Get the free Apply for a savings suspension

Get, Create, Make and Sign apply for a savings

How to edit apply for a savings online

Uncompromising security for your PDF editing and eSignature needs

How to fill out apply for a savings

How to fill out apply for a savings

Who needs apply for a savings?

How to apply for a savings form: A comprehensive guide

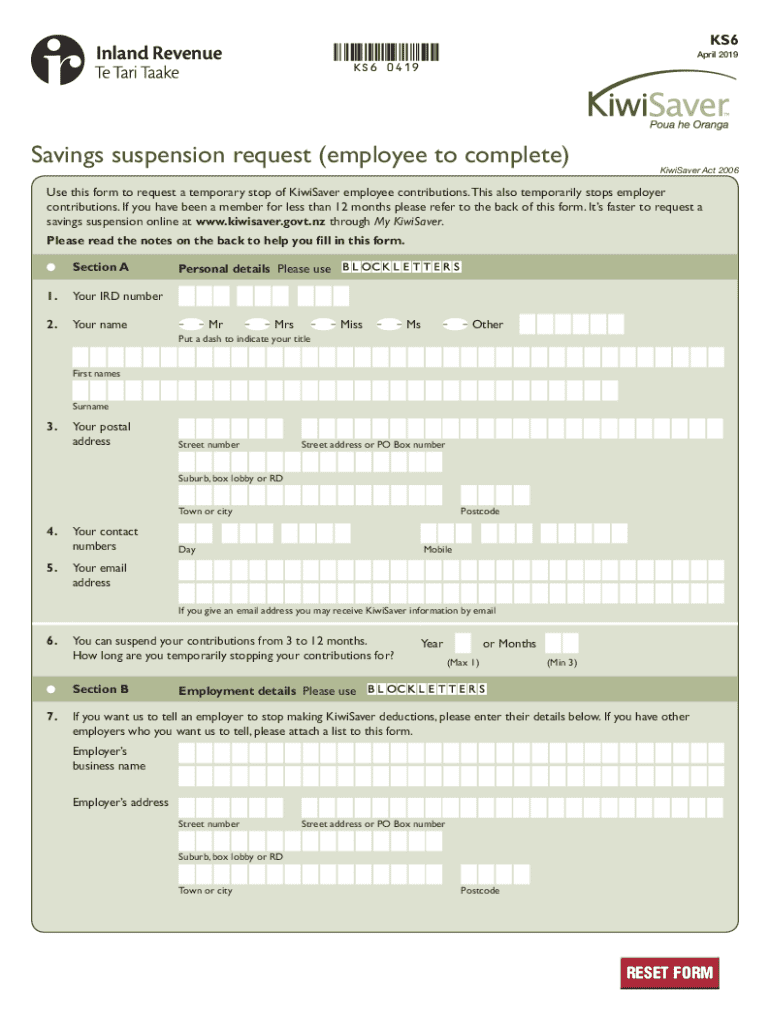

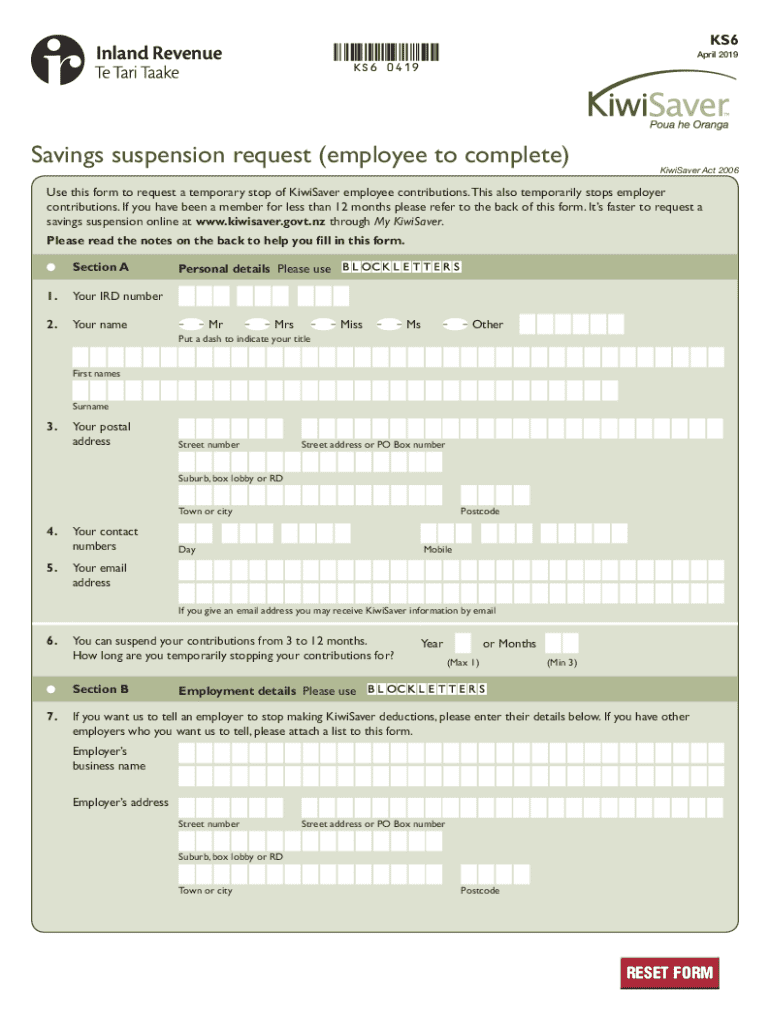

Understanding the savings form

A savings form is a document that facilitates the opening and management of a savings account at a financial institution. This form outlines your personal details, account preferences, and any conditions related to your savings account. By applying for a savings form, you initiate the process of securing a savings account that can aid in financial growth and stability.

Importance of using a savings form

Using a savings form is crucial for accurately setting up your account. It ensures that all relevant information is collected and processed efficiently. Furthermore, filling out the form carefully minimizes delays in getting your savings account activated, allowing you to start saving promptly.

Key benefits of applying for a savings form

Applying for a savings form offers several advantages:

Preparing to apply for a savings form

Before initiating your application for a savings form, it's essential to identify your financial goals. Knowing whether you are saving for emergencies, a specific purchase, or long-term growth will influence the type of account you choose. Once your goals are clear, you can proceed with gathering the necessary documentation.

Identifying your financial goals

Financial goals could range from short-term objectives, such as saving for a vacation, to long-term aspirations like purchasing a home. Each goal may require different savings strategies, impacting your choice of savings accounts and interest rates.

Requirements for applying

Preparing to apply necessitates understanding the requirements set by your chosen financial institution.

Steps to apply for a savings form

Applying for a savings form can be done efficiently by following structured steps. Accessing the form is your first task, followed by accurately filling it out and reviewing your application before submission.

Accessing the savings form

You can easily find the savings form on pdfFiller. Simply navigate to the forms section, where you will see a wide array of templates. Alternatively, check your bank's official website or contact their customer service for a direct download.

Filling out the savings form

Filling out the savings form requires attention to detail. Follow these step-by-step instructions:

Tips for accurately completing the form

Take your time while completing the application to avoid common errors. Double-check your information, ensure all fields are filled, and follow any specific formatting instructions noted on the form.

Editing and reviewing your application

Once you've finished filling out the form, the next step is to edit and review it using pdfFiller's editing tools. This platform allows you to make adjustments, add notes, and collaborate on your application before submission.

Common mistakes to avoid

