Get the free Certificate of Foreign Status of Beneficial Owner. Certificate of Foreign Status of ...

Get, Create, Make and Sign certificate of foreign status

Editing certificate of foreign status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of foreign status

How to fill out certificate of foreign status

Who needs certificate of foreign status?

Comprehensive Guide to the Certificate of Foreign Status Form

Understanding the certificate of foreign status form

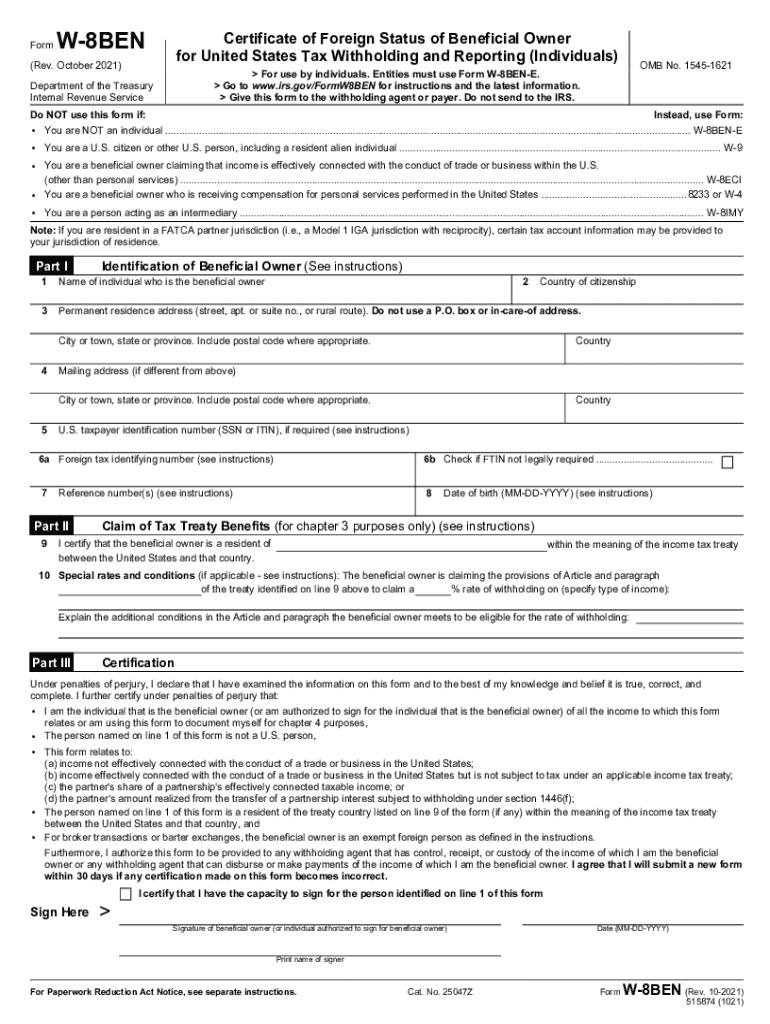

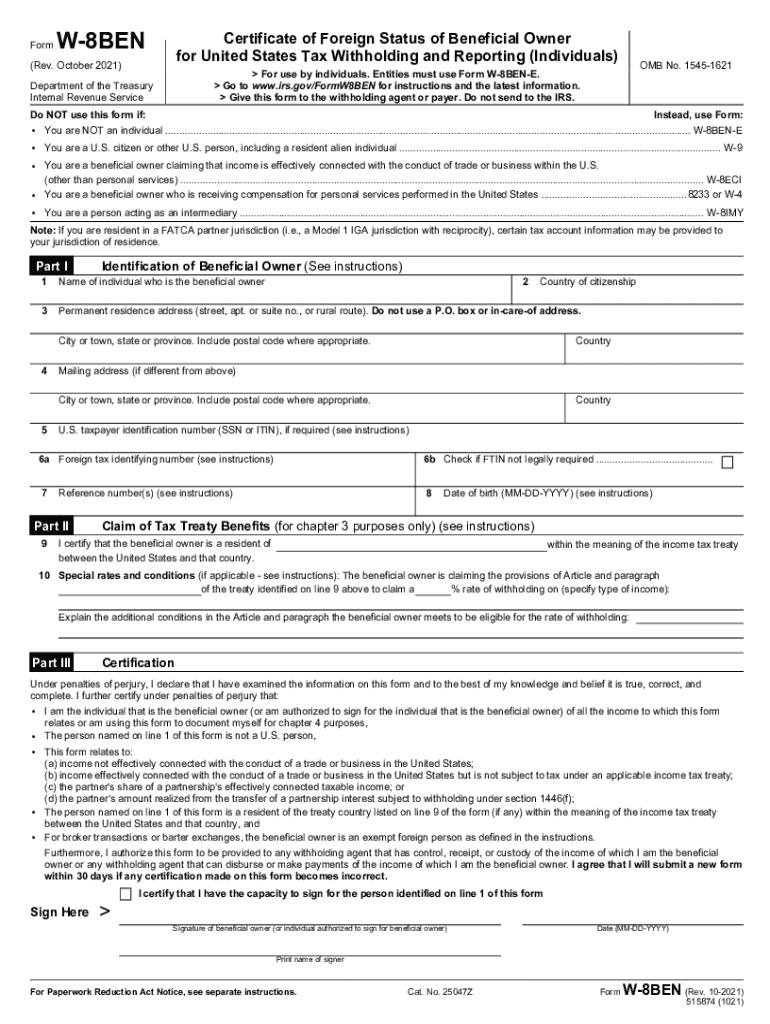

The Certificate of Foreign Status Form, commonly referred to as Form W-8BEN, is a vital document for non-U.S. residents and foreign entities to claim tax treaty benefits or to certify their foreign status. This form allows foreign entities and individuals to establish that they are not subject to certain U.S. tax withholdings, which can be particularly advantageous for foreign investors seeking exposure to U.S. markets.

This form is crucial because it helps determine the correct amount of tax withholding required on income received by foreign persons. Income such as dividends, interest, rents, and royalties may be subject to U.S. tax withholding if not claimed properly. By submitting the Certificate of Foreign Status Form, foreign entities can assert their status and potentially reduce withholding tax obligations as stipulated by applicable tax treaties.

The Certificate is required when a foreign entity or individual receives income from U.S. sources and needs to establish that they are not subject to certain tax requirements. For instance, if you are a foreign singer receiving royalties from a U.S. music company, you'll need to file this form to ensure that the withholding tax isn't at the maximum rate of 30%.

Who needs to complete the certificate of foreign status form?

Eligibility to complete the Certificate of Foreign Status Form primarily applies to foreign entities and individuals earning income from U.S. sources. Foreign corporations, partnerships, and individuals that do not reside in the U.S. are required to complete this form in order to avoid or reduce tax withholding on eligible income. This includes income types such as dividends, royalties, rents, and certain interest payments.

