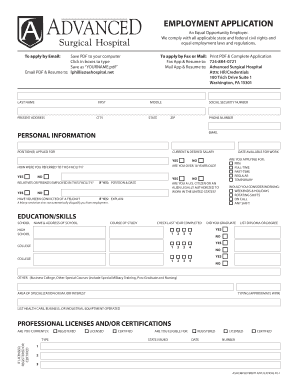

Get the free colorado dr 0108

Get, Create, Make and Sign co dr 0108 form

How to edit colorado dr 0108 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out colorado dr 0108 form

How to fill out dr 0108 - statement

Who needs dr 0108 - statement?

Navigating the DR 0108 Statement Form: A Comprehensive Guide

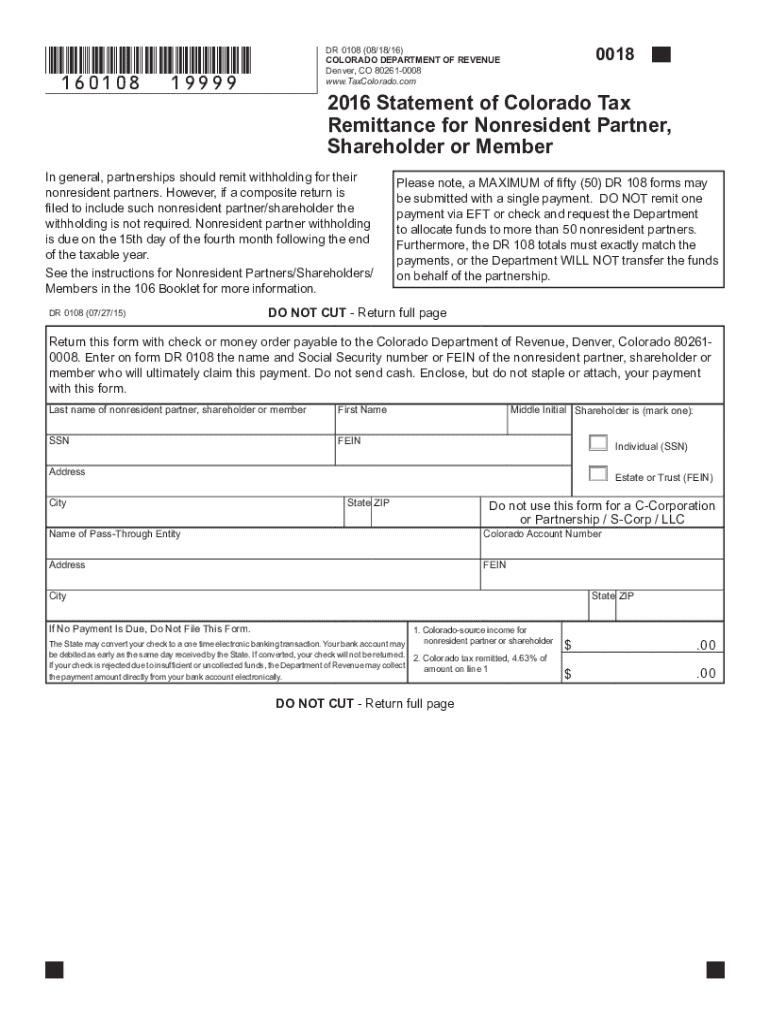

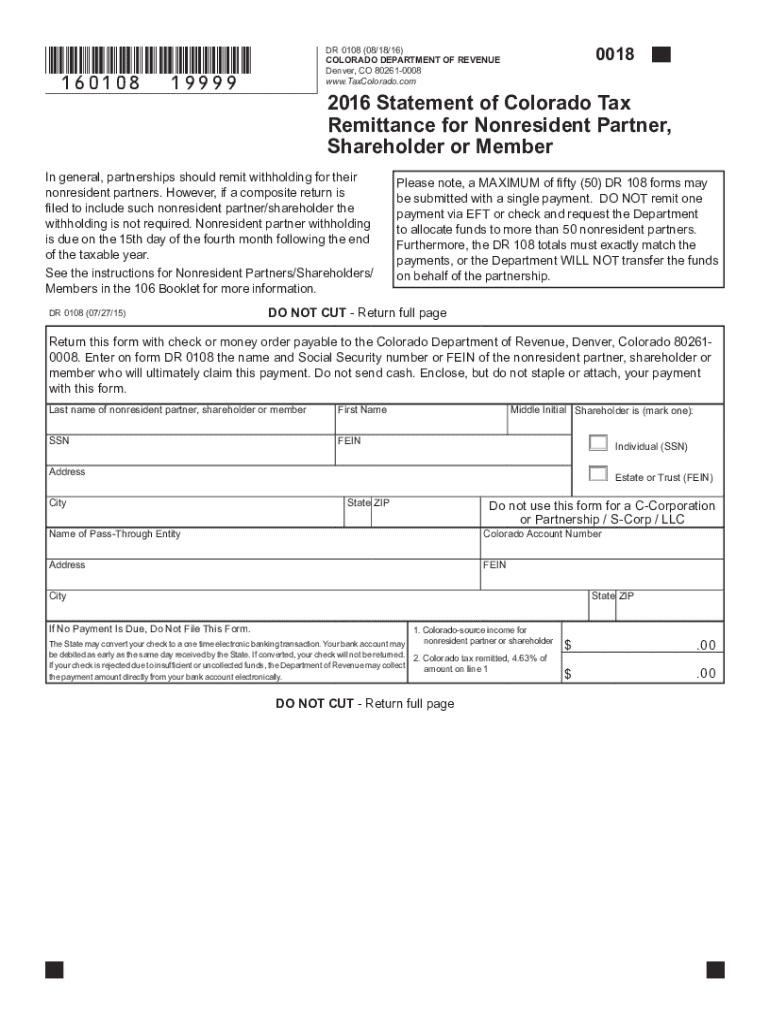

Overview of the DR 0108 Statement Form

The DR 0108 Statement Form is an essential tax document administered by the Colorado Department of Revenue. It primarily serves nonresident partners and shareholders in Colorado-based partnerships and S corporations. This form plays a crucial role in reporting income and claiming deductions related to those earnings, enabling nonresident entities to comply with Colorado tax obligations.

For nonresident partners and shareholders, understanding the DR 0108 is paramount. It not only helps clarify tax liabilities but also assists in optimizing potential deductions. Key definitions, such as what constitutes a nonresident partner or shareholder, are pivotal for accurate completion and adherence to state tax regulations.

Who needs to use the DR 0108?

The DR 0108 form is specifically designed for two categories: nonresident partners in Colorado partnerships and nonresident shareholders in S corporations. If you fall into either of these categories, it's vital to ensure compliance by filing the DR 0108 to report your shares of income and claim allowable deductions.

Eligibility criteria include being a nonresident, which means that your primary residence lies outside Colorado yet you earn income through Colorado-based ventures. This form typically comes into play during tax seasons or when an entity undergoes significant financial changes, necessitating the declaration of income or further deductions.

Step-by-step guide to filling out the DR 0108

Filling out the DR 0108 might appear daunting, but a systematic approach can simplify the process. First, gather necessary documents such as your Social Security number, tax identification, and income statements. Familiarizing yourself with the tax deduction process will also make it easier to accurately represent your financial situation.

Breaking down the form into its sections can help. Start by completing Section 1, which covers personal information, including your name and address. Next, provide details in Section 2 about your partnership or corporation, including its name and tax identification number. Moving on, Section 3 will require you to outline your income and deductions. Finally, don’t forget to sign and date the form in Section 4, indicating your acknowledgment of the information provided.

Common mistakes include incorrect identification numbers and misreported income. To enhance accuracy, double-check your figures and ensure all necessary fields are completed prior to submission.

A tip for accuracy is to cross-verify your submitted information with your supporting documents. This practice ensures that all entries are cohesive and correctly presented.

Editing and managing your DR 0108 statement form

Managing your DR 0108 efficiently can significantly reduce the hassle often experienced with tax forms. Utilizing tools like pdfFiller streamlines this process. To start, upload your completed form to pdfFiller. This platform provides interactive tools that allow you to edit your document effortlessly, ensuring that all necessary changes can be made quickly and accurately without the need for a physical copy.

