Get the free GIT-2 -IRA Withdrawals - NJ.gov

Get, Create, Make and Sign git-2 -ira withdrawals

How to edit git-2 -ira withdrawals online

Uncompromising security for your PDF editing and eSignature needs

How to fill out git-2 -ira withdrawals

How to fill out git-2 -ira withdrawals

Who needs git-2 -ira withdrawals?

A Comprehensive Guide to Git-2 IRA Withdrawals Form

Understanding the git-2 IRA withdrawals

Git-2 IRAs, or Individual Retirement Accounts, are designed to provide investors with tax-advantaged ways to save for retirement. The primary purpose of a git-2 IRA is to keep retirement funds growing tax-deferred until withdrawal. Understanding the specific features of git-2 IRAs is crucial for effective retirement planning.

Grasping the nuances of making withdrawals is an important step for anyone considering accessing these funds. Withdrawals can significantly impact overall retirement savings and financial stability.

Importance of understanding withdrawals

Understanding the processes and implications of withdrawals from a git-2 IRA is vital for maintaining long-term financial health. Withdrawals may be needed for various reasons, and each comes with specific implications.

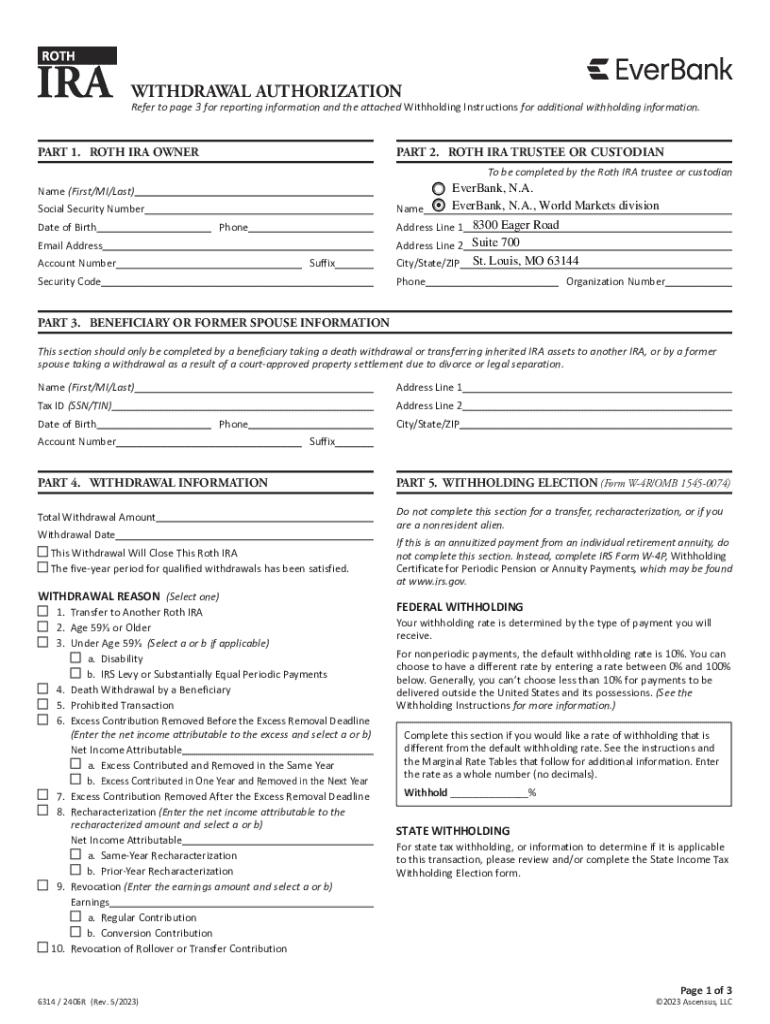

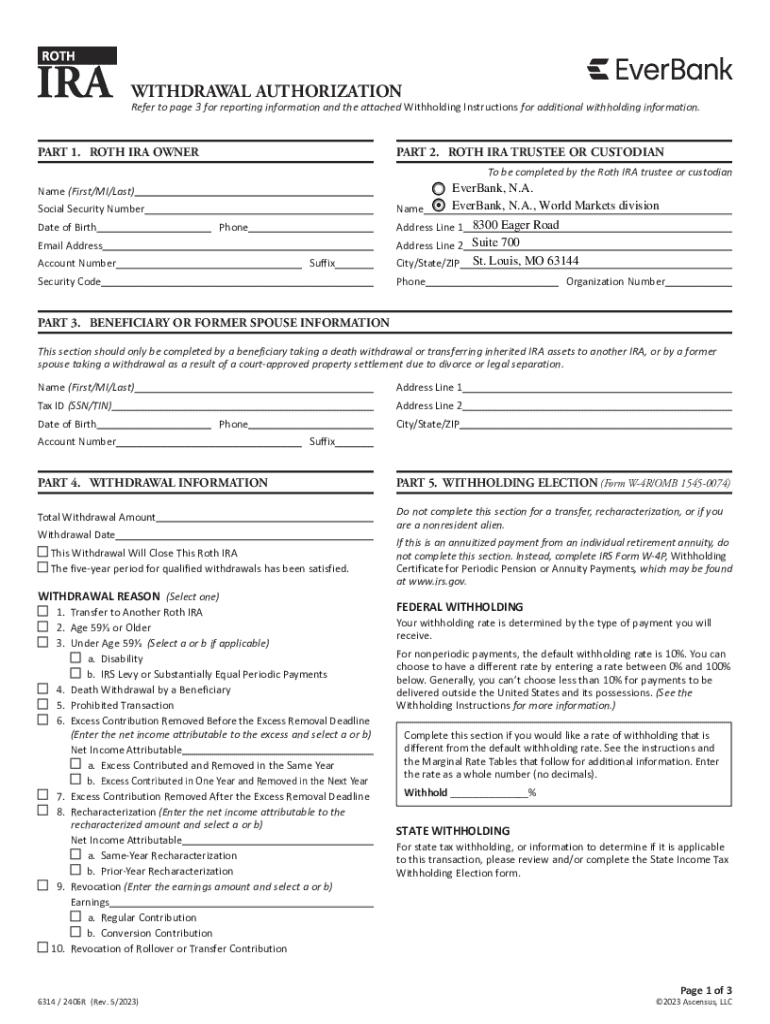

Preparing to fill out the git-2 IRA withdrawals form

Before completing the git-2 IRA withdrawals form, certain prerequisites must be in place to ensure that the process is smooth and successful. Gathering necessary documents and understanding common terms can significantly streamline this process.

Prerequisites for completing the form

Filing the git-2 IRA withdrawals form requires specific information and documentation that verifies your identity and justifies the withdrawal request.

Common terms defined

Familiarity with key terminology is essential before filling out the form. Understanding these terms helps in accurately completing each section of the form and knowing what types of withdrawals may entail penalties.

Step-by-step guide to completing the git-2 IRA withdrawals form

Filling out the git-2 IRA withdrawals form correctly is essential to avoid any delays or issues. This guide provides detailed steps to ensure that every section is accomplished appropriately.

Accessing the form

To begin, locate the git-2 IRA withdrawals form through pdfFiller. This user-friendly platform allows for instant access and editing capabilities that aid in managing your documents effectively.

Filling out the form section by section

Completing the form requires attention to detail in every section. Here’s a breakdown of what to include in each part of the git-2 IRA withdrawals form.

Tips for accuracy and completeness

To minimize errors, here are several tips to follow while completing the git-2 IRA withdrawals form. Being meticulous can save time and prevent unnecessary delays.

Options after form submission

Once you have submitted the git-2 IRA withdrawals form, it’s important to know what to expect and how to follow up on your request.

Tracking your withdrawal request

After submitting your form through pdfFiller, you can track your withdrawal request easily. Here’s how to do that effectively.