Common mistakes to look out for include omitted information, incorrect account details, and illegible handwriting. Always confirm that your name matches your ID to prevent processing issues.

Submitting your savings form

With your application completed and reviewed, the next task is to submit it. Depending on your preference, there are multiple submission options available.

Methods of submission

Tracking your application status

After submission, tracking your application is straightforward. If you've used pdfFiller, you can easily check your status through the dashboard. For additional assistance, reaching out to customer support can help clarify any updates.

Managing your savings account after application

Once your application is processed, managing your savings account effectively is essential to achieving your financial goals. Understanding the next steps post-submission can set the tone for a productive banking relationship.

Utilizing pdfFiller for document management

pdfFiller not only helps with application forms but also assists in managing all documents related to your savings account. By storing and organizing your savings documents in one place, you ensure easy access and maintain an overview of your financial progress.

Collaboration tools for managing accounts

If you're working with a financial advisor or a team, utilizing collaboration tools available on pdfFiller can streamline account management. Multiple users can access and edit documents simultaneously, ensuring everyone stays informed.

eSigning documents related to your savings account

The ability to eSign documents also makes managing your savings account effortless. You can complete necessary documentation online, eliminating delays and making your banking experience seamless.

Frequently asked questions (FAQs)

What if make a mistake on my savings form?

If you find an error after submission, contact your bank immediately to rectify it. Most institutions have procedures in place to address minor mistakes without delaying the overall process.

Can save my progress and complete the form later?

Yes, with pdfFiller, you can save your progress. This feature allows you to return to your application whenever convenient, ensuring you complete it with the utmost accuracy.

What to do if my application is rejected?

If your application is rejected, seek feedback from your bank to understand the reasons behind it. You may need to provide additional documentation or clarification, which pdfFiller can help facilitate.

Additional considerations

Understanding the terms and conditions of savings accounts plays a pivotal role in your financial decision-making. Always read the fine print and clarify any uncertainties with your bank.

Tips for choosing the right savings account for your needs

Consider these factors when deciding which savings account is best for you:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my apply for a savings directly from Gmail?

Can I create an electronic signature for signing my apply for a savings in Gmail?

Can I edit apply for a savings on an Android device?

What is apply for a savings?

Who is required to file apply for a savings?

How to fill out apply for a savings?

What is the purpose of apply for a savings?

What information must be reported on apply for a savings?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.