However, not all foreign entities or individuals may qualify for reduced withholding rates or exemptions. To differentiate, it is important to classify entities correctly as 'foreign' or 'domestic.' If an entity is considered domestic under U.S. tax law, it is subject to the same tax rates as U.S. residents. Therefore, careful documentation and criteria must be followed when evaluating an entity's classification.

Detailed breakdown of the certificate of foreign status form

The Certificate of Foreign Status Form consists of three main parts that must be completed accurately to ensure compliance and proper handling of your claims. Understanding the structure of the form will facilitate a smoother filing process.

Part : Identification of beneficial owner

Part I requires the identification of the beneficial owner of the income. This includes essential information such as name, country of citizenship, address, and taxpayer identification number. All details must be complete; partial information can lead to delays or rejection of the form.

Supporting documentation is also required. For instance, if the beneficial owner is a corporation, a Certificate of Incorporation may be requested to substantiate the entity’s existence and classification.

Part : Claim of tax treaty benefits

In Part II, individuals and entities must claim any applicable tax treaty benefits. Tax treaties between the U.S. and various countries provide a framework to reduce withholding rates on certain types of income. Knowing the specifics of the treaty that applies to your circumstances is critical.

Completion of this section requires knowledge about the type of income you expect to receive and the specific treaty clauses that apply. It’s advisable to check the Internal Revenue Service (IRS) website for detailed information regarding treaties, as this can significantly influence your withholding tax rate.

