Get the free Banks Jerel A

Get, Create, Make and Sign banks jerel a

How to edit banks jerel a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out banks jerel a

How to fill out banks jerel a

Who needs banks jerel a?

Banks Jerel a Form: A Comprehensive How-to Guide

Overview of Banks Jerel Form

The Banks Jerel Form is a crucial document used within the banking and finance sector, primarily for transactional purposes. This form serves as a formal request or authorization for various banking activities, ensuring that all financial transactions are documented and processed efficiently. By providing essential information about the individual or organization, the Banks Jerel Form plays a significant role in maintaining transparency and compliance within financial systems.

Understanding the importance of the Banks Jerel Form is vital for individuals and teams engaging with banking institutions. Proper usage can lead to smoother transactions, reduced errors, and a clearer record of financial activities. As such, it is imperative to know how to accurately complete and manage this form.

Understanding the context of the Banks Jerel Form

Historically, the Banks Jerel Form originated to streamline the process of banking transactions. Initially, banks required physical submission of various forms for each transaction. Over time, this evolved to integrate more systems, digitizing processes to enhance efficiency. The evolution of this form reflects the changing landscape of banking, where digital solutions have transformed how transactions are documented and executed.

Common use cases for the Banks Jerel Form include authorization for wire transfers, loan applications, and account changes. It is essential in scenarios where precision in financial records is critical, such as high-value transactions or legal implications surrounding offers and contracts.

Components of the Banks Jerel Form

The Banks Jerel Form is composed of specific sections that need careful attention. Each component contributes to the overall effectiveness of the form, ensuring all necessary data is captured accurately. Here’s a detailed breakdown of its sections:

Key terminology associated with the Banks Jerel Form includes terms like 'transaction authorization,' 'account holder,' and 'financial institution,' which are crucial for understanding the implications of the form during usage.

Step-by-step instructions for filling out the Banks Jerel Form

Filling out the Banks Jerel Form requires preparation and attention to detail. Here’s a step-by-step guide to ensure you complete it accurately:

Common mistakes to avoid

While filling out the Banks Jerel Form might seem straightforward, there are common pitfalls to be aware of. Many users forget crucial information, leading to incomplete submissions that can delay processing.

Tips for successful submission include double-checking your entries before submission and keeping a copy of the completed form for your records.

Editing and modifying the form

After filling out the Banks Jerel Form, you might find the need to edit or modify your information. Utilizing a platform like pdfFiller makes these changes seamless.

To edit a filled Banks Jerel Form using pdfFiller, follow these simple steps: first, upload the completed form to the platform. Utilize its editing features to make any necessary changes. You can even collaborate with team members, allowing multiple individuals to review and suggest edits before finalizing.

Signing the Banks Jerel Form

Once the Banks Jerel Form is filled out, signing it is the next crucial step. pdfFiller offers an efficient eSignature solution that simplifies this process.

The eSignature process involves creating your electronic signature using pdfFiller’s tools, which can then be applied directly to the form. It’s essential to understand the legal implications of eSigning, which carries the same weight as a handwritten signature.

Managing the Banks Jerel Form after submission

After submitting the Banks Jerel Form, it is important to understand what happens next. Typically, processing timelines can vary based on the nature of the request and the policies of the banking institution.

Follow-up actions include tracking the status of your application through the bank’s online portal or by direct inquiry. Keeping notes of contact points within the bank can facilitate efficient communication if any issues arise.

Interactive tools and resources

pdfFiller offers various interactive tools to enhance the experience of working with the Banks Jerel Form. Users can take advantage of features like document collaboration and sharing, making the process more efficient and organized.

Conclusion of the process

The process of managing the Banks Jerel Form efficiently can significantly impact your banking experience. By understanding the workflow—from filling, signing, to submission—users can enhance their document management skills.

Utilizing pdfFiller’s comprehensive document solutions empowers you to edit, eSign, collaborate, and manage documents seamlessly. Taking advantage of cloud-based capabilities brings organization and accessibility to your financial documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my banks jerel a in Gmail?

How do I edit banks jerel a in Chrome?

How do I complete banks jerel a on an iOS device?