Once uploaded, utilizing pdfFiller’s features can enhance your experience. This includes options for saving your document securely in the cloud, which provides any time, anywhere access. Additionally, any forms stored within pdfFiller are protected, ensuring the confidentiality and safety of your information. Understanding these features is key to efficiently managing your compliance documentation.

eSigning your DR 0108 statement form

The significance of eSigning the DR 0108 cannot be overstated. An electronic signature acts as a legal validation of your document, ensuring the authenticity and integrity of your submission. This step adds a layer of security and helps maintain a record that can be tracked easily throughout the filing process.

To eSign your DR 0108 using pdfFiller, follow simple steps. First, click the 'Sign' button within the pdfFiller interface. You can then create your signature directly on the platform or upload an existing one. Finally, place your signature appropriately before saving the document. The tracking features in pdfFiller also allow you to monitor who has signed the document and when, streamlining communications and ensuring all needed parties are in sync with the filing process.

Common questions about the DR 0108

Navigating the DR 0108 form often leads to a multitude of questions. Common inquiries include how to accurately report income, potential mistakes during form filling, and necessary documentation that needs to accompany the filing. Each of these factors plays a pivotal role in ensuring compliance and accuracy.

To assist users, pdfFiller offers extensive support resources. These include step-by-step FAQs that cover a variety of issues, from filling out specific sections to troubleshooting common mistakes. Should you encounter complex issues, their support team is readily available to provide personalized assistance. Overall, leveraging these resources can significantly streamline the form-filling process.

Post-filing considerations

After submitting the DR 0108 form, it’s crucial to keep thorough records of your submission. Make copies of your form and any accompanying documentation for your own records. This is particularly important if you are subject to an audit or need to address any discrepancies later. Understanding the follow-up procedures with the Colorado Department of Revenue can help you navigate potential issues more efficiently.

It's also essential to adhere to timely filing standards. Late submissions can incur penalties or additional taxes. Regularly monitor deadlines for filings related to your nonresident status, and stay proactive in managing any changes in income or business relations that may affect your tax obligations.

Related forms and resources

The DR 0108 is but one piece of the tax puzzle for nonresident partners and shareholders. Familiarity with similar tax forms, such as those for withholding taxes and other remittance forms applicable in Colorado, can enhance your overall compliance strategy. Understanding these forms allows users to navigate the intricate landscape of tax obligations faced by nonresidents.

For a more comprehensive approach, it's beneficial to compare Colorado requirements with those at the federal level. This comparison highlights any discrepancies and aids in fostering a better understanding of your tax duties. Additional tools and templates related to these forms can be found within the pdfFiller platform, providing vital resources for effective tax management.

Customer success stories

A growing number of users have found that using the DR 0108 form through pdfFiller has simplified their document management process. Testimonials highlight their experiences, particularly regarding the ease of filling out, signing, and editing PDFs seamlessly within one platform.

Many have noted that utilizing pdfFiller's cloud-based solutions has alleviated the stresses associated with traditional paper filing methods. By digitizing the process, they have saved considerable time and minimized errors, all while ensuring that they remain compliant with both state and federal tax obligations.

Interactive tools to enhance your experience

To further enhance the user experience while working with the DR 0108, pdfFiller offers various interactive tools. Document analysis features assist in identifying any potential areas of improvement in your filings. This proactive approach helps ensure that your forms are not just filled out, but are also optimized for accuracy and compliance.

Additionally, pdfFiller provides interactive FAQs and chat support, which allow users to find answers to their concerns quickly and efficiently. This instant access to information enables users to resolve issues as they arise, ensuring a smoother experience with tax filings and document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my colorado dr 0108 form in Gmail?

Can I edit colorado dr 0108 form on an Android device?

How do I complete colorado dr 0108 form on an Android device?

What is dr 0108 - statement?

Who is required to file dr 0108 - statement?

How to fill out dr 0108 - statement?

What is the purpose of dr 0108 - statement?

What information must be reported on dr 0108 - statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.