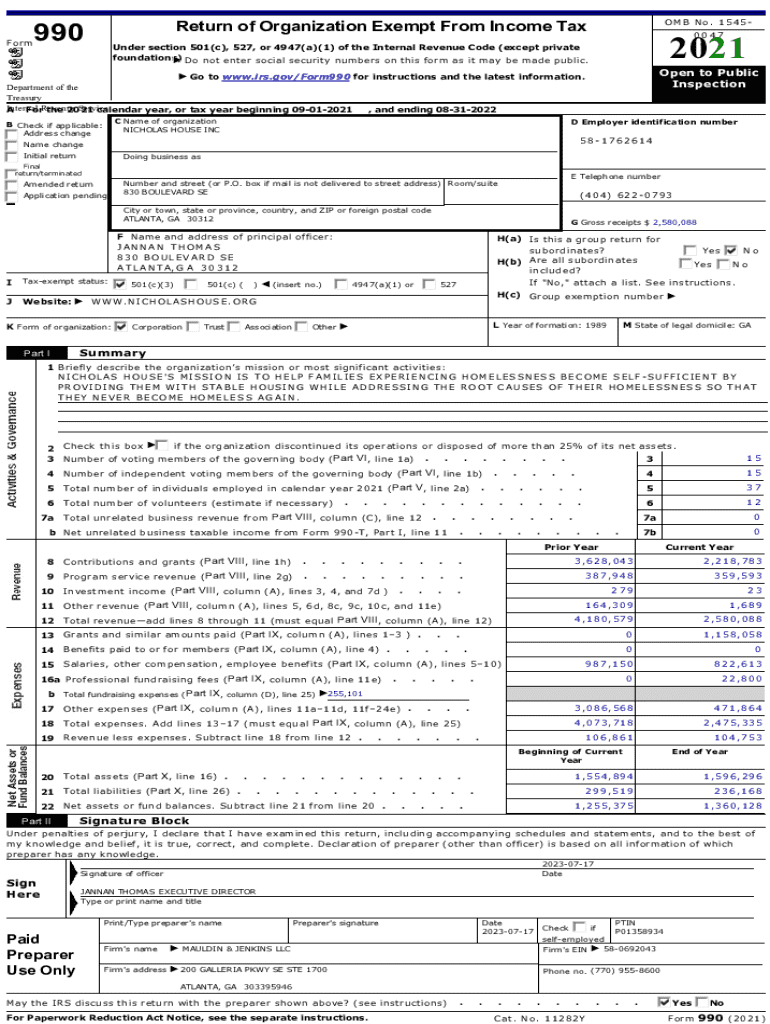

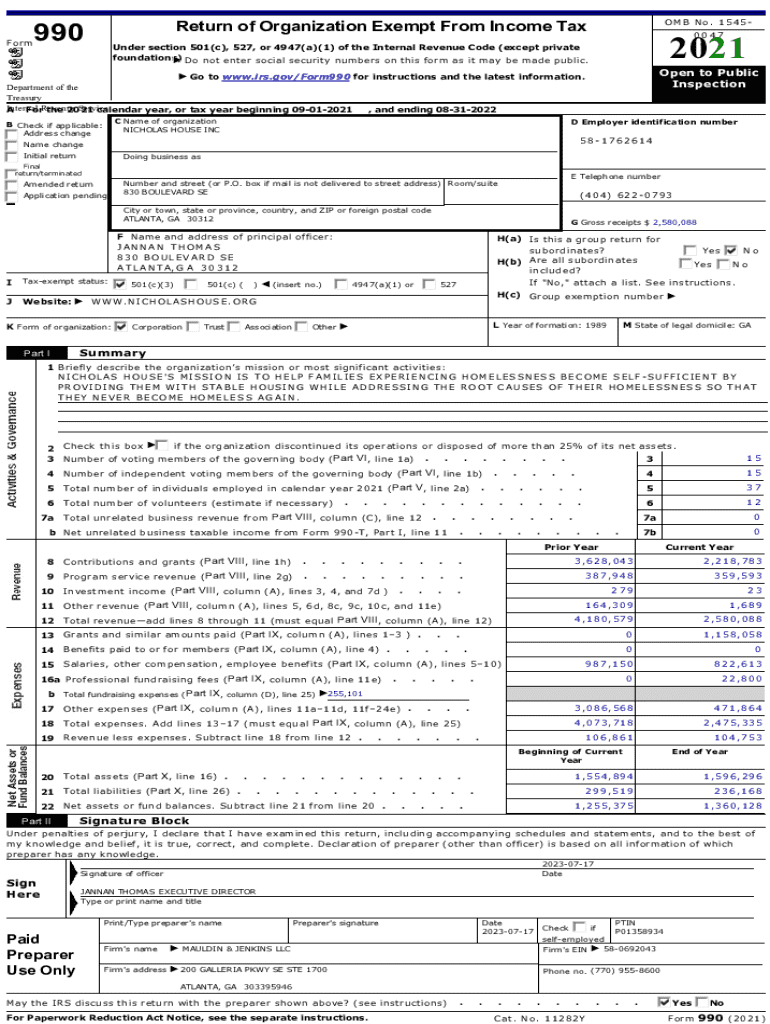

Get the free calendar year, or tax year beginning 09012021

Get, Create, Make and Sign calendar year or tax

How to edit calendar year or tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calendar year or tax

How to fill out calendar year or tax

Who needs calendar year or tax?

Understanding Calendar Year vs. Tax Form

Overview of calendar year and tax forms

The 'calendar year' is a fundamental time frame in financial planning that runs from January 1 to December 31. Understanding this concept is vital for anyone managing personal finances or business operations, as it dictates how income and expenses are reported for taxation purposes. Tax forms, on the other hand, serve as essential documents individuals and businesses use to report their financial activities to the government. They play a pivotal role in the tax filing process, influencing tax calculations, liabilities, and refunds. Recognizing how calendar years intersect with tax form requirements can lead to improved financial management and enhanced compliance.

Calendar year explained

A calendar year is defined as the period from January 1 to December 31. This timeframe is universally recognized and forms the basis for various financial activities, including tax calculations. For many individuals and businesses, aligning finances with the calendar year simplifies tracking income and expenses, which are critical for accurate tax reporting and strategic financial planning.