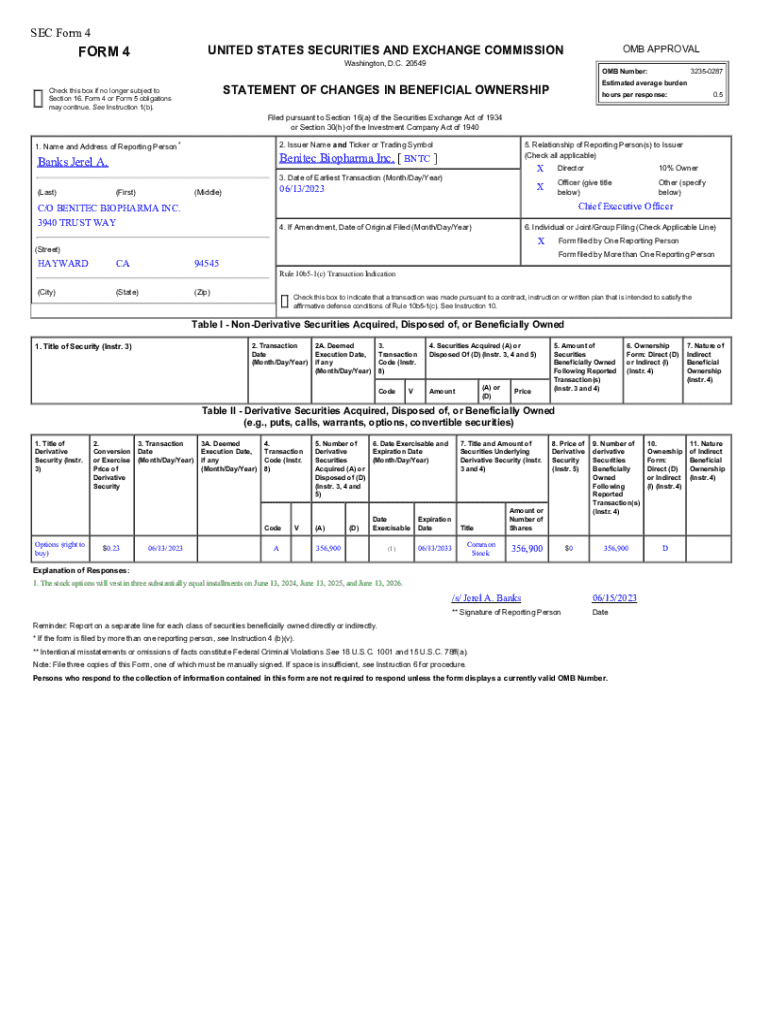

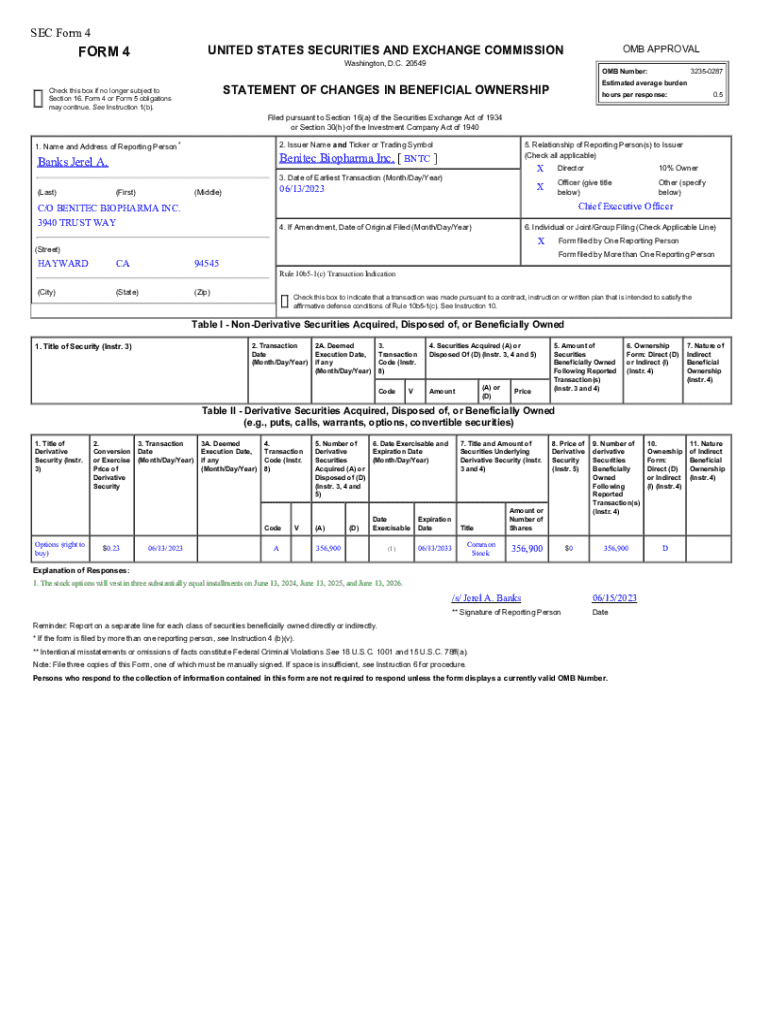

What is banks jerel a?

Who is required to file banks jerel a?

How to fill out banks jerel a?

What is the purpose of banks jerel a?

What information must be reported on banks jerel a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.