Get the free 2023-2024 How to complete the Data Collection Sheets

Get, Create, Make and Sign 2023-2024 how to complete

Editing 2023-2024 how to complete online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023-2024 how to complete

How to fill out 2023-2024 how to complete

Who needs 2023-2024 how to complete?

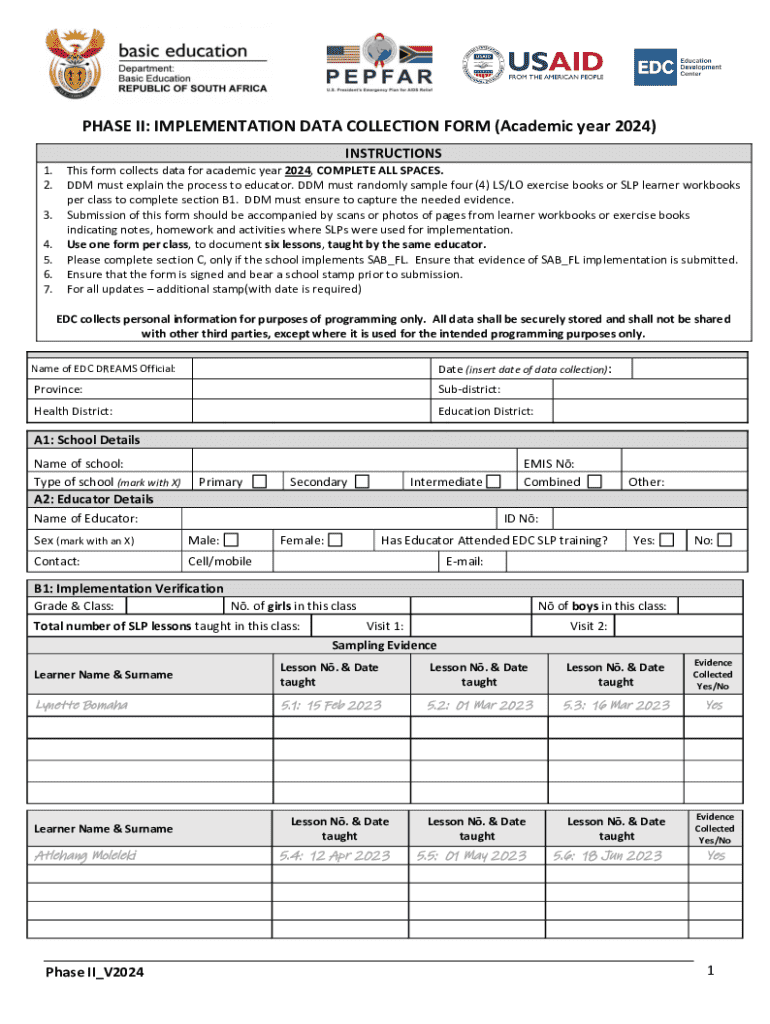

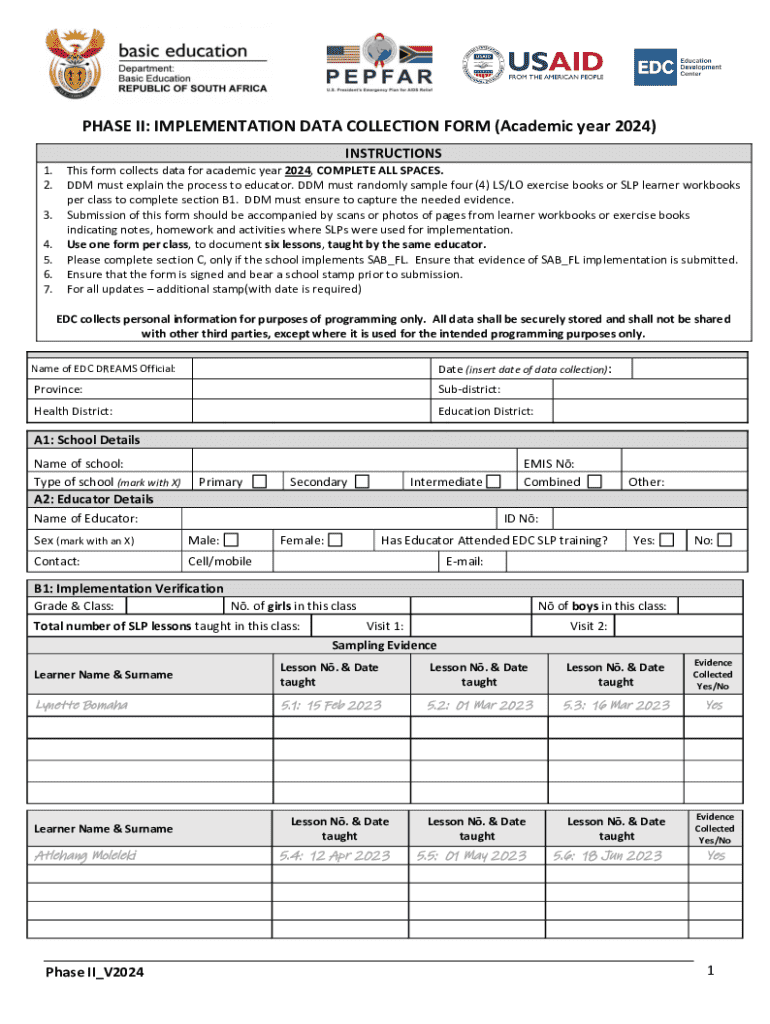

2 How to Complete Form

Understanding the 2 form landscape

Form 2 has undergone several key changes for the 2 period, making it crucial for individuals and organizations to stay updated. Key adjustments include revised income reporting requirements, updates to deduction eligibility, and changes in submission procedures. For example, adjustments to standard deduction amounts can significantly impact tax calculations, affecting the overall amount owed or refunded.