Potential outcomes after submission

Once the withdrawal form is processed, various outcomes may occur. Understanding these can prepare you for the next steps.

Understanding tax implications and penalties

Withdrawals from a git-2 IRA can have significant tax implications that vary based on age and withdrawal type. Understanding these obligations will help you plan better.

Taxes on withdrawals

Withdrawals from a git-2 IRA typically incur tax liabilities that must be addressed during tax filings.

Exceptions to penalties

Certain situations allow for penalty-free withdrawals despite being under the age threshold, which can be crucial for managing finances.

Additional scenarios for withdrawals

Other specific circumstances may also require you to withdraw funds from your git-2 IRA. Understanding these scenarios can help prepare you for unexpected financial needs.

Withdrawals for medical expenses

Medical emergencies can often be a reason for tapping into your git-2 IRA funds. It’s critical to understand the process and documentation required for these types of withdrawals.

Withdrawals due to financial hardship

Sometimes financial hardships necessitate withdrawals from your IRA. Understanding eligibility criteria is vital for ensuring compliance and minimizing penalties.

Strategies for managing withdrawals over time

Planning your withdrawals strategically can enhance your overall retirement strategy. Here are a few best practices.

Common issues and solutions

While completing and submitting the git-2 IRA withdrawals form, certain common problems may arise. Addressing these can streamline your process.

Troubleshooting common problems

Issues can occur from technical difficulties to incomplete submissions. Here’s how to handle common challenges.

Contacting support for assistance

If issues persist, reaching out to customer support can provide clarity and guidance. Prepare specific information for an efficient conversation.

Resources for further information

Accessing additional resources can heighten your understanding of the git-2 IRA, improving your overall management strategy.

Links to additional documentation

The IRS provides comprehensive guidelines on IRAs, including withdrawal rules and tax implications. Navigating their website can give you specific insights.

Using pdfFiller for document management

pdfFiller offers robust tools for not only managing the git-2 IRA withdrawals form but also any other documentation you may need. With features for editing and e-signing, pdfFiller empowers users to manage their documents seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send git-2 -ira withdrawals for eSignature?

How do I make edits in git-2 -ira withdrawals without leaving Chrome?

Can I create an eSignature for the git-2 -ira withdrawals in Gmail?

What is git-2 -ira withdrawals?

Who is required to file git-2 -ira withdrawals?

How to fill out git-2 -ira withdrawals?

What is the purpose of git-2 -ira withdrawals?

What information must be reported on git-2 -ira withdrawals?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.