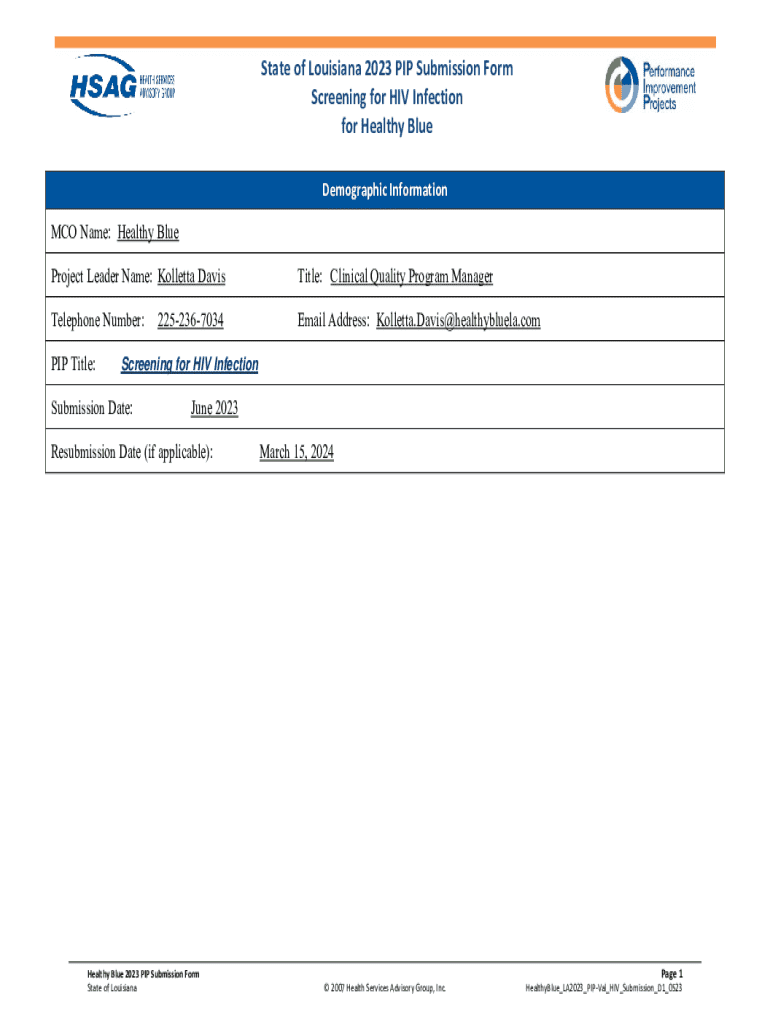

Get the free State of Louisiana 2023 PIP Submission Form Screening ...

Get, Create, Make and Sign state of louisiana 2023

Editing state of louisiana 2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of louisiana 2023

How to fill out state of louisiana 2023

Who needs state of louisiana 2023?

State of Louisiana 2023 Form: A Comprehensive Guide for Tax Filing

Overview of the Louisiana 2023 income tax forms

The state of Louisiana requires residents to file specific income tax forms each year, and the 2023 tax year is no exception. Understanding the definition and purpose of these forms is crucial for compliance and financial planning. State forms like the IT-540 not only streamline the filing process but also determine the tax obligation for individuals and businesses. Filing accurately and on time is critical to avoid penalties and ensure proper fiscal management.

In 2023, there are several notable updates to Louisiana tax regulations that taxpayers should be aware of, including adjustments to tax credits and exemptions. These changes may significantly affect your financial situation, making it vital to stay informed.

Specific forms in Louisiana for 2023

Form IT-540

Form IT-540 is the individual income tax return for residents of Louisiana. This form is necessary for individuals earning income in the state and must be filed annually. Understanding who should file this form is essential. Typically, anyone with a taxable income must submit Form IT-540 to report earnings, credits, and deductions.

Common mistakes on Form IT-540 can lead to filing delays or audit risks. It's important to accurately report all income and carefully check calculations to avoid errors. Ensure that you have all relevant documentation before submission.

Other Louisiana tax forms

In addition to Form IT-540, there are several other forms that taxpayers may need to consider. For instance, Form IT-540B is for those who wish to claim dependent exemptions for children, while Form IT-541 is utilized by fiduciaries of estates or trusts. Choosing the correct form depends on your specific tax situation, income type, and filing status.