Understanding these updates ensures compliance and maximizes potential benefits when completing your forms. Utilizing outdated or incorrect forms can lead to processing delays, penalties, and potential audits, highlighting the importance of accuracy during completion.

Types of forms relevant for 2

Several types of forms are critical for navigating the 2 Form 2 landscape. Among the most common are personal income tax forms, which include individual and joint submissions, and estimated tax forms that facilitate quarterly tax payments for self-employed individuals. Additionally, fiduciary and composite forms cater to those managing trusts or holding interests in partnerships.

Understanding which specific form applies to your situation helps streamline the filing process. Specialty forms, while not as commonly used, also serve essential purposes, especially for specific circumstances like claiming disaster relief or foreign income adjustments.

Step-by-step guide to completing the form

Preparing to complete Form 2 involves several critical steps. Initially, gather all necessary documentation, including previous tax returns, proof of income, and valuable deduction receipts. Understanding eligibility requirements based on your filing status will help in ensuring you complete the form correctly.

Next, let's break down each section of the form to simplify the process.

Section 1: Basic Information

When filling out this section, be sure to include all personal details, such as your name, address, and Social Security number. Ensure accuracy in the details provided, as inaccuracies can lead to processing issues.

Section 2: Income Reporting

This section is essential for reporting all types of income, including wages, dividends, and interest. Collect supporting documentation like W-2 and 1099 forms to substantiate your claims.

Section 3: Deductions and Credits

Identifying eligible deductions can significantly lower your taxable income. Common deductions include medical expenses, mortgage interest, and state taxes. Be aware of credits you may qualify for, like the Earned Income Tax Credit or the Child Tax Credit.

Section 4: Signatures and Declarations

This final section requires your signature, certifying that the information provided is accurate. Electronic signatures are increasingly accepted, simplifying the submission process. Follow the specified steps for signing your form to ensure compliance.

Advanced tips for completing your form

Utilizing tools like pdfFiller can enhance your form completion experience. Interactive tools available on pdfFiller allow you to edit, sign, and collaborate on your documents seamlessly. This tailored experience can help avoid common errors and streamline communication with others involved in the process.

To further ensure accuracy, be mindful of the most common mistakes. Misinterpreting questions or leaving sections unfilled or incorrectly filled can result in delays and complications.

Managing your completed form

After completing your form, the next crucial step is submission. Consider the differences between e-filing and mailing your documents. E-filing tends to be faster, reduces the risk of lost paperwork, and allows for quicker processing times. Meanwhile, mailing might be preferable for certain circumstances or if paper forms are required.

Once submitted, tracking the status of your form is vital. Most online portals offer a way to verify the status of your submission quickly. Archiving and storing your documents securely is just as important, especially for reference in future filings.

FAQs on completing forms for 2

Common concerns regarding Form 2 often revolve around errors discovered after submission. If you realize you've made a mistake, promptly reviewing the appropriate procedure for amending your form can save you from potential complications. Tax authority websites typically outline these steps in detail.

Additionally, clarifications regarding specific forms can help individuals understand which forms suit their circumstances best. It's beneficial to familiarize oneself with these variations, enhancing the overall accuracy and efficiency of the filing process.

Utilizing pdfFiller for your form needs

pdfFiller offers powerful capabilities that streamline the form completion process. Features allow users to edit PDFs, eSign, collaborate with others, and manage documentation from a single cloud-based platform. These tools empower both individuals and teams to navigate complex forms confidently.

Many users have shared success stories about how pdfFiller has transformed their document management practices. For instance, teams have streamlined their internal paperwork, resulting in faster approvals and less time spent on administrative tasks.

Interactive tools and support options

Accessing help through pdfFiller is straightforward. The platform offers various customer support options, including dedicated service representatives who can assist with specific inquiries. Users can also benefit from community forums where they share tips and experiences, further enriching the collective knowledge base.

Additionally, pdfFiller provides a range of video tutorials, enabling users to visually navigate the process of completing their forms correctly. These resources are a valuable asset, especially for visual learners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2023-2024 how to complete online?

How do I fill out the 2023-2024 how to complete form on my smartphone?

How do I edit 2023-2024 how to complete on an iOS device?

What is 2023-2024 how to complete?

Who is required to file 2023-2024 how to complete?

How to fill out 2023-2024 how to complete?

What is the purpose of 2023-2024 how to complete?

What information must be reported on 2023-2024 how to complete?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.