Adherence to a calendar year can provide several advantages. For instance, it allows for a straightforward comparison of yearly financial performance, aiding in personal and business budgeting. Most small to medium-sized businesses prefer this structure as it aligns with personal tax filings and employees’ schedules, particularly in the U.S. A calendar year is often advantageous in sectors such as retail, which experience predictable sales cycles that align with the broader calendar.

Insights on tax forms

Tax forms encompass a wide variety of documents that serve distinct purposes within the tax filing process. The most common types include individual forms like the 1040 for tax returns, W-2 forms that report wages, and 1099 forms for freelance income. Corporations utilize forms like the 1120 to report corporate income and expenses. Understanding the different contexts in which these forms are used is crucial as each form has unique requirements and deadlines.

Accuracy when filing tax forms is imperative, as any discrepancies can result in penalties or delayed refunds. Familiarity with key tax dates, such as the annual filing deadline, helps mitigate risks and ensures adherence to governmental regulations. Moreover, incorrect filings can lead to audits or even criminal charges in severe cases, underscoring the necessity of precise and timely submissions.

Calendar year vs. fiscal year

A fiscal year differs from a calendar year in that it does not necessarily start on January 1st and may last for 12 months, ending on any day of the year. For example, a common fiscal year runs from July 1 to June 30. Businesses often choose a fiscal year to align with their unique business cycles, which can vary widely depending on industry or market conditions.