Preparing to file the Louisiana 2023 form

Documents needed for Form IT-540

Before filing Form IT-540, having the right documents is essential to streamline the process. Taxpayers need to collect forms such as W-2s, 1099s, and any other documents that pertain to income earned throughout the year. This preparedness ensures accurate reporting and can help expedite any potential refund.

Gathering financial information can be made easier by keeping organized records throughout the year. Consider creating a dedicated folder for tax-related documents to ensure nothing goes missing during the busy filing season.

Important tax information

Understanding your filing status can significantly impact your tax calculations. The state of Louisiana recognizes various statuses, including single, married filing jointly, and head of household. Each status comes with different rates and brackets for tax calculation.

For 2023, Louisiana tax brackets have seen minor adjustments. Being aware of these brackets allows taxpayers to calculate their tax liability accurately based on their income level.

How to fill out the Louisiana 2023 form

Step-by-step guide to completing Form IT-540

Filling out Form IT-540 involves several important steps. Start with the Personal Information section to provide your name, address, and Social Security number. This sets the foundation for the rest of your filing.

Next, move to the Income Reporting section. This is where you will list all sources of income, including wages, self-employment earnings, and any interest or dividends received. Be thorough and double-check your entries to minimize the risk of errors.

In the Deductions and Credits section, accurately enter any deductions you qualify for, which can significantly lower your taxable income. It’s beneficial to review all available deductions permitted by Louisiana law. Finally, finalize your filing by signing the form and ensuring that all required attachments are included.

Interactive tools for easy form completion

Utilizing online tools to complete your Louisiana 2023 form can save you time and reduce errors. Platforms like pdfFiller offer interactive tools that allow users to seamlessly edit PDFs, eSign documents, and manage their tax filings efficiently from a single, cloud-based platform.

Filing methods for Louisiana 2023 forms

E-filing options

E-filing is a popular option for Louisiana residents, offering several advantages, including rapid processing times and the convenience of filing from your home. Using pdfFiller for e-filing is particularly beneficial as it simplifies the process with step-by-step guidance and direct submission to the Louisiana Department of Revenue.

To e-file using pdfFiller, create your account, upload your completed Form IT-540, and follow the prompts to submit directly to the state. You will receive confirmation of submission, reducing the worry of lost paperwork.

Submitting a paper form

If you prefer the traditional route, mailing your tax return is still an option. Be sure to print out your completed Form IT-540 clearly and sign it. Mail it to the appropriate address, which can be found on the Louisiana Department of Revenue’s website. Do note that submission deadlines apply, so be cautious to post your documents well in advance.

Post-filing considerations

Tracking your tax refund

After filing your Louisiana 2023 form, it’s normal to be eager for your tax refund. To track your refund, utilize the online tool provided by the Louisiana Department of Revenue. Input your details to check the status and estimated processing time, which usually ranges from four to six weeks for e-filed returns.

Handling audits or notices

Occasionally, taxpayers may receive notices from the Louisiana Department of Revenue concerning audits or required additional information. It's essential to read these notices carefully and respond promptly. Common notices may include requests for documentation or confirmation of filed income. Consulting with a tax professional can be beneficial if you face an audit.

Frequently asked questions (FAQs)

Many taxpayers have queries regarding income tax forms in Louisiana. Common questions include the differences between the various filing forms, what to do if you miss the filing deadline, and how to amend a submitted form. Each of these issues requires specific action, and having clarity during the filing process can alleviate stress.

Integration with pdfFiller features

pdfFiller not only provides the tools for filling out the Louisiana 2023 form but also facilitates document management and collaboration throughout the tax filing process. Users benefit from cloud-based access, enabling them to manage their forms from any device, whether at home or on the go.

The collaboration tools available allow teams to work together efficiently on multiple filings. Whether you’re part of a family filing jointly or a team managing business taxes, pdfFiller simplifies the entire process, reducing administrative burdens and enhancing productivity.

Appendices

For further clarity, the following glossary of tax terms may be helpful. Moreover, links to official state resources and documentation ensure that you have access to the most accurate and current information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send state of louisiana 2023 to be eSigned by others?

How do I make changes in state of louisiana 2023?

Can I create an electronic signature for the state of louisiana 2023 in Chrome?

What is state of Louisiana 2023?

Who is required to file state of Louisiana 2023?

How to fill out state of Louisiana 2023?

What is the purpose of state of Louisiana 2023?

What information must be reported on state of Louisiana 2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.