Get the free Part VII Compensation of Officers, Directors, Trustees, Key ...

Get, Create, Make and Sign part vii compensation of

How to edit part vii compensation of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out part vii compensation of

How to fill out part vii compensation of

Who needs part vii compensation of?

Comprehensive Guide to Part Compensation of Form 990

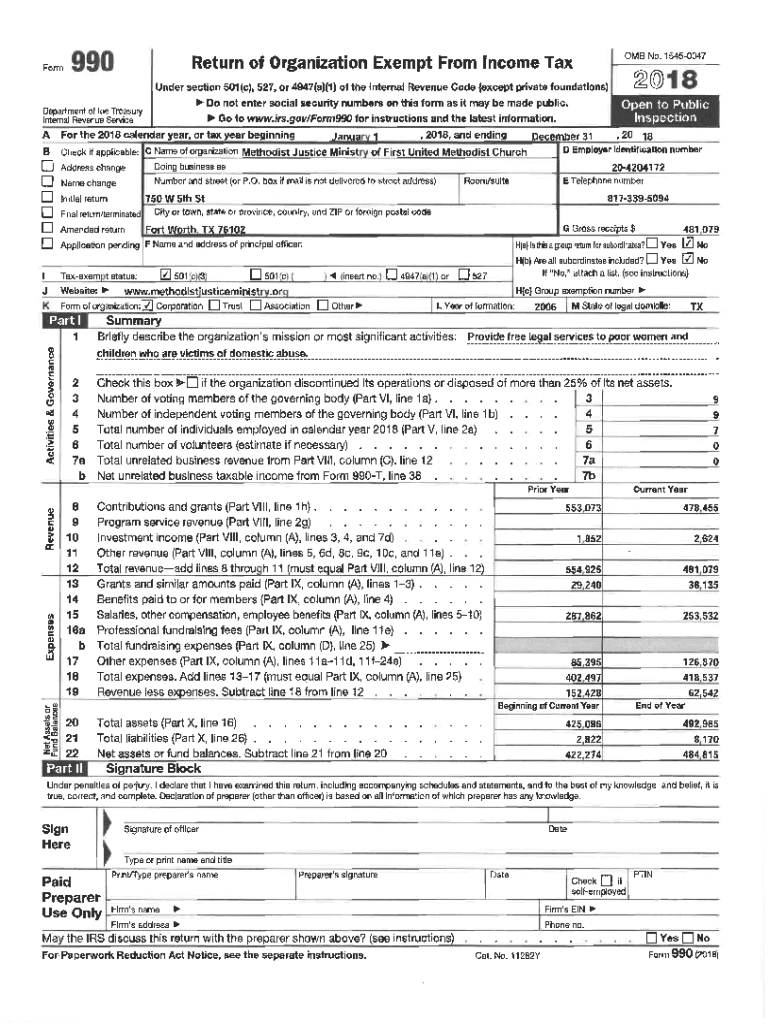

Understanding Part of the Form 990

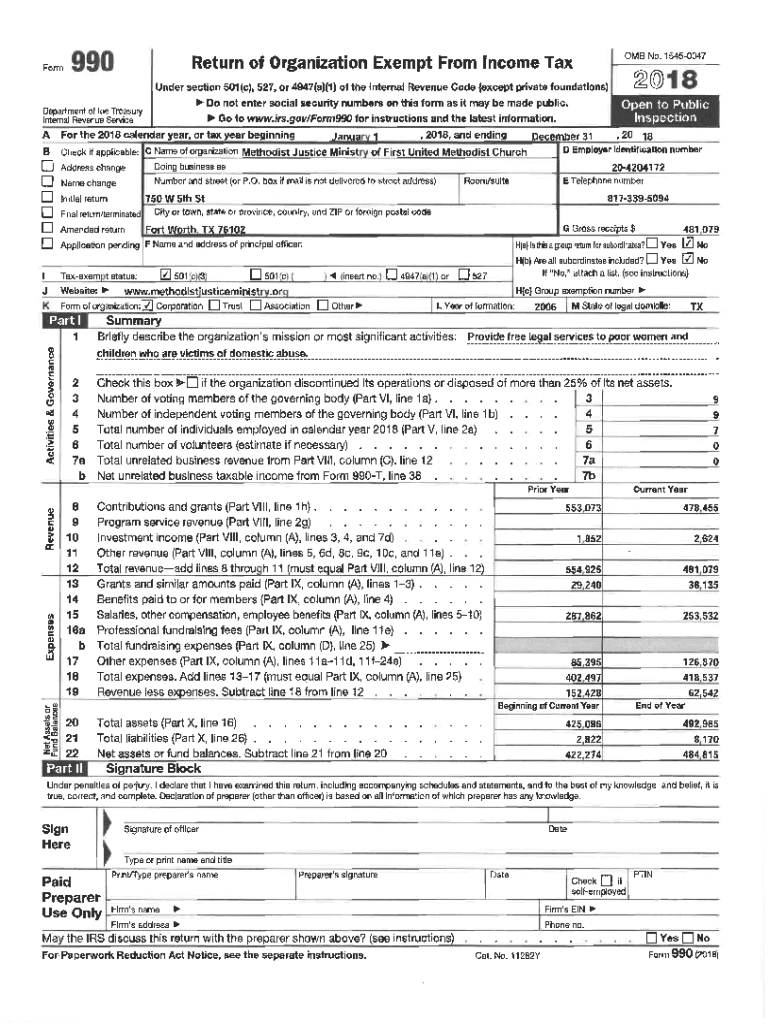

Part VII of the Form 990 provides essential insights into the compensation structures of non-profit organizations. The Form 990 is a crucial reporting tool used by tax-exempt organizations to provide transparency to the public and the IRS regarding their financial performance and organization structure.