Choosing a fiscal year can be particularly advantageous for businesses with seasonal operations. For example, a retail business may benefit from a fiscal year that ends after the holiday season, allowing it to report the peak sales period in its financials accurately. However, it is essential for businesses to consider how changing their fiscal period may affect tax form obligations. Transitioning from a calendar year to a fiscal year may necessitate different reporting forms and can complicate tax filings if not managed carefully.

Interactive tools for managing calendar year tax forms

pdfFiller offers robust document management capabilities, providing a seamless experience for users preparing tax forms. With tools dedicated to creating, editing, and eSigning documents, pdfFiller simplifies the often-complicated process of tax preparation. The platform allows users to access their tax documents from anywhere, easing collaboration between team members to ensure accuracy in filings.

For those concerned about document security, pdfFiller features secure storage and management of sensitive tax documents. Leveraging efficient eSigning capabilities further circumvents the need for physical paperwork, making the tax process faster and more efficient. Embracing digital tools like pdfFiller can prove invaluable, particularly during the hectic tax-filing season.

Common misconceptions about calendar years and tax forms

Misunderstandings about tax filing deadlines and the implications of filing in different years are frequent. One of the biggest myths is that late filings incur a flat penalty, whereas penalties can vary based on how late the forms are submitted and unpaid taxes. Many assume that filing ignores previous years' earnings, which can lead to inaccuracies and complications when applying deductions.

Another prevalent misconception is that changing to a fiscal year eliminates tax responsibilities for prior periods. This is not the case; businesses must account for all earnings reported in their active tax forms, which could lead to complexities in matters like rollover losses or asset depreciation. Understanding these nuances is essential to avoid pitfalls during tax preparation.

Case studies: real-life examples

Individuals who consistently track their income and related expenses throughout the calendar year often find themselves better prepared during tax season. For instance, a freelance graphic designer who organizes their invoices and receipts monthly streamlines tax preparation, arguably maximizing their deductions and minimizing their tax burdens. Conversely, a late filer who waits until the last minute often misses opportunities for deductions simply due to a lack of documentation.

Looking at businesses, a seasonal retailer that transitioned from a calendar year to a fiscal year ending in February was able to report its post-holiday sales and expenses in a single tax period, thereby improving clarity in its financial statements. This shift prompted more strategic financial planning and helped the business secure an investment, demonstrating how aligning financial reporting with operational cycles can promote growth.

Future trends and considerations

As finance, technology, and compliance landscapes evolve, so do tax regulations, which are increasingly influenced by the digital economy. This means taxpayers must remain adaptable and informed regarding upcoming legislative changes that could affect their financial reporting practices. Keeping abreast of tax reform discussions can help in timely compliance and in leveraging any potential benefits that arise from new regulations.

Best practices for preparing for future tax years include adopting methodical documentation habits throughout the calendar year, regularly reviewing financial statements, and exploring digital tools that enhance efficiency. Emphasizing the integration of resources like pdfFiller can also facilitate easier transitions between tax forms and reduce stress during filing seasons. Adapting to changing regulations while ensuring accuracy in tax submissions remains a key strategy for both individuals and businesses alike.

Conclusion: the importance of clarity and preparation

In summary, understanding the implications of a calendar year in taxation is crucial for effective financial management. Staying informed about the various types of tax forms and their specific requirements empowers individuals and businesses to navigate the tax landscape with confidence. pdfFiller emerges as a powerful ally in this journey, simplifying the process of document creation and collaboration.

By leveraging the tools available through pdfFiller, users can enhance their strategies for optimal tax management, reduce filing stress, and promote proactive planning. Ultimately, staying educated about both calendar years and tax forms will lead to better outcomes in both personal and professional financial endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in calendar year or tax?

How do I make edits in calendar year or tax without leaving Chrome?

Can I edit calendar year or tax on an iOS device?

What is calendar year or tax?

Who is required to file calendar year or tax?

How to fill out calendar year or tax?

What is the purpose of calendar year or tax?

What information must be reported on calendar year or tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.