Part : Certification

The final part requires the signature of the beneficial owner or an authorized representative. This section certifies that all information provided is accurate and truthful. It is crucial not to overlook this part, as failure to sign can invalidate the submission.

Strategically, it is beneficial to double-check all entries for accuracy before submission. Errors might lead to increased withholding tax rates or complications with your claim.

Submitting the certificate of foreign status form

Once the Certificate of Foreign Status Form is accurately completed, it needs to be submitted to the U.S. withholding agent or financial institution from which you are receiving income. It is essential to first confirm with them about their specific filing requirements or preferences, as submission procedures may vary.

Ensure you are aware of important filing deadlines. Typically, this form should be submitted before any payments are made to you in order to avoid unnecessary withholding. If your financial institution has an established cutoff date for new submissions, missing this deadline can result in statutory withholding tax being applied at maximum rates.

After submission, the recipient party will process your form and apply the appropriate withholding rates based on the details provided. It may take some time to see tax adjustments reflected in payment amounts.

Common mistakes to avoid when filling out the form

Completing the Certificate of Foreign Status Form incorrectly can lead to severe repercussions, such as higher withholding taxes or the rejection of your claim. To avoid common pitfalls, pay attention to the following:

FAQs about the certificate of foreign status form

Addressing the most frequent inquiries surrounding the Certificate of Foreign Status Form helps clarify common uncertainties:

Digital options for completing the certificate of foreign status form

In today’s digital age, utilizing a platform like pdfFiller to complete your Certificate of Foreign Status Form presents numerous benefits. This solution streamlines the form-filling process, allowing users to fill out, edit, and eSign documents conveniently from anywhere.

Here’s a quick step-by-step guide to utilizing these interactive tools effectively:

With pdfFiller, access your forms anytime, anywhere, ensuring you are always prepared to complete your Certificate of Foreign Status Form promptly and efficiently.

Real-life scenarios illustrating form usage

Consider two scenarios exemplifying the importance of correctly filing the Certificate of Foreign Status Form. In the first case, a foreign company from Canada formed a corporation and began earning royalties from a U.S.-based publisher. By completing the form accurately, they leveraged the U.S.-Canada tax treaty, reducing their tax withholding from 30% to 15%.

In another instance, an individual investor from the United Kingdom invested in U.S. stocks. Unaware of the need to complete the certificate, they received dividends at the maximum rate. Once informed and upon filing the form, they successfully reduced their tax withholding and were able to recover funds previously withheld.

These examples highlight the necessity of understanding tax responsibilities and complying with U.S. tax regulations through the Certificate of Foreign Status Form.

Regulatory updates and changes to the form

Tax laws and regulations are subject to frequent changes, and it is essential for users of the Certificate of Foreign Status Form to stay informed about recent updates. For instance, changes in tax treaties can affect withholding rates and require individuals and entities to re-evaluate their submissions regularly.

To maintain compliance, regularly check the IRS website or consult tax professionals regarding applicable tax treaties. It might be equally beneficial to subscribe to updates from reliable financial and tax news sources to stay updated on developments impacting the Certificate of Foreign Status Form.

Resourcefulness and vigilance in monitoring these changes will ensure that you remain compliant and make the most of treaty benefits.

Additional support and interactive features on pdfFiller

To further enhance your experience with the Certificate of Foreign Status Form and any other forms you may need, pdfFiller offers extensive support options. Users can turn to a comprehensive FAQs section for immediate answers as well as access live chat for real-time assistance.

Moreover, engaging within the community forum available on pdfFiller encourages discussion and sharing advice among peers navigating similar situations. This collaborative approach fosters a deeper understanding, best practices, and helps with problem-solving around the complexities of tax documentation.

Taking advantage of these resources can significantly ease the process of managing the Certificate of Foreign Status Form while ensuring you have the support needed to navigate compliance successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certificate of foreign status directly from Gmail?

How can I send certificate of foreign status for eSignature?

How do I edit certificate of foreign status in Chrome?

What is certificate of foreign status?

Who is required to file certificate of foreign status?

How to fill out certificate of foreign status?

What is the purpose of certificate of foreign status?

What information must be reported on certificate of foreign status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.