Understanding Part VII is pivotal for assessing the governance and accountability of a non-profit. It offers a clear breakdown of the compensation received by key individuals within the organization, hence fostering trust among donors and the public.

Overview of compensation reporting requirements

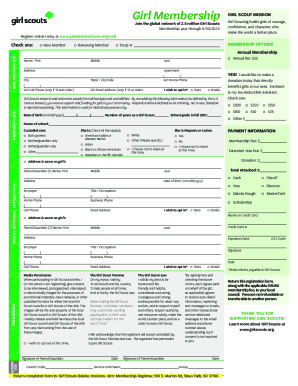

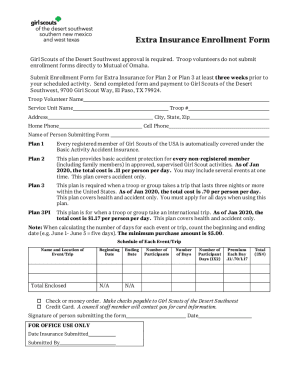

Reporting compensation accurately is fundamental to the integrity of Form 990. The primary parties required to report include current directors, trustees, officers, key employees, and the highest compensated employees. Each of these roles has a specific set of requirements under IRS rules.

Clearly defining these roles helps streamline the reporting process and ensure compliance. For instance, former employees can also be reported, but their compensation details should reflect the last year of actual remuneration.

Detailed breakdown of compensation categories

Understanding the different types of compensation is essential when filling out Part VII. Organizations must report various categories that contribute to an individual’s overall compensation package.

These categories help to present a holistic view of how much each person is compensated, including direct pay and additional benefits.

Required individuals on Part

Not all individuals associated with a non-profit need to be reported on Part VII. Understanding the eligibility criteria for inclusion is critical for ensuring compliance. Directors, trustees, officers, and key employees must meet specific standards set forth by the IRS.

Moreover, the process for identifying which individuals need to be reported should be revisited periodically, particularly in light of changes in personnel or roles within the organization.

Step-by-step guide to completing Part

Completing Part VII may seem daunting, but following a clear step-by-step process can simplify the task. First, collecting necessary documents such as payroll records and contracts is crucial for accuracy.

Next, compile total compensation information meticulously, ensuring each entry aligns with IRS guidelines. When filling out the form, pay attention to each compensation field, and cross-verify for common mistakes that can lead to compliance issues.

Interactive tools for compensation calculation

Utilizing tools like pdfFiller can enhance the experience and accuracy of filing Form 990. Interactive features allow for real-time collaboration, making it easier for teams to work together effectively.

These tools streamline the document management process, ultimately saving time and reducing errors in the reporting process.

Understanding form instructions and compliance

Adhering to the instructions for Part VII is paramount for compliance. Each non-profit must familiarize itself with the detailed instructions provided by the IRS, which specify how to report compensation.

Common compliance challenges arise from misinterpretation of these instructions, resulting in potential legal consequences for organizations. Staying aware of these pitfalls is crucial for all staff involved in financial reporting.

Insights on executive compensation trends

Understanding industry standards for non-profit compensation is important for organizations to remain competitive and comprehensive in their reporting. Keeping abreast of compensation trends not only helps benchmark salaries effectively but also aids in aligning with best practices in reporting.

Non-profits must ensure that their compensation packages are fair while also promoting fiscal responsibility, given their reliance on donor funds.

Frequently asked questions about part compensation

Many individuals and organizations have queries regarding Part VII of Form 990. Understanding common questions and misconceptions about this segment of the form can lead to better reporting practices and enhanced compliance.

Addressing FAQs helps to demystify compensation reporting and empowers non-profits to effectively fulfill their responsibilities.

Staying updated on regulatory changes

Regulatory changes can impact reporting requirements significantly, making it critical for non-profits to stay updated. Regular reviews of compensation guidelines assure organizations are aligned with current expectations from the IRS.

Tools offered by pdfFiller help organizations keep track of these changes and ensure compliance, thereby avoiding potential penalties.

Client stories and testimonials on efficient form management

Many non-profits have successfully utilized pdfFiller for completing their Form 990 filings. These client success stories highlight the ease of form management and the collaborative tools that enhance productivity.

Testimonials often reflect time savings, improved accuracy, and alleviation of confusion over complex reporting requirements.

Connect with our experts

For personalized assistance or additional inquiries regarding Part VII of the Form 990, reach out to our team of experts at pdfFiller. We are dedicated to providing support to ensure your organization navigates the complexities of compensation reporting seamlessly.

Connect with us through our website to explore further insights and engage with our resources for effective document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my part vii compensation of directly from Gmail?

How can I get part vii compensation of?

How do I edit part vii compensation of straight from my smartphone?

What is part vii compensation of?

Who is required to file part vii compensation of?

How to fill out part vii compensation of?

What is the purpose of part vii compensation of?

What information must be reported on part vii compensation of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.