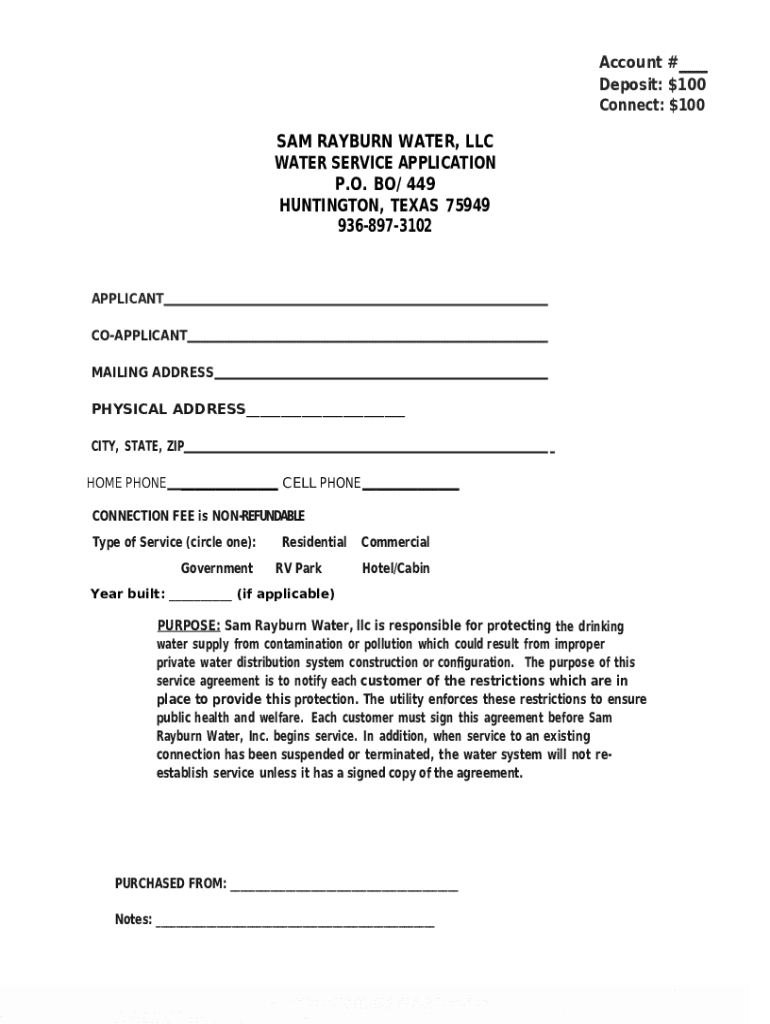

Eligibility for the $100 account deposit offer

Before filling out the Account Deposit 100 Connect Form, it’s essential to understand who qualifies for the $100 incentive. Typically, this bonus is available primarily to new customers who are opening an account for the first time. However, existing customers often have different promotional offers, so it's worth checking with your banking institution to clarify.

Some common misconceptions surround this offer. For instance, many potential applicants wonder if current customers are automatically excluded from receiving bonuses. The truth is, while the $100 incentive is designed for new account holders, various banks also provide limited-time promotions for existing customers. Transactions that count as qualifying deposits typically include direct deposits from payroll, government benefits, or other consistent income sources.

Preparing for the account deposit

Preparation is key when it comes to filling out the Account Deposit 100 Connect Form. Start by gathering all necessary information, especially your bank account details. You’ll need to provide precise account numbers and routing information to ensure smooth processing of your deposit. Furthermore, personal information such as your full name, address, and contact numbers is often required.

Timing is also important. Most banks provide an estimated timeframe for when you can expect to receive your bonus after submitting your form. Generally, it takes a few business days for the deposit to reflect in your account, though this can vary based on your financial institution's policies.

Step-by-step guide to completing the account deposit connect form

Filling out the Account Deposit 100 Connect Form may initially seem daunting, but following a step-by-step approach can simplify the process. Here is how to do it:

Accessing the connect form by navigating to the pdfFiller website and selecting the appropriate template for account deposits is the first step.

Fill in your personal information accurately, which includes your name, address, contact information, and, if required, your Social Security Number.

Input your bank account information including your account number and routing number. Double-check these details to prevent errors that could delay your deposit.

Indicate your deposit amount clearly, ensuring that you specify the $100 incentive intended for new deposits.

Add any required supporting documents, like a voided check or deposit slip, via pdfFiller's platform for a complete submission.

Finally, submit your form. You can choose between online submissions or mailing it in, based on your preference.

Managing your account after submission

Once your submission is complete, managing your account effectively becomes essential to ensure you receive your bonus and that your balance is accurate. You can easily check your account balance online or through your bank's app. Most financial institutions provide a way to track the status of your deposits, so utilize these features for updates.

Moreover, understanding regular account fees and potential bonuses can significantly enhance your banking experience. It's worth noting that many accounts have features like cashback rewards or interest accruals. Utilize pdfFiller not just for the deposit process but also for broader document management, keeping track of statements, and other important documents.

Frequently asked questions (FAQs)

Questions often arise during the process of filling out the Account Deposit 100 Connect Form, so having a solid understanding of common FAQs can ease any concerns.

What if I encounter issues while filling out the form? Reach out to pdfFiller customer support or check their help center for guidance.

How do I resolve errors or incorrect submissions? Review your submission carefully and contact customer support if you notice discrepancies.

Is the bonus taxable? It's advisable to consult a tax professional, as bonuses might be considered taxable income.

What if my deposit hasn’t appeared within the expected timeframe? Check the bank’s processing times and contact customer service if the issue persists.

Additional tips for smooth account management

Maintaining a well-managed account after setting it up is paramount. Setting up notifications for deposit alerts can help ensure you don’t miss any important transactions or bonuses. Additionally, adopting best practices for account security—like using strong passwords and two-factor authentication—can protect your finances.

Utilizing the tools offered by pdfFiller can further streamline your document management. The platform allows for easy editing, signing, and storing of documents, so keeping your financial information organized is simpler than ever.

Other account options to consider

While the Account Deposit 100 Connect Form is a great starting point, it's beneficial to explore additional account options that may suit your financial needs. Savings accounts, for example, often yield interest on deposits, providing an avenue for growing your funds over time. Conversely, checking accounts typically offer more accessibility for everyday transactions.

Also, take advantage of the various tools and services provided by pdfFiller. These can support account management, ensuring you have access to financial documentation and tools essential for efficient tracking.

Important notices and disclosures

It's vital to be aware of any legal considerations regarding account deposits and the promotions associated with them. Always read the account terms and conditions provided by pdfFiller, as they clearly outline any obligations or restrictions on the $100 incentive and other offers.

Familiarizing yourself with these terms will equip you with the knowledge needed to navigate your banking experience confidently.

Contact and support information

If you have further questions or encounter any issues, reaching out to pdfFiller’s customer support is an ideal approach for assistance. The help center on the pdfFiller website is also an invaluable resource, providing access to a wealth of information and troubleshooting tips tailored to the connect form and other features.